Risk or Volatility?

Is it risk or volatility?

There are many reasons why people fail at trading. The major causes are

- lack of trading strategy based on empirical evidence, or

- over trading with minimal capital.

But it’s still possible for someone with a proven strategy and adequate capital to fall flat.

And usually this occurs when confusing risk and volatility.

They are not the same.

Risk is the permanent loss of capital or, loss of enough capital, to restrict your financial welfare.

A good example of risk is to ensure your strategy actually has an edge, and a lasting one. I revisited my first ever trading strategy HERE. Even though it was rule based, those rules hadn’t been tested. As you can see, I was simply lucky and had I stayed the course I would’ve suffered a terminal loss.

Volatility on the other hand is the swings in equity that are part-and-parcel of trading and investing. These swings can be viewed daily, weekly, monthly and yearly.

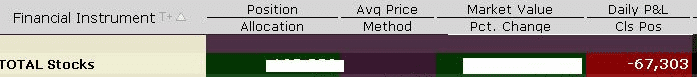

Below is the daily equity change of my own trading account in USD for November 10th 2021.

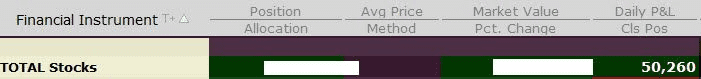

Here is the same account for November 18th 2021.

That’s volatility. November 10 was no more ‘risky’ than November 18. It was just a losing day, which is part of the journey. Yet for some people, experiencing these downs can be debilitating and cause a premature exit of a perfectly good strategy.

Here’s a few ways to overcome the volatility conundrum.

- Think process, not outcome. Stop thinking about the money (the irony being we’re all playing the game to make money). But thinking money only stirs emotions and it’s these emotions that ensure novice traders make irrational decisions.

- Think in percentages, not dollars. Take November 10th above – that single day equity swing is equivalent to the annual salary for the average Australian. Thinking in dollars creates an emotional rollercoaster.

- Allow the edge to play out. Too often I see someone start a perfectly good strategy only to drop it after a small losing period. By using rolling window analysis I can assign probabilities of profit over time frames. For example, the ASX Momentum Strategy has a 92% chance of profit in any 12-month window – regardless of when you start. That means there is an 8% chance of having a losing year. If you decide that 12-months is enough time to justify continuing, then you may fail to see the edge actually work its wonders.

- Diversify across strategies. I have discussed this infinitum and most recently HERE. The more diversification, the smoother the ride of the total portfolio. A good real-time point of reference is the ASX Momentum and the US Momentum. The ASX is struggling to stay in the green this year, but the US Momentum is +34%.