The Chartist Client Question: Entry Timing

Today I thought I’d revisit a question we received a little while ago but weren’t able to answer fully at the time. You can reread the original article here.

The question was:

“for the ASX momentum system as it’s a monthly system and if using a super account…where you can choose what to invest in, is there a difference between doing the sell orders on first trading day of month and buy orders on second trading day of month?”

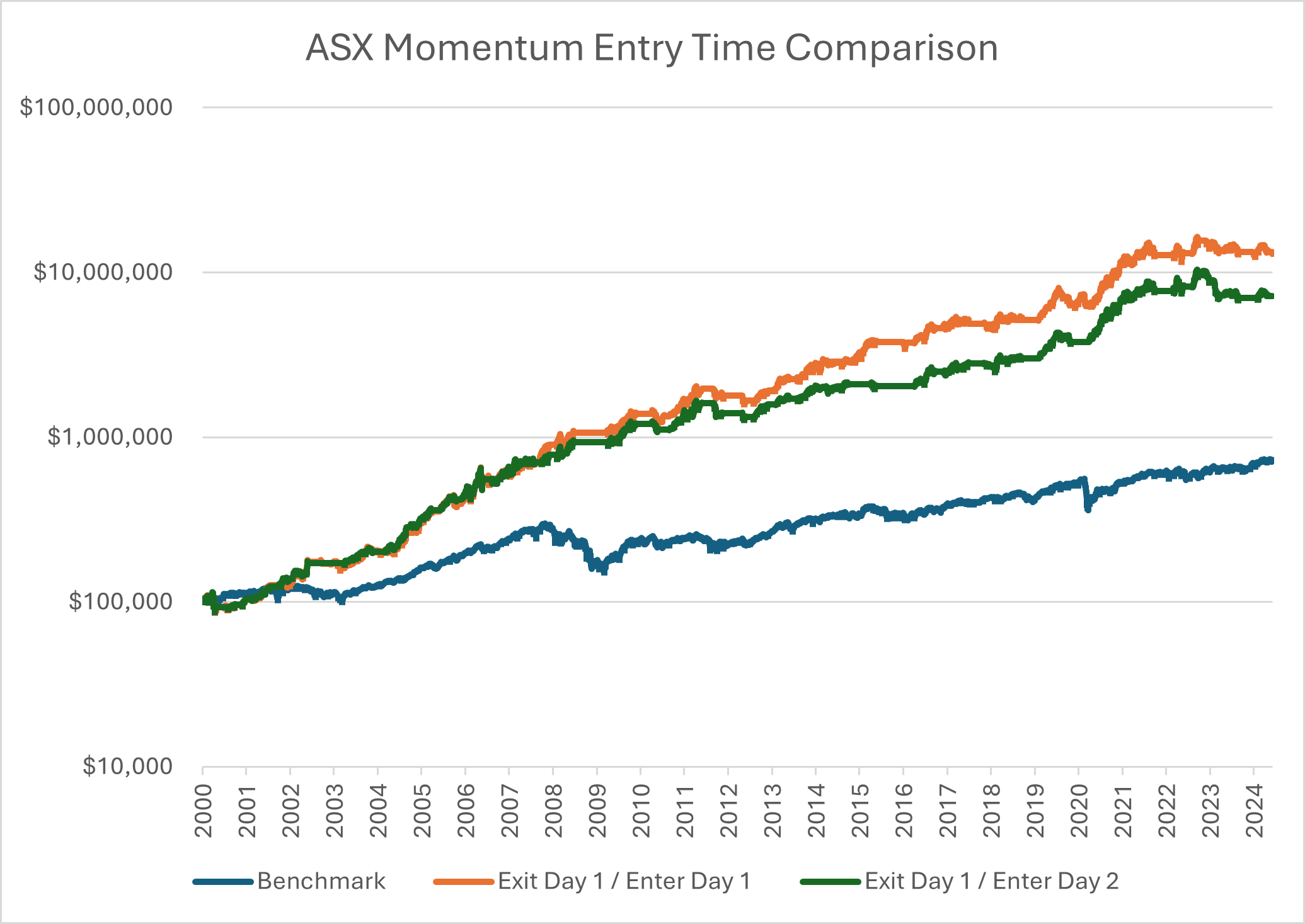

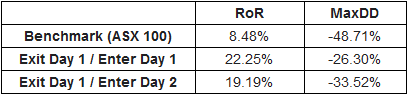

This is an important question as it’s a common issue for those running SMSF who may not have access to excess capital or margin, allowing them to place concurrent exits and entries. At the time of the original article, we could only test the variance between entry orders placed at the Open, High, Low, or Close, and the difference was found to be essentially negligible. However, now that we have access to the RealTest software, we can accurately answer the question, and you may find the results surprising.

What we can see is that waiting a day to enter places a fairly significant drag on the results. While some of this drag would come from the difference in entry prices, a large portion would also be the lack of utilization, as capital is left sitting waiting for one day each month. While it may not seem like much, across 24 years (as in the graph above), this equates to 288 trading days of idle capital.

One solution to this problem is to use a broker that allows more complex order types. Interactive Brokers, for example, provides a Good After Time (GAT) order that allows you to specify a time the order is placed. Using this, exit orders can be placed as usual for the market open, with the entry orders delayed for 5 minutes later.

Alternatively, as the ASX Momentum comprises only 5 positions, the exits could be placed before the market open, and the entries placed manually after market open when you have a spare minute. While both solutions may incur some slippage, given the low turnover and long hold length of the strategy, this would be minimal.