Personalising a Trading Strategy

I commonly post some of my strategies with Radge tweaks. There are a number of reasons why.

Firstly, the more money tracking a strategy, the more likely that it could deteriorate over time. People are naturally greedy. They could front run an entry or exit in order to beat other followers. Worse, they could trade the front-run itself, and not the strategy.

Secondly, and probably more importantly (because it’s not like we sell thousands of these strategies), is because I have spent 37-years of solid research and no amount of money is going to make me give out my best ideas.

Nothing pleases me more than seeing someone taking a strategy and making it their own. People like that are born winners and will go on to become successful traders.

But there are other people who want it all dropped in their lap. They’re the ones stuck in the Beginners Cycle, playing the blame game and spending hours posting on trading forums rather than spending that time working on their own strategies.

Let’s face it, testing and tweaking a strategy isn’t rocket science. I have written about finding trading ideas HERE and there are ample other places to get ideas and insights.

A tweak doesn’t necessarily have to create a higher return. It could reduce the drawdown, lower the volatility of equity growth, or create an equity growth path that is uncorrelated to another strategy.

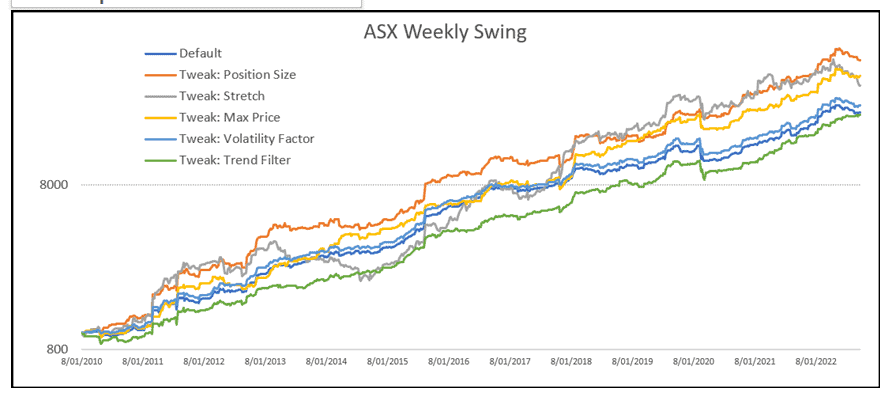

Let’s take a look at some basic tweaks you can make to the ASX Weekly Swing Turnkey Strategy which we’ve just released.

ASX Weekly Swing

All of these are adjustments to the default parameters that can be done without any knowledge of coding. No optimisations have been done – they’re just random for example puposes.

For example, by adjusting the default position size of 20 positions at 10% allocation (leveraged version) to 10 positions at 20%, then we see much higher growth.

Adjusting the stretch also gives high growth, but the trade-off is a longer and deeper drawdown. This may suit more aggressive traders wanting higher returns who feel they can handle bigger declines in equity.

If the stock trend filter is adjusted from the default 50 to say 200, you get lower growth, but a much smoother ride – lower volatility and lower drawdowns.

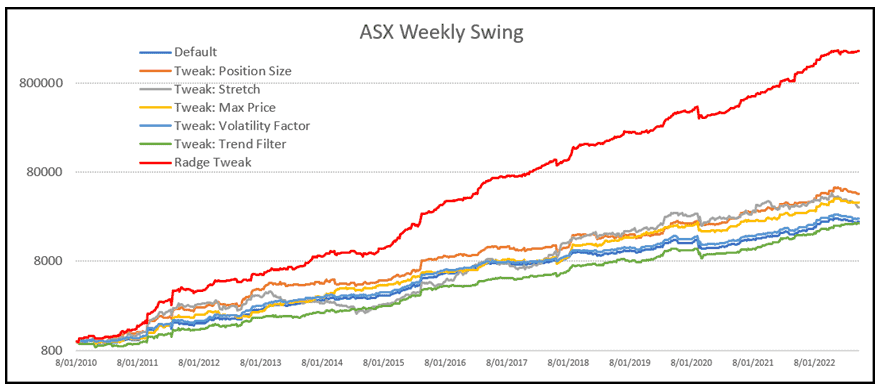

And here’s the ASX Weekly Swing with my own tweaks.

ASX Weekly Swing Tweaked

The secret sauce is not a filter, special indicator or a different time frame.

There are three elements that can super-charge returns;

- a position sizing model that maximises profits (think Fixed Ratio, Kelly Criterion or Secure-f). Plenty of literature out there on any of these.

- creative portfolio construction – not to be confused with choosing a trading universe

- patience and long term application – can’t be bought off a shelf