The Best Returns

2017 has been a fantastic year for investors.

The US has enjoyed one of the longest bull markets on record.

As the famous saying goes “the best returns are made at five minutes to midnight.”

So it’s understandable that the temptation to watch the clock is irresistible.

Improvements in global growth could not have come at a better time.

Locally, investors should be feeling pretty good about the world and comfortable with current market valuations.

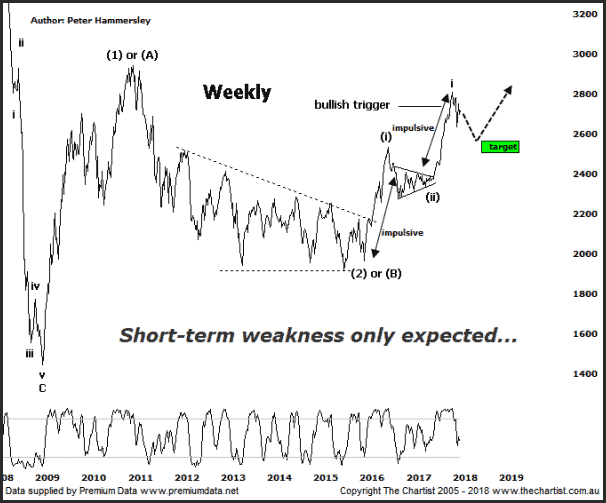

As we countdown the final days of this year, and head into 2018, the ASX 200 is trading at an almost decade high.

We retain a bullish outlook for the coming years, maybe even next decade.

On the resources front, commodity prices have enjoyed a year-end rally which are providing a steady buffer for the 2017-18 earnings period moving forward.

On the economic front, corporate capex is picking up and we can see this in the confidence numbers as well.

Overall, there’s been a marked improvement in the economy and this has been critical.

There has been a steady shift for the better part of a decade away from three main areas:

1. Purchasing experiences away from physical goods.

2. Sales away from shopping malls to online channels.

3. And a steady shift from small, independent local retailers to multinationals.

Whilst the latter is not great for small, local businesses it is great news for international companies listed on the ASX.

Geopolitically, the world seems to have gotten back on track and for the most part the squabbles of 2017 are behind them.

In the United States, President Trump’s tax cuts appear to be a done deal. Whether you believe these to be right or wrong the news was positive for corporations and domestic profits.

The result of which has sent the S&P 500 above 2,600 points.

And the Dow Jones soaring above 24,700.

With a positive outlook for the year ahead, 2018 should be a bumper year especially for investors who take the time to develop and validate their own trading systems.

On that note, The Chartist Growth Portfolio, continues to do well.

With expectations of an uptick in capital markets activity and optimism around forthcoming floats… there’s no reason not to be positive.

As investors, we should head into 2018 with an optimistic mindset. I certainly am.