Will Inflation Lead To Turbulent Times Ahead?

Economists constantly monitor and worry about the levels of inflation.

Rising inflation has an insidious effect that spreads quickly.

Input prices are higher, consumers have lower purchasing power, and business slows.

But could rising inflation roil global equity markets?

It’s only early days, yet some economists and ex federal reserve bankers are of this opinion arguing that we could be on the cusp of turbulent waters in the global equity markets.

In the US, we have the Federal Reserve overseeing an orderly raising of interest rates.

This would mean a third rate hike for the year, taking it to 1.50 percent.

Given the increasing price pressures in the wholesale market, this will most likely be reflected in higher consumer inflation in the coming years.

However, equity investors are shrugging off the prospect of rising interest rates.

Globally, market confidence remains and central banks (including the Fed) will pull the chain when it comes to tightening, if needed.

Former RBA governor, Glenn Stevens, mentioned this earlier in the week.

Stevens made the point that a tightening of US monetary policy, at a time of expansionary US fiscal policy, could result in serious implications for financial markets.

The former RBA governor commented that “Central bankers, for their part, would welcome a bit more inflation”.

He went on to say “This has been their avowed aim. Thus far, however, market pricing seems to embody doubts that they will be successful.”

Joining the Macquarie Group since retiring as Reserve Bank of Australia governor, Glenn Stevens currently holds a position on their board.

He argues that “there was a reasonable chance that a pick up in inflation could see markets flip from their current scepticism… to worries about them being exceeded”.

The logic behind the reasoning being, it would put central banks around the world in a rather precarious position.

Tighten interest rates too fast to “catch up” and you risk an economic slowdown.

Or tighten too slow and you lose anti-inflation credibility.

Remember… some inflation is good, but too much, too quickly, can be a bad thing.

It’s a delicate balancing act, much like regulating the amount you can drink if you are driving.

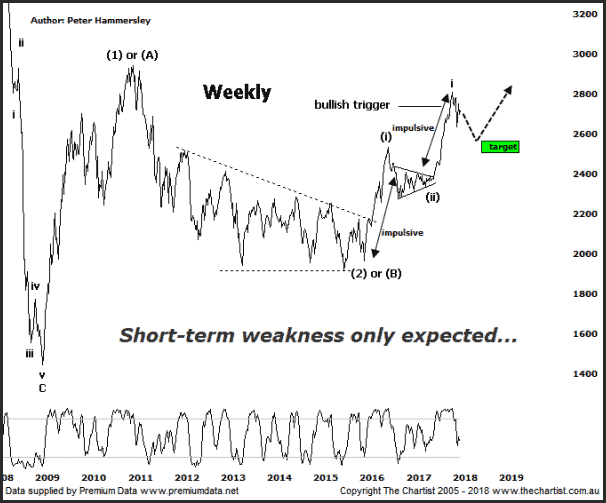

With equity markets surging to current sky-high valuation levels.

It’s prudent that inflation is kept in check with careful tightening when necessary.