Putting a Spin on Warren Buffett’s Advice

In his 2013 letter to Berkshire shareholders, Warren Buffett shared his posthumous investment strategy. He advised that 10% of his cash be allocated to short-term government bonds and 90% to a low-cost S&P 500 index fund.

Buffett expressed confidence in this approach, stating, “I believe that this method will yield superior long-term results compared to most investors, including pension funds, institutions, or individuals who use high-cost managers.”

While a 90/10 portfolio is highly aggressive, it does raise concerns regarding risk management. Though it can offer reasonable returns, averaging around 11.2%, it also exposes investors to significant drawdowns, with the average being approximately 37%, which can be unsettling for the typical investor.

Is there an alternative? I believe so.

Gold is often seen as a safeguard, a defensive asset that maintains or even increases its value during financial upheavals, economic instability, or inflation. This resilience positions gold as a key diversifier for portfolios, especially those dominated by stocks. Stocks and gold often move in opposite directions; when stock markets face downturns, gold prices typically rise (and vice versa). This inverse relationship can help stabilize the portfolio’s value over time, reducing the impact of market volatility on the investor’s holdings.

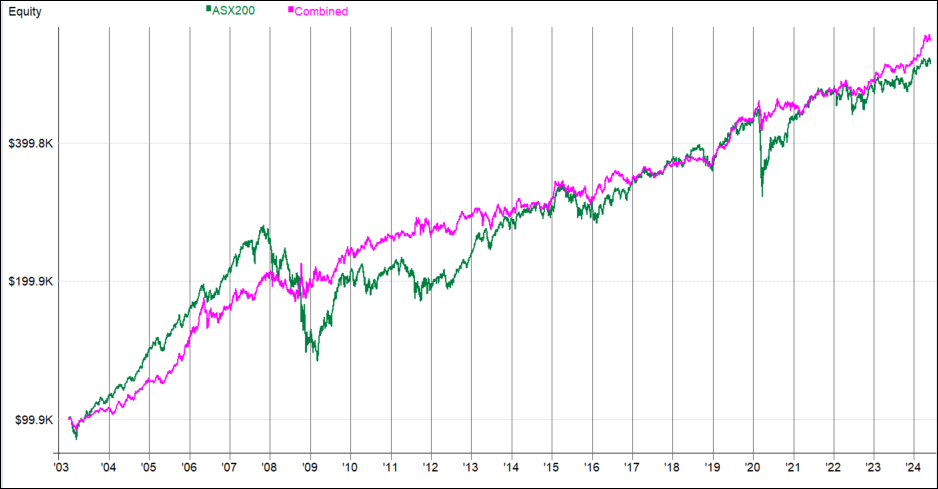

The following chart shows the performance of gold (pink line, Gold ETF) versus the Australian stock market (green line, S&P/ASX 200 ETF). The divergence during the Global Financial Crisis highlights gold’s protective quality in times of market distress.

As previously mentioned, a portfolio with 90% growth assets (stocks) and 10% defensive assets is considered highly aggressive. The aim of this exercise is to achieve reasonable returns (greater than cash in the bank) while mitigating the inevitable downturns to some extent.

What if we take a conservative stance and invest 50% in stocks using the State Street SPDR S&P/ASX 200 ETF (STW) and invest the other 50% in the Global X Metal Securities Aust ETF (GOLD). At the end of the year, the portfolio is rebalanced back to 50/50.

The following equity growth chart shows our portfolio (pink line) vs. a Buy & Hold (green line) portfolio represented by the S&P/ASX 200 ETF (STW).

The portfolio shows a reasonable return of +9.36% vs. the Buy & Hold of +8.40%. Importantly, the maximum drawdown is just -16.17% vs. -48.10%. The volatility of the portfolio is lowered to 10.9% vs. 15.6%.

It’s important to note that during very strong up years, the portfolio can lag the benchmark due to its defensive allocation to gold. Unfortunately, we can’t have our cake and eat it too.

In summary, the portfolio’s capacity to outperform its benchmark while keeping risk and volatility at lower levels highlights the effectiveness of this simple strategy mix.