Too Many Opportunities. Not Enough Capital.

Trading Equities

Trading equities with a large universe of stocks presents a variety of challenges for system traders.

Regardless of whether you trade breakouts with a trend strategy or pullbacks with a mean reversion strategy, there will be times when opportunities exceed available cash.

Too many signals to choose from means the variance of returns will be very broad.

If we have 20 selections and can only take 10, how will our returns be affected if we choose the wrong 10? Or if we fail to choose one or two big winners?

Let’s use a simple mean reversion strategy to get a better view of the issue. Here’s the system rules:

Entry:

Close > 100 day moving average

RSI(2) < 20

Buy next day at limit price at ATR(10)*0.5 below the low

Max # positions = 20

Exit:

RSI(2) > 20

Exit next open.

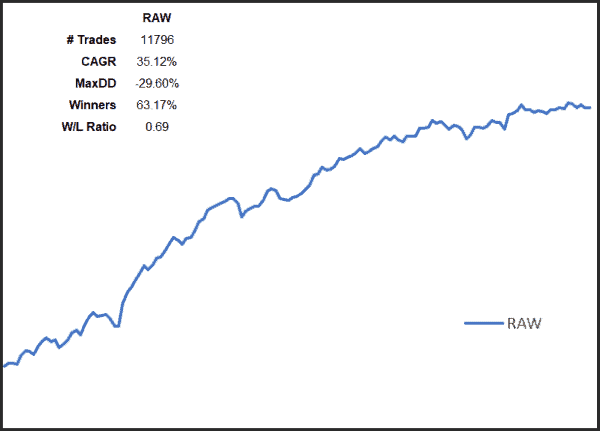

The following chart provides some insight to what the ‘raw’ system produces.

Looks okay on the surface right? Unfortunately this is deceiving due to Selection Bias.

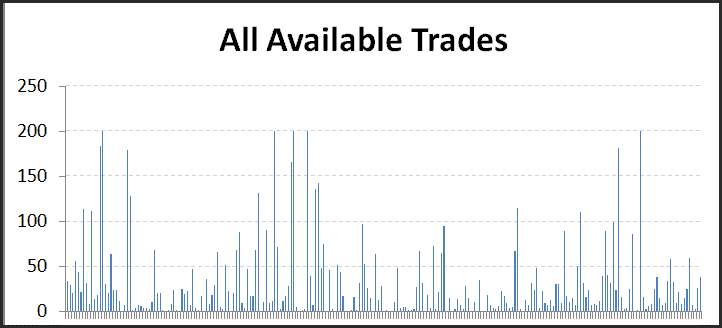

One of the system rules is that we can only take a maximum of 20 positions. Yet due to the basic entry criteria there will be days where there are many more potential trades that get ignored.

The next chart shows the available trades on any given day. If we can only select 20, which 20 is the backtest showing? A good selection? A bad selection? Or just the average across the range?

Whatever the answer it means our backtest result is flawed and real time results will more than likely be vastly different.

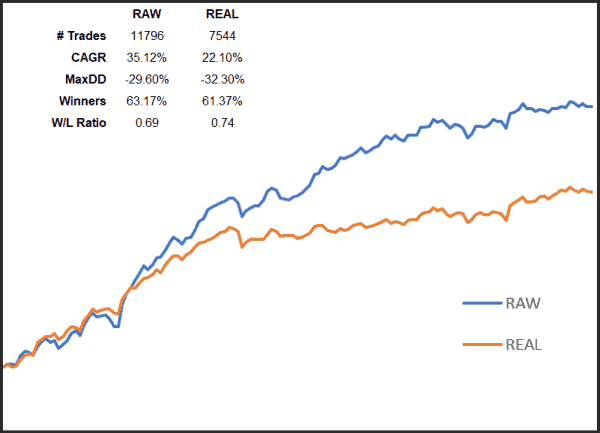

The most robust way to bypass Selection Bias is to rank strategy signals and then pass those signals through the backtest processor. There are a variety of ways to rank signals, including volatility or momentum.

For our simple example we’ll use momentum over the last week. The signals with the highest momentum are passed through (and traded real time), and all others outside the top 20 are ignored from both the testing and from real time placement.

The following chart provides a more realistic equity growth where Selection Bias has been completely eliminated.

This article is a very basic explanation of Selection Bias. There are many other factors that system traders need to be aware of, and account for, in order to be fully cognisant in building a testing trading systems. For more detailed information please visit our Trading System Mentor Course.