The Life Cycle of a Trade

A common misunderstanding with trading and investing is the life cycle of a trade, specifically, when does analysis become an actual trade?

To put it another way; an unfolding scenario does NOT automatically equate to a position being taken or a position being removed.

Let’s use a real time example to look at the life cycle of a trade.

The Setup

The Setup is the initial analysis that could, at some stage in the future, lead to a position being initiated. The setup phase of the cycle is a ‘watch and wait’ situation.

It does NOT mean a position should be initiated or removed.

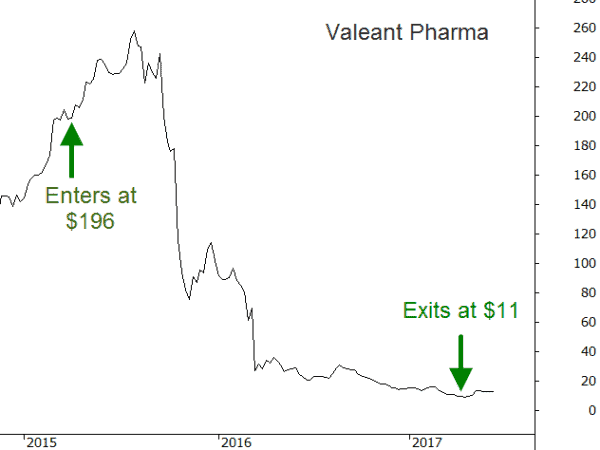

The following chart shows the current analysis of the ASX-200 (XJO) from the ASX Chart Research service. The analysis suggests a Head & Shoulders topping formation is potentially taking shape. This phase of the cycle is the setup.

To reiterate; a setup is the building of a scenario that may, or may not, unfold at some stage in the future.

The Confirmation

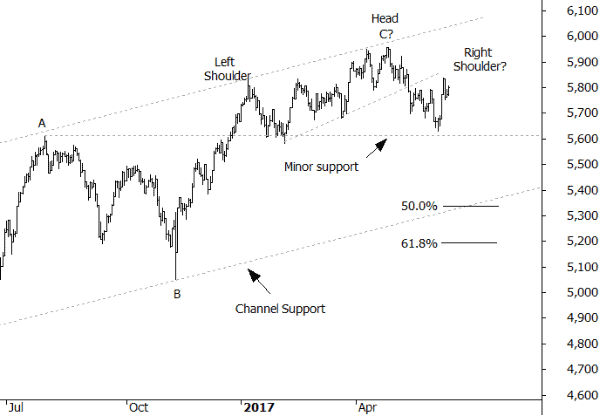

The next phase of the cycle is the confirmation or the trigger. This is where the ongoing analysis is being proven correct and is the point at which a position should be initiated or removed. Up until this point, the pattern has not been proven and therefore could fail to eventuate.

In our example above, according to classic technical analysis, the confirmation occurs when the market closes below the neckline of a Head & Shoulders pattern.

In all forms of analysis, technical or fundamental, there is a certain point at which enough confirmation has occurred that the trader or investor will be comfortable or ready to put on a position.

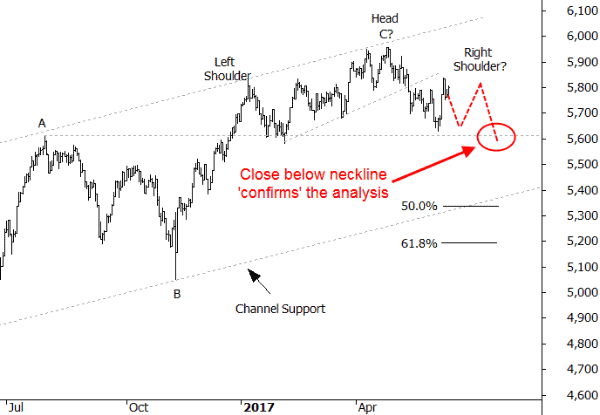

A recent example would be the US election result. Donald Trump had touted broad reflationary stimulus. But the market was unconvinced of his victory. They played ‘wait and see’. When the result was announced, the confirmation phase, the S&P 500 started trading higher.

Validate / Invalidate

The last stage of the cycle is the ongoing trade management, specifically if the expected outcome continues to follow the wanted path, or reverses course. In order to continue to hold a position the market needs to continue to validate the position until the desired results or target is met.

If the desired outcome is not being met then the position should be managed.

In our example, a continued decline toward the target zone is the desired outcome – validation – and a break back above the Right Shoulder would invalidate the trade. At this point, the analysis was proven incorrect and defensive action needs to be taken.

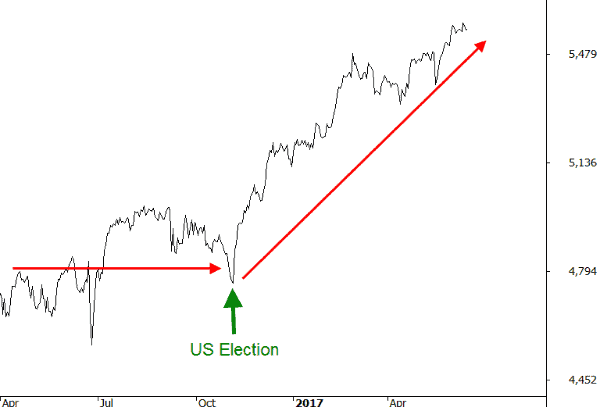

Knowing the point that the analysis is invalidated is an important element of successful trading – and tends to be easier with technicals than fundamentals. The following chart of Valeant Pharmaceuticals is a great example. Bill Ackman, billionaire hedge fund manager, took a $2.5b position in 2015 at an average price of $196. He exited in early 2017 at $11 after conceding that management were unable to turn the company around.