What to do during major pullbacks

What can we do during major pullbacks?

Bull markets make us complacent.

Be it property, stocks or commodities, investors and traders get so used to the markets going up, that they panic when things start reversing and some of their profits disappear.

Yet pullbacks are inevitable. If pullbacks are not in your thinking then your investment plan is not a realistic one. In fact it is likely to be a plan fraught with danger.

However, if you design your investment plan to cope with market ups and downs, then your actions during major market pullbacks are simple. That is, do NOTHING.

If you have a robust trading strategy, whether it be systematic, rules based or discretionary, then an appropriate risk management strategy should already be locked in with every trade you are taking.

If this is the case, then your stop placement will take care of the rest. The time to consider how much of a loss you are willing to take shouldn’t be thought about during a correction when emotions are high. It should have been calculated well before the trade was taken.

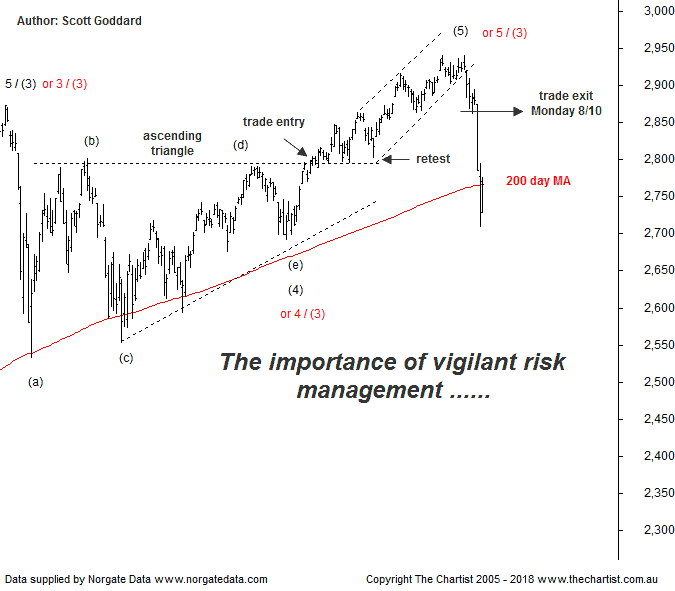

As many of our subscribers know, we had a long trade recommendation in the S&P 500 that triggered on the 13th July at 2802, with our initial stop placed at 2691. The aim, post trigger, was to strategically trail our stop higher and to see if our standout pattern target could be achieved at 3050.

Questions:

Did we know the trade was going to move in our favour? No.

Did we panic every time the market dipped throughout the process? No.

Did we focus on our target, determined that it must be achieved for the trade to be a success? The answer again is no.

What we did focus on was our risk management.

Our strategy was to trail our stop just below every pivot point to the downside that locked in post every ‘higher swing low’ pattern that triggered.

The chart below shows the end result of this trade, which was an exit well short of target at 2864.

Did we know the trade was going to start moving against us? No.

Did we panic when we witnessed the early stages of the market starting to weaken? No.

Did we change anything about our strategy based on the fact that our target may be at risk of not being achieved? Once again the answer is No.

We simply followed our processes and not the money making side of things. We took what the market was willing to give us rather than what we wanted it to give us.

The rest is now history.