The Importance of Regime Filters – Part 1

Today we discuss regime filters and what impact they have on certain styles of trading systems.

A regime filter, or index filter as it’s sometimes known, defines the trend of the broader market. Some strategies benefit from being aligned to that same trend. i.e. be long equities when the S&P 500 is trending up, but remain in cash when that broader market trend is down.

Regime filters can be simple moving averages, a moving average cross-over, an indicator such as an RSI. Or they could even be defined using breadth indicators such as NYSE New Highs/New Lows.

Bollinger Band Breakout

The first strategy we’ll look at is the Bollinger Band Breakout (BBO) which appeared in Unholy Grails back in 2012. I continue to trade a version of this today. The BBO is an absolute trend following strategy that uses daily bars for signals.

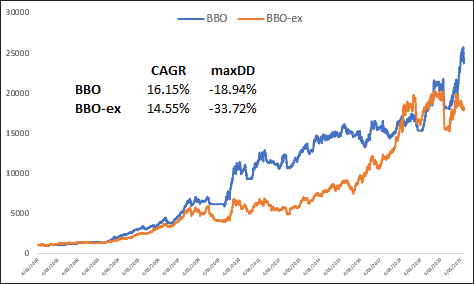

The following chart shows the equity growth from 2000 through today of both the BBO and the BBO excluding its regime filter. There’s not a large differential in return, but there is a considerable difference in drawdown. From experience, the threshold for drawdown tolerance is 20%. So the exclusion of the regime filter here could be a deal breaker.

ASX Momentum

Let’s look at another style of strategy, namely our ASX Momentum portfolio that rotates out of weak stocks and into strong stocks. It trades a concentrated set of stocks in the ASX-100 and only trades monthly.

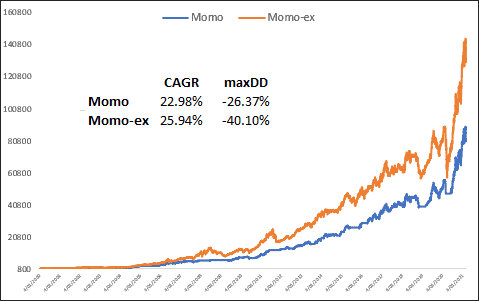

At first glance, the equity curve of the strategy excluding the regime filter is well ahead of the other. However, that’s a function of compounding in late-stage outperformance. The differential in CAGR is about 3% annually.

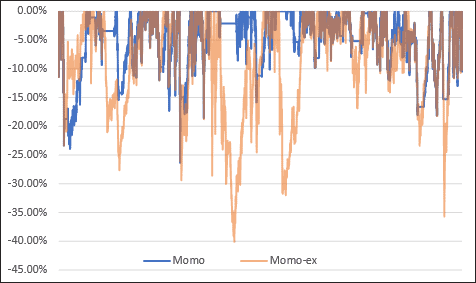

However, taking a closer look at the underwater equity curve, we can see that strategy without the regime filter, Momo-ex, has quite a few sharp drawdowns that exceed 30%.

And here’s another interesting fact. At Momo-ex maximum drawdown at -40.10% in March 2009, the Momo strategy using the regime filter was only in a drawdown of just -2.12%.

That’s a huge psychological hurdle.

In summary, as far as trend style systems go, it appears that regime filters lower the ‘pain’ threshold of trading them, but doesn’t tend to lower the returns.