Market Timing vs. Time in the Market: What Really Matters?

Many investors worry about finding the perfect moment to enter the market, believing that timing their entry correctly will significantly impact their long-term returns. However, data from our ASX All Weather Portfolio suggests that time in the market matters far more than timing the market, especially in lower-volatility strategies.

The Data: Consistent Growth Regardless of Start Date

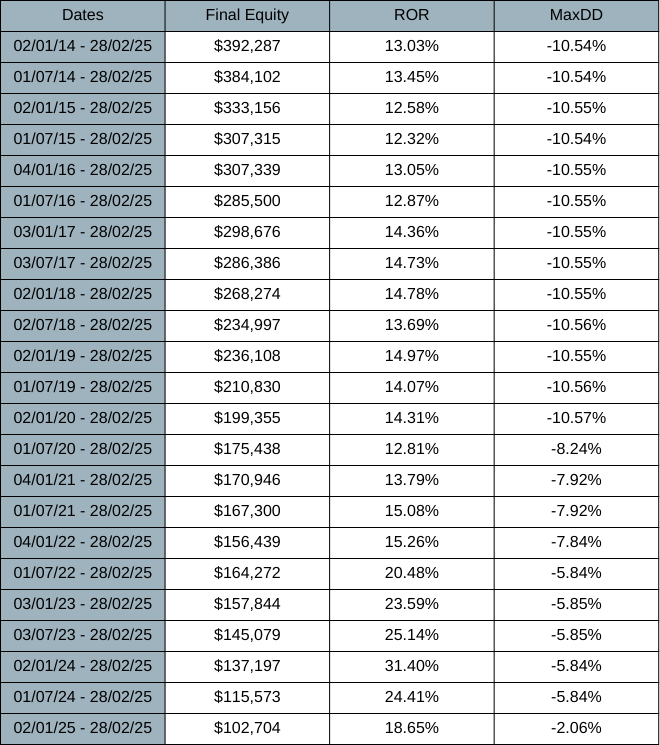

The table below compares the final equity values of investments in the ASX All Weather Portfolio that began at six-month intervals, each starting with an initial balance of $100,000. The start date spans from January 2014 to January 2025, offering a long-term perspective on how different entry points affect long term capital growth.

Despite variations in start dates, the Annual rate of return (ROR) remained steady over time, and drawdowns (MaxDD) stayed within a low range. Highlighting the steady low volatility returns the strategy seeks to capture.

Key Takeaways: Why Market Timing Isn’t Critical

Consistent Long-Term Returns – Over the 11-year period, ROR remained within a tight range, showing that a consistent systematic investment approach leads to steady growth over time, regardless of minor timing differences.

Manageable Drawdowns – The maximum drawdown (MaxDD) hovered around -10.5% for most periods, demonstrating that this portfolio effectively limits volatility and provides a smoother investment experience.

Late Entries Still Perform Well – Start dates between 2023-2025 saw strong returns, reinforcing the principle that being in the market is what drives long-term capital growth.

Have a Long-Term Perspective – In only 4 out of the 23 test windows was the final equity lower than if the investor waited 6 months before entering the market.

The data from our ASX All Weather Portfolio shows that consistent long-term investing outperforms attempting to time the market. By avoiding emotional decision-making and sticking to a rules-based system, investors can achieve steady growth while keeping risk under control.

If you’re waiting for the “perfect time” to invest, the data is clear: the best time to start was a decade ago—the next best time is today.

Both the ASX and US All Weather portfolios are accessible on our 14 day free trial. Our Systematic Portfolio Guidebook has extensive metrics on both these systems as well as our combined portfolios, this can be found inside the members area.