Make a Large Profit

It’s hard to deny that you’ll never make a large profit by taking a small profit.

Jesse Livermore, possibly the world’s most famous speculator, made one of the more frequently cited quotes in the business…

“It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! It is no trick at all to be right on the market. You always find lots of early bulls in bull markets and early bears in bear markets. I’ve known many men who were right at exactly the right time, and began buying or selling stocks when prices were at the very level which should show the greatest profit. And their experience invariably matched mine–that is, they made no real money out of it. Men who can both be right and sit tight are uncommon.”

It’s a hard act to ride long trends.

It requires an evidence-based plan. Confidence. Discipline. And patience.

Traits that, for the majority, are difficult to adhere to.

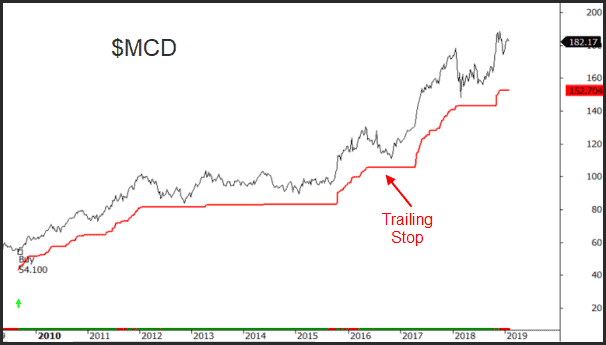

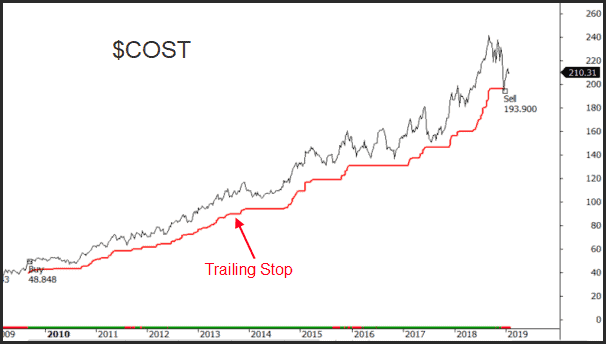

Yes, as the following charts show, big trends are there for the taking.

These signals were generated by the 20% Flipper Strategy (Weekly) taken directly from Unholy Grails.

The key to staying on board a long trend requires a balancing act.

A trailing stop that allows you to exit the position when the trend reverses.

Yet also allows the position to ‘move’ during market noise.

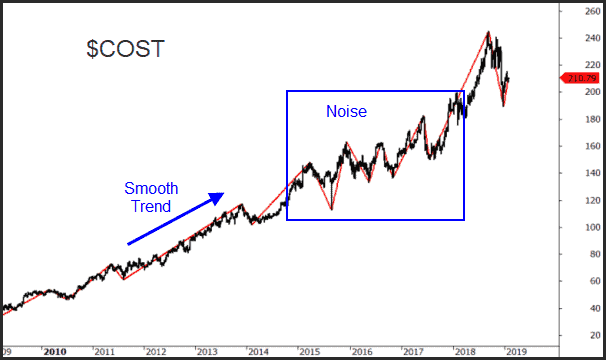

Let’s add in all the 10% swings that occurred during Costco’s ($COST) meteoric rise.

These are the times where investor conviction wanes. Where profits are locked in.

Usually prematurely.

Trailing stops need not be complex. But they do need to take into account market noise and recognise the difference between a correction in the trend and a reversal of the trend.

For further reference you may find my presentation, The Science of Stop Losses, a valuable resource.