Take The Trading Day Off

Recently we discussed the Skip Day Strategy. Some more evidence from Bespoke has come to my attention which reinforces our findings, this time with the S&P 500 ETF (SPY).

From Bespoke,

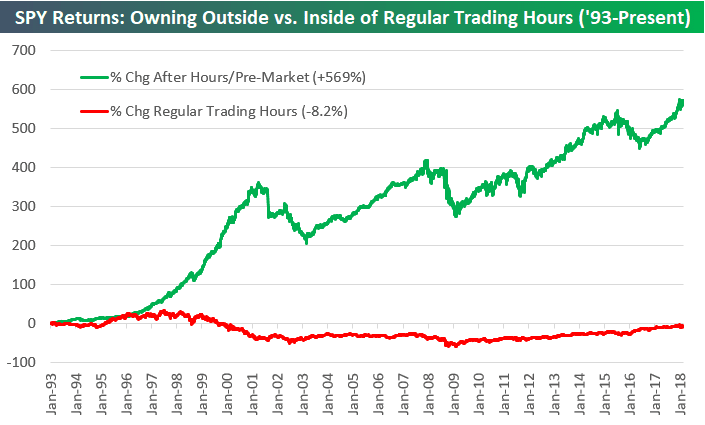

In early February we published a report for our research subscribers showing that more than 100% of SPY’s price change since 1993 (when it began trading) can be attributed to after-hours trading. If you bought SPY at the close on every trading day since 1993 and sold it at the next trading day’s open, you’d have a gain of 569%. Conversely, if you bought SPY at the open of every trading day and sold it at the close that same day, amazingly, you’d be down 8.2%. Below is a historical chart showing the cumulative price change since 1993 for both of these strategies.

The chart above looks at the trading strategy over a very long time period. Today we wanted to see how the strategy has been doing just over the last year.

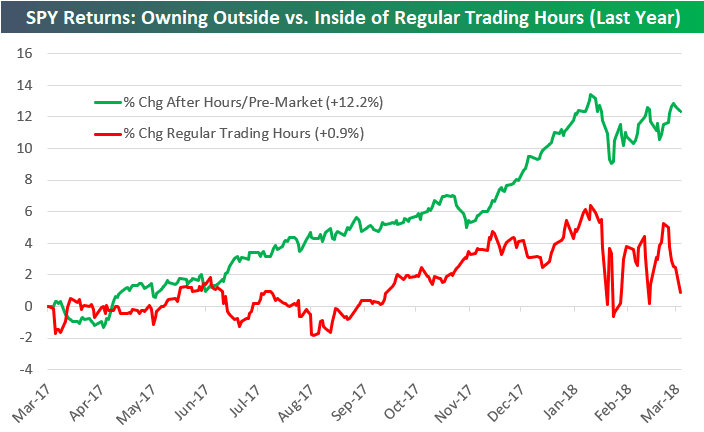

As shown below, after-hours trading is still where it’s at. Over the last year, had you bought SPY at the close every trading day and then sold it at the open the next morning, you’d be up 12.2%. Had you done the opposite and bought SPY at the open of every trading day and sold it at the close that same day, you’d only be up 0.9%.

So far in 2018, the after-hours strategy has meandered along, while the intraday strategy has really struggled of late. Translated: there has been a lot of selling going on during regular trading hours recently.

Source: www.bespokepremium.com

Our Trading System Mentor Course is currently open to new clients. Ask me how we can help to convert your own trading ideas into fully-fledged real time strategies.