Too Big To Trade?

Recently I mentioned that liquidity constraints were an important factor when thinking about trading or investing. Not only is it imperative that a strategy is scalable, at least to some degree, but also moving in and out of positions shouldn’t disrupt the market.

History is littered with examples of liquidity blow-ups, the most prominent being the Long Term Capital Management (LTCM) hedge fund in 1998. As their performance and popularity grew, they not only moved away from their core strategy, but also into more esoteric and low liquidity markets. When Russia defaulted in 1998 LTCM was forced to exit a number of its positions. As rumours of the hedge funds difficulties spread, some market participants actually positioned themselves in anticipation of a forced LTCM liquidation.

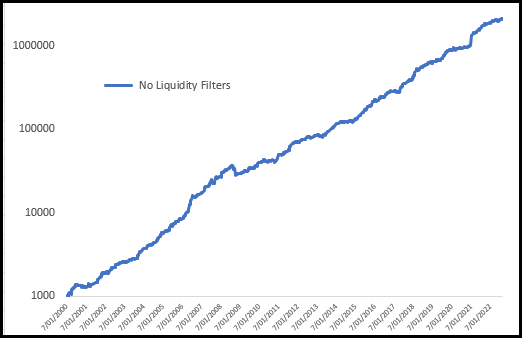

Let’s revisit last week’s ASX Weekly Swing strategy and remove all liquidity filters. The equity growth below is 40% CAGR, or every $1000 invested turns into $2.1m after 20 years. Just like magic…

ASX Weekly Swing

Magic aside, we’ll run into some serious issues in the real world.

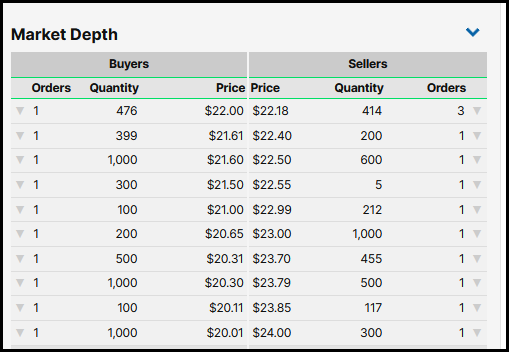

Below is the market depth for $AVR.asx. Not only is the bid/offer spread some 4%, but the liquidity either side is extremely low.

Market Depth

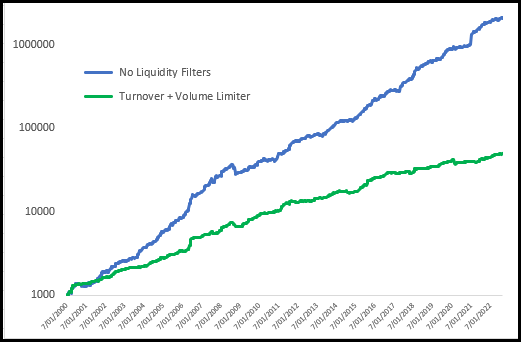

To get a more realistic picture we need to add in some liquidity filters. Either using turnover or volume or a combination of both. Below is the equity growth of the same strategy where liquidity filters have been applied. The main one being capping the order size to 10% of the daily traded volume.

Equity Growth

In this case the CAGR drops from 40% to 24%. While not as appealing, it is more realistic.

There are a variety of ways to work around scale issues, namely trading different strategies across different timeframes and markets. I’ve written about some solutions HERE.