Create Your Own Trading Strategy

It’s hard to envisage or create your own trading strategy.

As much as we’d like to wake one morning and be a better trader, taking your trading up a notch will take some effort and work, not unlike succeeding in any field. From experience, I find the best way to move forward is to question everything and then make it your own. Specifically, make minor adjustments to a core concept so it better suits your personality.

Long term readers are aware of my ‘aha!’ moment in the early 90’s after reading PPS Trading System by Curtis Arnold. Obviously having a personal connection to the strategy was important for success.

Regardless of how good a strategy might be, if it doesn’t ‘feel right’ you won’t be able to execute it.

But my trading moved forward in the 18-months that followed because I made small adjustments that not only made sense to me, but also made the execution of the strategy easier for me. Comfort creates sustainability which in turn leads to long term success.

Sometimes making it your own means borrowing small bits and pieces from someone else. I know one of my weaknesses is not thinking outside the box. Thinking differently. Thinking up new ideas. Thankfully in this day and age of social media and blogs we can access the ideas and thoughts of others. Here’s a great example I found recently.

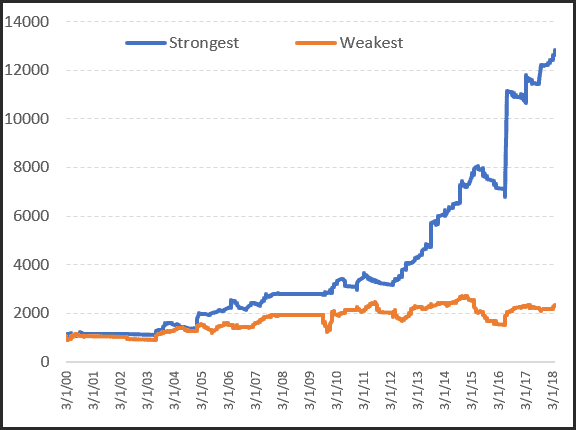

Andrew Selby of Don’t Talk About Your Stocks, talks about finding financial independence through trading and other means. In his quest for finding a robust trend following strategy, he stumbled across our very own Weekend Trend Trader strategy. But he had already been influenced by several authors such as Michael Covel and traders including the great William O’Neil. All their findings resonated with him, so he mixed the various pieces that made sense to him and came up with the Quantitative Growth Fund strategy.

But it didn’t stop there.

In a conversation with Cesar Alvarez, a professional market researcher who had previously worked for Connors Research for many years, Andrew was introduced to historical volatility. Cesar was so intrigued with the simplicity and robustness of Weekend Trend Trader that he decided to run some tests with the inclusion of historical volatility. The results were even more promising, so much so that Andrew included the filter in his existing Quantitative Growth Fund model.

And so it comes back to me. I hadn’t heard of Cesar until my name started appearing alongside this research. And I really hadn’t explored historical volatility coupled with a trend following strategy such as our very own Growth Portfolio. I had researched it with regard to shorter term time horizons, but nothing beyond a week’s length.

So you can guess what The Chartist research team are working on now…

In summary, there are a lot of clues out there – and one doesn’t need to spend thousands of dollars for it. There are lots of ways you can question, test, validate, add, subtract and generally move forward. But you need to be motivated to look.

If you are interested in learning how to properly design, test and validate systematic trading systems. Maybe our Trading System Mentor Course is for you. Alternatively, take our free trial and browse through our extensive range of education material in our members only zone.