Taking An Active Interest in Investing – Part 3

The last few articles we’ve been discussing a simple strategy that provided highly encouraging performance on both the US and Australian index ETFs.

For 90% of investors who take an interest in their own investments (probably 30% of the population) then these K.I.S.S. strategies are ideal.

But they’re not for me.

Let me explain.

It’s a well known fact that share markets have an upward bias over the longer term – approximately 80% of the time.

It’s impossible for an index tracking ETF to outperform the index during an uptrend and

This strategy however only outperforms by standing aside during sustained bear markets, such as the 2008 crisis.

To gain truly exceptional returns over the longer term, we need a strategy that not only stands aside during the downshifts yet can also capture more upside when it’s available.

And to do this we trade stocks that provide a higher beta.

In laymans terms Beta relates to the volatility of an instrument in relation to the underlying market. In general a Beta of less than 1 means the stock moves less than the market. A Beta higher than 1 means the stock moves more than the market.

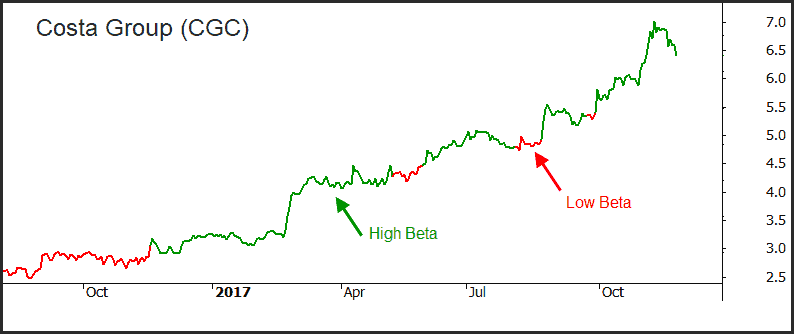

In a strong bullish environment, higher Beta stocks that are trending higher will greatly enhance returns. Here’s an example.

This is a price chart of Costa Group (ASX:CGC) – a solid performer within the Growth Portfolio this year. The colour coding indicates a change in Beta, specifically when green the Beta is greater than that of the market (in this example we’ve used the STW ETF) and when it’s red the Beta is less than that of the underlying market.

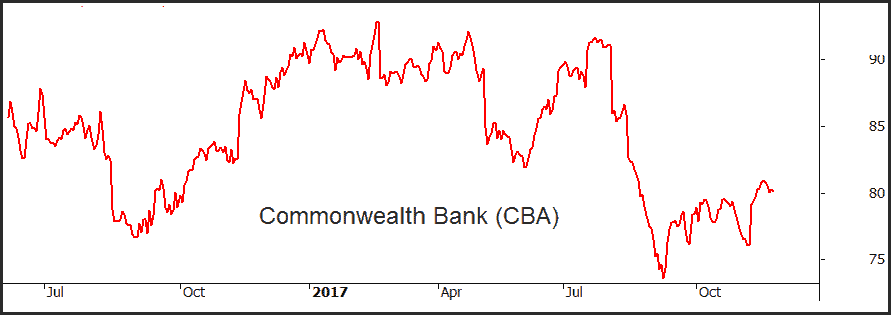

Let’s now compare that with Commonwealth Bank. Which makes up a considerable portion of the market capitalization that it’s almost a good proxy for the index itself. This chart shows no higher beta data points (no green). Like the market, not much trend and not much return (aside from dividends).

This is not to say that Commonwealth Bank can’t provide a higher Beta. It certainly can – but not right now.

Currently the market strength, or higher Beta, is found in the Small Ordinaries area of the market. Which is where I have focused my own efforts and is providing solid returns.