US Momentum

A Long-Term Strategy that Trades Once a Month

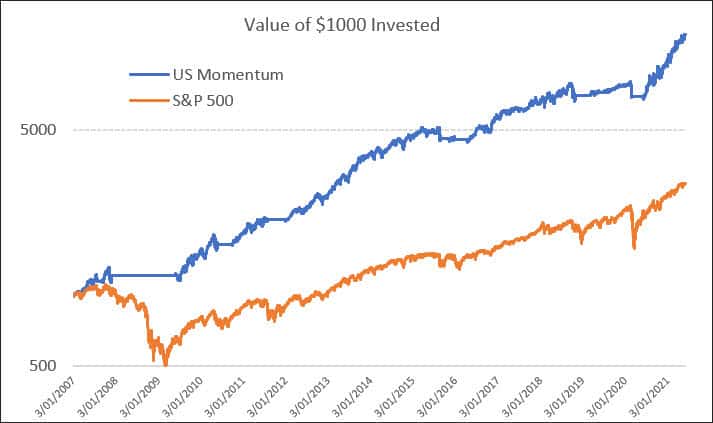

The US Momentum Portfolio is an active investment strategy that attempts to keep users fully invested when the market is rising and automatically revert to cash during sustained bearish markets such as witnessed during the GFC.

The strategy is systematic meaning that it does not rely on human opinion or any type of discretionary analysis. It derives its buy and sell signals using non-disclosed mathematical algorithms tested over many years of data and market conditions.

To generate above-market returns using the US Momentum Portfolio, it is recommended the user apply the strategy for a minimum of 3 years to gain exposure to a full investment cycle.

How does it work?

The US Momentum Portfolio trades once a month and does not require any monitoring in the interim periods.

Signals are generated after the close of business on the last trading day each month.

Existing positions that do not meet the new months’ signals should be sold.

The number of positions will vary each month with a maximum number of 10. Sometimes the portfolio may hold excess cash.

On the next day’s open, new orders are placed to be executed At Market.

What’s the Performance?

**Please read the Performance Disclaimer below

US Momentum Portfolio FAQs

How much does the US Momentum cost?

Membership to the The Chartist is currently closed. If you would like to be advised when membership reopens, register here.

What payment methods do you accept?

Payment is via credit card however we can also provide an invoice if you would like to pay via bank deposit.

Is the membership tax-deductible?

Check with your accountant or tax advisor.

When do you buy?

Buy ALL stocks listed to become 100% invested when you start following the strategy.

What broker do you use?

We use Interactive Brokers for this portfolio but you can use the discount or online broker of your choice.

Do you use leverage?

No.

Do you trade short?

No. Research and experience show that being in cash is more profitable and stress-free than attempting to trade bear markets.