Trading the Bitcoin Hype: Public interest as an indicator

Cryptocurrency has shown itself as a relentless force with no signs of going away. It is a rare sight when what on paper looks like a niche tech innovation captivates the interest of the public across the globe. In the post-COVID era, interest in crypto and Bitcoin has rocketed, with cryptocurrencies becoming legitimized by private and government entities alike.

With the price of Bitcoin surging and crypto once again becoming the hottest topic, let’s see if there is anything to be learned from the relationship between public interest and the price of Bitcoin.

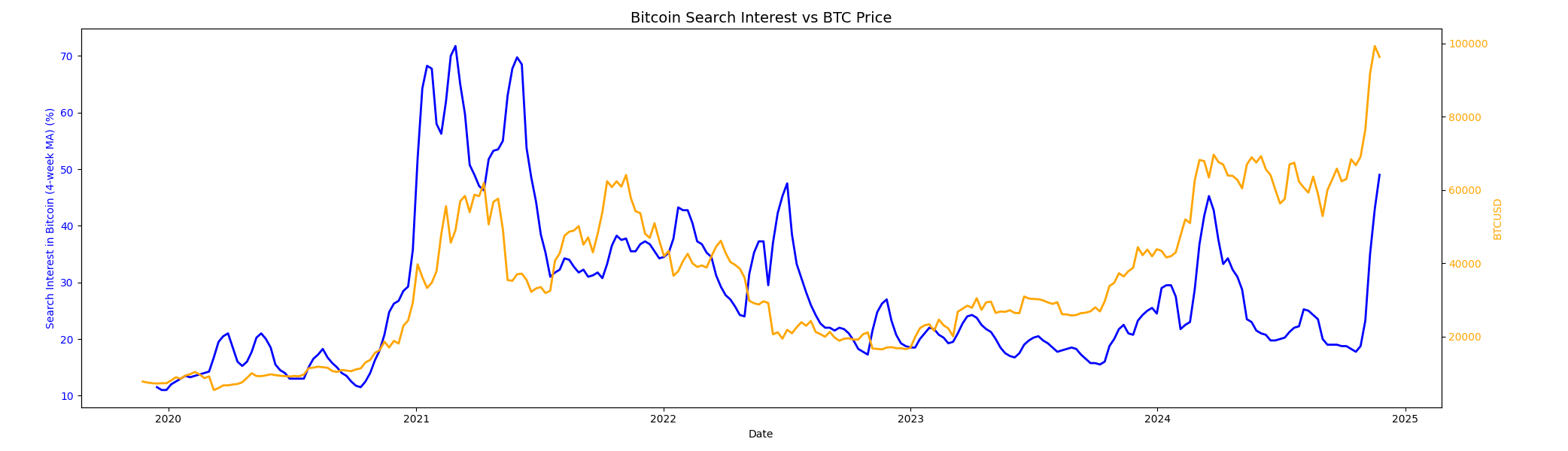

The chart below demonstrates the Google search interest in ‘Bitcoin’ shown in blue versus the value of Bitcoin relative to the US Dollar across the past five years.

There are a few interesting takeaways from this data. Firstly, search interest in Bitcoin appears to increase based on both negative and positive price movements.

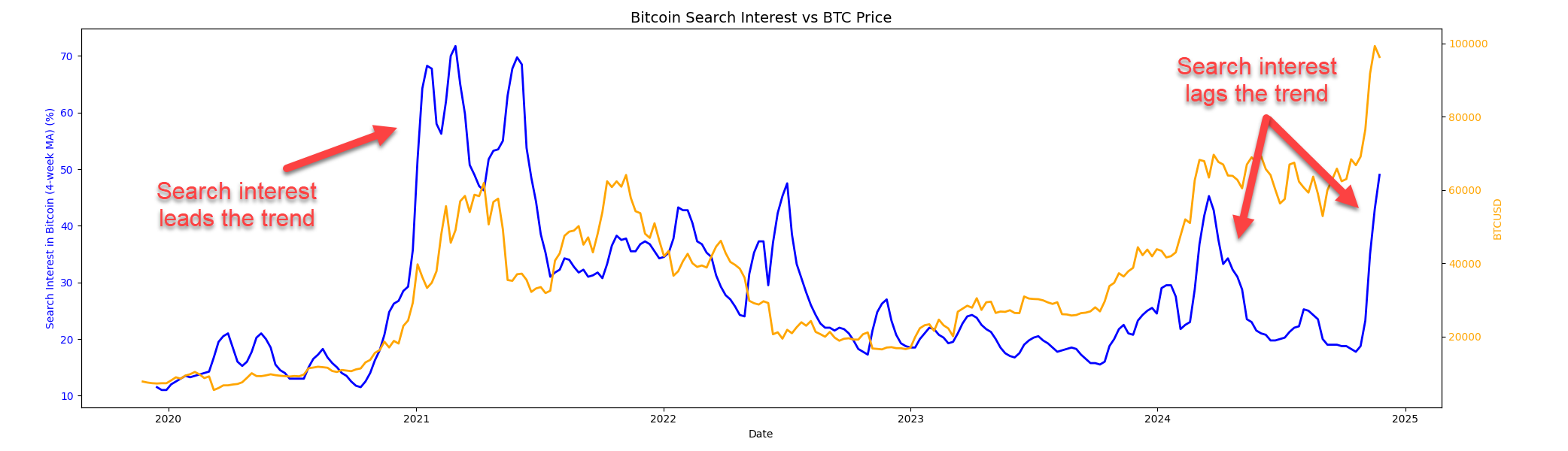

Secondly, the sharp value increase seen across the transition from 2020 to 2021 is preceded by a large influx of interest in Bitcoin. Comparatively, in 2024, search interest only increased after the value had already increased. This change could potentially have been driven by increased corporate ownership, as opposed to retail or individual ownership of Bitcoin. Supporting this is a report by River Financial, which states that corporate ownership of Bitcoin has grown 587% since 2020.

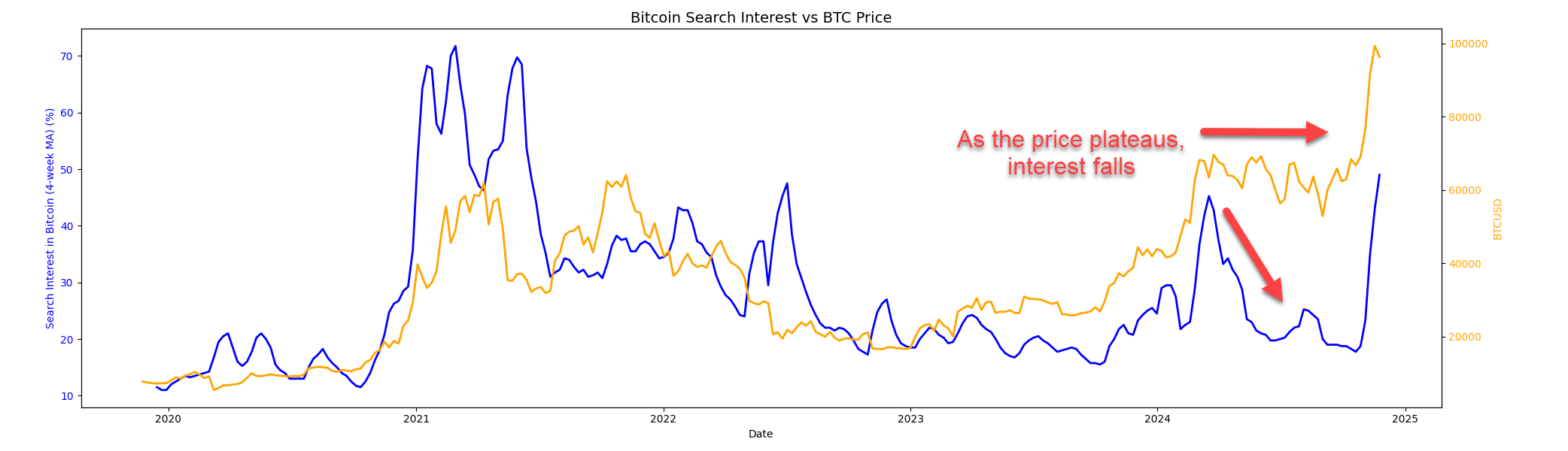

Further observation of the data shows that public interest falls off as the value of Bitcoin plateaus, before rising again as the price increases.

So, what can we learn from this data? For starters, in more recent years, broader public interest appears to be largely reactive rather than proactive. So, by the time it’s trending on Twitter or in news headlines, the immediate price movement has likely already occurred. Furthermore, public interest spikes with both value increases and decreases, while lower interest indicates stability of value.

If you’re interested in learning more about the price movement and trajectory of Bitcoin, you can find recent in-depth analysis and outlook from our analyst, Scott Goddard, available under Chart Research with a free trial membership.