Re-engineering the US All Weather Strategy

We recently explored alternative portfolio allocations during market downturns. This week, we’re taking the concept a step further—by re-engineering the US All Weather strategy in a more aggressive light.

Our All Weather systems use a variety of ETFs, grouped into both growth and defensive assets. Depending on the prevailing market trend, the system tactically adjusts its allocation between these subgroups. The core benefit of this approach is its ability to generate low-volatility returns, making it well suited for investors with a lower risk appetite or those looking to manage overall portfolio volatility.

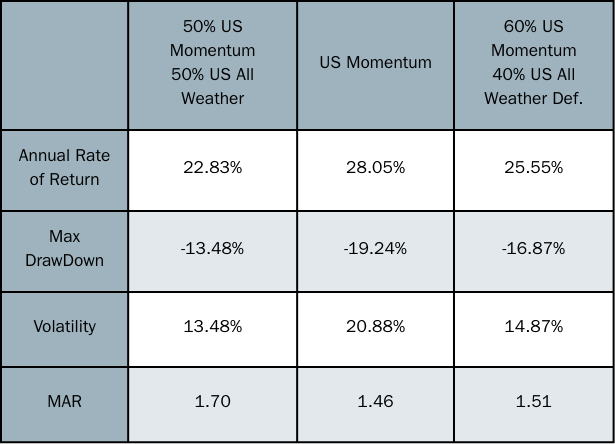

The trade-off, however, is that in strong market environments, this strategy is less likely to outperform major indices. To explore a more assertive configuration, the following experiment replaces the growth portion of the US All Weather strategy with the US Momentum portfolio.

In the standard setup, a balanced portfolio would hold 50% in US Momentum and 50% in US All Weather. In this variation, we allocate 60% to US Momentum and 40% to the defensive portion of the All Weather strategy.

The results are compelling.

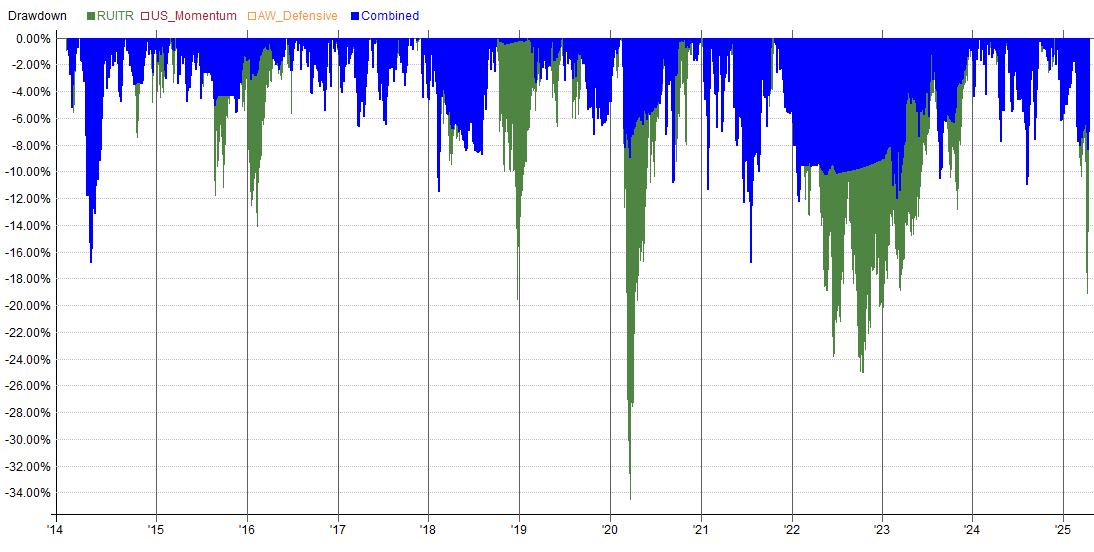

- Volatility drops significantly, which in turn reduces maximum drawdown and helps smooth out returns, as shown in the drawdown graph below.

- Annual returns remain high, showing only a modest decrease compared to a full US Momentum allocation.

- The 40% allocation to the defensive side of All Weather also introduces exposure to other market segments—such as gold’s current uptrend (GLD) and prior allocations to bonds (TLT) & commodities (PDBC) as some examples —that would otherwise be missed in a pure momentum portfolio.

This hybrid model offers another advantage that’s often overlooked: psychological comfort. Traders may struggle when a strategy like the US Momentum moves entirely to cash due to the Regime Filter turning off. In this blended approach, a portion of the portfolio remains invested through the defensive All Weather allocation—helping maintain engagement and discipline during uncertain times.

As part of our 14 day free trial. You can access both the current and past positions of the US Momentum and US All Weather Portfolios. Our Systematic Portfolio Guidebook, shows the returns of these portfolios as well as extensive combined metrics.