Why Trade With ETFs?

In the past decade, Exchange Traded Funds (ETFs) have become increasingly popular, increasingly varied, and increasingly useful. ETFs offer simplified access to a wide array of assets while potentially offering lower costs and lower effort.

What is an ETF?

As the name suggests, ETFs are funds that can be traded on stock exchanges, akin to any other stock. Unlike traditional market or hedge funds in which money is transferred in like a bank account, ETFs can be bought and sold immediately through any modern brokerage platform.

An ETF is essentially a basket or pool of assets that the investor can purchase a share in. The first ETFs were created to mirror stock indexes such as the S&P-500, enabling investors to replicate index performance, without needing to buy 500 different stocks themselves. ETFs soon became available for market sectors, sub-sectors, commodities, futures, bonds, and more recently cryptocurrency. This allows for diversification with much less effort than buying a wide range of individual stocks.

ETF Based Strategies

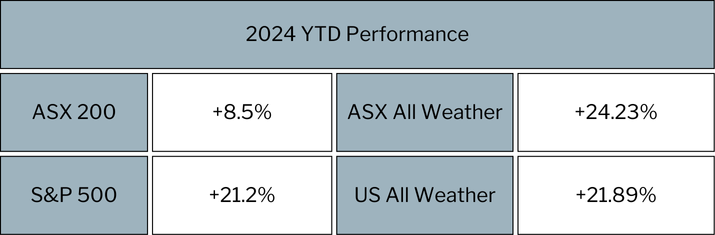

Whilst buying and holding a singular ETF can offer reasonable returns, it comes with all the ups and downs along the way, i.e. in 2022 an S&P 500 ETF would have finished the year down -19.4% alongside the index. However, ETFs themselves can be mixed and matched to provide even wider diversification. Our All-Weather strategies, for example, combine index ETFs with ETFs in traditionally stabler assets such as gold and bonds, while also diversifying in newer avenues such as cryptocurrency. This combination allows for a smooth ride, with very low effort required.

Not only does this approach remove volatility, but stagnation or decline in one area can be offset in another. For example, the ASX has been lackluster this year, however exposure to gold has kept the ASX All Weather going strong.

The All Weather strategies are available now through our membership plans, and are soon to be available through our coming Retail Fund.