Taking An Active Interest – Part 1

In this article we will look at taking an active interest. Previously I discussed the risks of being a Buy & Hope Hold investor in an index fund ETF.

Watching the value of your assets decline by 50% isn’t comfortable. It’s easy to look back with the benefit of hindsight and pick those great buying opportunities. But, at the time, the viability of the whole financial system was in question and most wanted to end the pain as quickly as possible.

What can an investor do to grow their capital, yet protect from bear markets that come along every decade or so?

Well, one reader wrote the following:

- Buy the [Index] SPY ETF

2. Sell to cash if the price falls below the simple 10-month moving average

3. Buy back when it crosses back above againIf you just do that you beat most investors.

And I completely agree, although this is not a new strategy. It was one I employed for many financial planners and brokers who needed a better business model after the GFC.

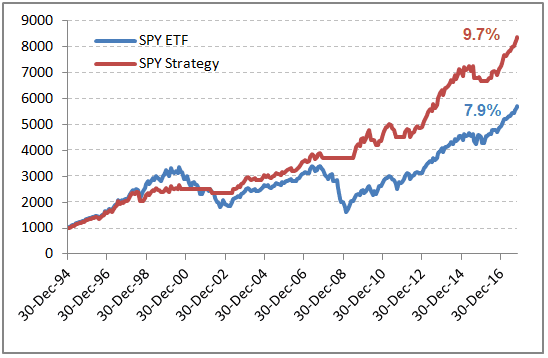

Let’s put it to the test using the S&P 500 Index ETF (SPY) back to January 1995. Here’s the metrics (vs buy and hold):

CAGR: +9.7% (+7.9%)

Exposure: 75% (100%)

# Trades: 12 (1)

Win%: 75% (100%)

W/L Ratio: 5.43 (n/a)

The equity curve looks like this…

That’s a good looking equity curve.

The strategy is invested 75% of the time and does minimal trading.

Easy workload. Minimal commission drag.

By eliminating exposure to negative sentiment it provides a higher annual return than buy and hold.

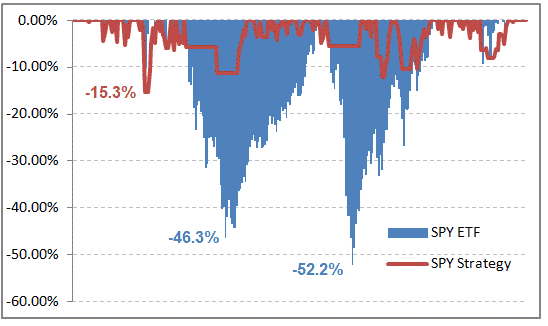

The next chart is the most important – because we all hate pain.

This is called an ‘Underwater Equity’ chart. It shows the depth of any decline in capital from a peak to a trough. These declines are known as drawdowns.

If you can’t handle the depth of the drawdown, you can’t trade the strategy.

Bottom line?

Whilst Buffett and his parrots propose everyone just buy and hold an index ETF, the chart above shows they must also wear a 50% drawdown in equity.

Hard to swallow in the real world.

The SPY Strategy on the other hand has had a maximum drawdown of just 15.3%.

Considerably more palatable.

Read more about actively investing with ETFs here.