Weathering Financial Storms

Imagine having a financial tool that helps protect and grow your money, no matter the economic weather. One that is designed to work well when the economy is doing great, and also when the economy isn’t doing so well.

Consider a well-balanced investment strategy that doesn’t put all your eggs in one basket. It spreads your money across different investments, like stocks, bonds, and other assets. This diversity helps to reduce the risk of losing a lot of money if one type of investment doesn’t do well.

Well, such a strategy, the All Weather Strategy, does exist and has been popularised by Ray Dalio’s mega hedge fund, Bridgewater Associates since 1991. (read the full All Weather story here)

The idea behind this strategy is to make sure your investments can weather any financial storm. When the economy is strong, the strategy will aim to make you some money, and when things are not going so well, it will try to protect your money from big losses. It’s like having a financial umbrella that keeps you dry when it rains and a sunhat for when the sun shines, all in one.

While Bridgewater uses complicated mathematical models to help make these investment decisions, it is possible to replicate to some degree by using ETFs.

Here’s a sample. We will allocate a maximum of 20% of capital to the following five US ETFs:

QLD (Stocks – 2x Geared Nasdaq)

SPY (Stocks – S&P 500)

GLD (Metals)

DBC (Commodities)

TLT (US Bonds)

Now a few Radge twists.

1. We will use a 10-month moving average (210 days). When an asset is above this we will enter a position, regardless of which day of the month it occurs.

2. If, at month end, the asset is below that average, we will exit.

3. At the end of each month we will rebalance any open positions back to the respective 20% allocation.

4. Any cash held will accrue interest at the RBA cash rate minus 0.5%

5. The portfolio will be converted to AUD.

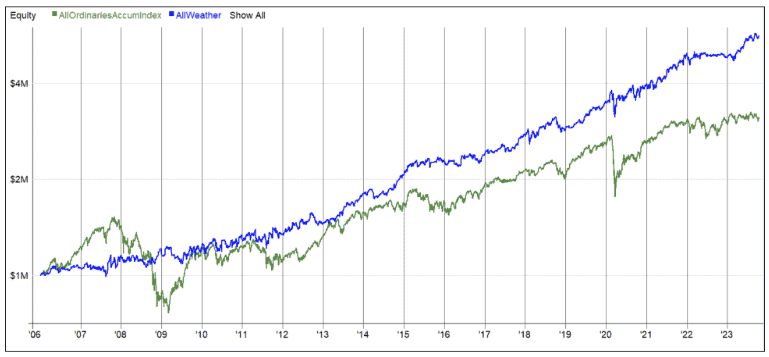

Here’s the equity curve vs the All Ordinaries Accumulation Index.

The key takeaway is the relatively smooth equity growth over time and the reduction of volatility. The CAGR of the portfolio is +8.0% vs +6.6% for the benchmark. The maximum drawdown is -12.4% vs -49.5% for the All Ords. Importantly volatility is reduced to 11%.

For me personally, as I approach retirement, moving from a pure growth stance to a more defensive stance makes sense. As such I have moved 100% of our retirement account into a similar strategy (the strategies I was using in my SMSF are still being traded but have been moved to other entities).

Both an ASX and US version of this type of strategy is available now to members of The Chartist.