Trading Holidays – To Trade or Not to Trade?

I am often asked what people should do with trading positions when on holiday. I’ve avoided the question because there is no simple answer. For example, are you away for 2‐days, 2‐weeks or 2‐months? Will there be reliable and secure internet access at your destination? Do you have a hand‐held device that allows access?

Each holiday will be different.

A Real Holiday

There is more to life than trading and the markets. If you’re going away to unwind and recharge your batteries then do exactly that ‐ close all positions and turn your trading brain off. If you’re touring several countries, the last thing you want to worry about is logging into your trading account at the next village.

The markets will be there when you return.

I just had 7 days sailing the Whitsundays. No internet. Perfect.

Use your holiday to switch off and truly escape. Don’t read a trading book either!

A Working Holiday

If you decide to trade whilst on holidays there are a variety of things to consider:

- Is the market strong and trending well, like we’re seeing since the March 2020 lows?

- Is it choppy and sideways, like it was in the latter half of 2019?

- Are you holding short-term positions or longer-term positions?

- Does the strategy trade on daily, weekly or monthly bars?

If the market is strong then perhaps setting stop losses at breakeven or better will allow you to only check in every few days. If the market is choppy, you may need to check in each day.

However, just be aware, if there is some kind of corporate action whilst you are away then all standing orders could be purged from the system ‐ including your stop loss. Now you have a problem. This scenario is improbable and rare ‐ but it is possible.

The other scenario is earnings releases, especially when trading US shares. As a rule of thumb we always recommend exiting short-term positions ahead of any earnings releases, but if you’re away then you may not realize the season is here. Remember that the US earnings season extends for a month or two.

If the market is trendless, as we saw in the latter stages of 2019, maybe just exit positions and let the market sort itself out whilst you’re away. Chances are you’re not going to miss too much.

Longer-Term Strategies

If you run a monthly strategy, then potentially you can take a few weeks during the month without issue.

However, longer-term trends take time to develop and in certain circumstances the failure to get on‐board the rising trend can be very costly if missed. In other words, you need to try and do everything you can to catch that trend.

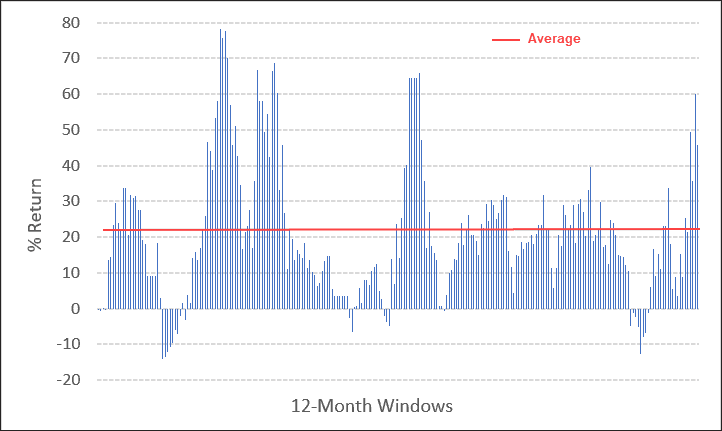

A good example was the second half of 2020. Between January and May my own account fluctuated a little up and a little down. However, from June onward the market took off and resulted in a bumper year. Had I been away when those trends began, then I would have missed the significant gains. So the issue when trading longer term is not so much managing open trades, but missing out when trends occur and you’re in cash.

In the US many brokers offer a service called ‘Auto Trading’ which allows the broker to automatically place orders from your requested newsletter on your behalf. It’s extremely popular, and for good reason. Unfortunately Australian laws make this straightforward concept more difficult because there’s a fine line between an auto trade and a Managed Discretionary Account, the latter having broad compliance requirements and therefore higher costs.

In Summary:

In summary, I do not have an appropriate answer for the signal entries apart from standing aside. Relying on a friend or family member opens up security issues as well as copyright/confidentiality breaches.

In terms of managing open positions within a longer-term portfolio, again we can exit if we feel dubious about the market trend however I never like to close the door on positions simply for the sake of doing it. I’d rather allow the market to take me out of a position on the reversing trend. If you use an ‘on close’ exit mechanism like the Growth Portfolio, then you’d need to place a ‘catastrophe stop’ a fair distance away from current price action ‐ something like 30% to 40%. This is a ‘just-in-case scenario which ideally won’t come into play but would give you peace of mind that you’ll be taken out if something drastic occurs – such as a COVID selloff.

Managing Longer Term Trades

Managing these longer-term trades really depends on your time away and connectivity. If you’re only away for a week or even two, then I’d let the positions run their course. If trends are stronger then it is less likely any action will be required. In the Whitsundays, I never logged into my account. The market was strong and trends remained firm and I felt content that not much untoward was going to occur. Longer-term systems allow more room so the impact of short term dips in the trend tends not to generate signals.

If you have secure connectivity, even intermittently such as once a week, then perhaps let positions run and just check in when you can. Being longer-term in nature, it won’t matter a great deal in the bigger picture if an exit is missed by a few days. The same is true for new entries. When we’re looking for swings amounting to many dollars, a few cents here and there won’t drag on performance.

Personally, I close all short term positions when holidaying. I simply manage longer-term positions by checking in every few days.