Leverage and Position Sizing

In recent articles we’ve been discussing risk management, so today I’d like to extend the conversation and introduce leverage. If you’ve not read the first two articles HERE and HERE, then it’s probably worthwhile before starting on this one.

We all know about the “2% Rule”, technically known as Fixed Fractional Position Sizing and how it enables us to correctly equalise risk on all positions. Any decent book or course that discusses risk management will highlight this. However, in real time trading, specifically when it comes to trading equities, one learns very quickly that the amount of capital needed to fund positions using the technique will exceed the cash value of the account, as was discussed in the most recent article. So what to do?

There are a few answers.

Back in the days before leverage I came up with a filter known as the Bang For Buck filter. The Bang-for-Buck simply filters the relative volatility of the stock in comparison to its price. To calculate the Bang-for-Buck filter, in layman’s terms, divide a $10,000 account by the closing price of the stock on any given day. This number is then multiplied by the average range of the stock for the last 200 days. The average range is the distance the stock has moved from high to low each day over the last 200-days. Dividing this number by 100 will convert the result to dollars and cents which in turn indicates the possible dollar return on any given day. The higher the ratio, the higher the profit potential and therefore selecting higher ratios will enable stock selection with potential for movement, which is what we want.

This method works well if you only need to choose between a limited number of possible trades, but if you have a larger selection of trades you really need to do the opposite. In our short term Discretionary Portfolios we use a “%Risk Filter” method which basically measures the risk on the trade to the underlying share price itself, therefore,

%Risk Filter = (EntryPrice – StopLoss)/EntryPrice

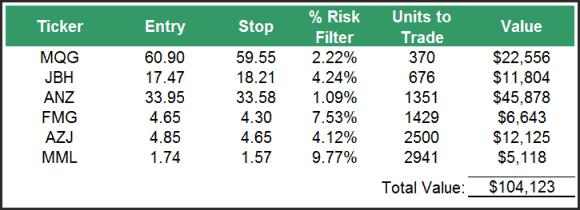

Let’s look at a selection of six random trades, assume we have account capital of $50,000 at our disposal and we’re willing to risk 1% on each trade. Ideally if we’re to follow the strategy as designed, we should be taking all six without question. However, as you can see, to take all six using Fixed Fractional of 1% will require capital of $104,123 – exceeding our available cash.

This table shows the relationship between the capital required and the %Risk Filter reading, specifically, the lower the reading the more capital is required to take a trade. ANZ has a reading of just 1.09% which is a reflection of the very tight stop loss and the high underlying value of the share price. If we only had to select a single position, like we used the Bang for Buck Filter for, then we’d definitely go with ANZ because we’d make a lot more profit for the same risk should the position move favourably.

However, in this case it’s not about selecting a single trade out of a few on offer. To gain diversification we need to take as many as we can with our limited capital. To that end we start with the highest %Risk Filter reading and work down to the lowest. Out of the six trades shown, we’d start with MML at 9.77%, then FMG, JBH, AZJ and finally we’ll just miss out on MQG, although we could take a half position. The four positions will use $35,690 worth of our capital and allows us to take 4 of the 6 trades, which offers slightly better diversification and allows us to trade the strategy as closely as possible to what was intended.

This process is fine if we have just 6 entries, but what if the market is ramping up, you have plenty more opportunities and you want to put your foot down?

The answer is leverage.

** Warning – leverage can lead to large losses and gains and is not appropriate for everyone. **

The significant error many amateurs make with leverage is they use a top down approach rather than a bottom up approach.

A top down approach goes something like this; we have $50,000 of our own capital, we can leverage to 75%, meaning our own capital represents just 25% of the available funds we can access, and therefore we can now trade using $200,000. So with that $200,000 we can risk 1%, or $2000 on each trade. The issue is that the $2,000 represents 4% of our actual capital which is well and truly above a reasonable and safe level. If we use the table of trades above and assume all 6 get stopped out at their respective stop levels, our account would be at -24% before we even blink. Maybe not financially, but psychologically it’s game over.

What we want to do is use a bottom up approach instead, meaning we size our positions from our own $50,000 of capital, but use the leverage to facilitate all the trades. Our 6 trades require a total of $104,123 which is well within the level of leverage provided so we can take all 6. Should all 6 positions get stopped out we lose $3,000, or just 6% of our capital, which is in stark contrast to losing 24% on the same trades.

So, in summary, we have a variety of ways to determine which trades to take based on capital levels. However, the most efficient way to trade, allowing the most diversification with lower risk, is using leverage to facilitate the trades.

REMINDER: ** leverage can lead to large losses and gains and is not appropriate for everyone. **