Long/Short Day Trade Strategy – Part 2

Last week I discussed the benefits of a long/short day trade strategy which generated a lot of questions. If you missed that article, you can find it HERE.

Some clarification before we go any further. In a recent interview with Better Systems Trader LIVE I said that I hadn’t found a short side system worthy of trading and that I should ‘pull my finger out’.

Well, I did. Since that discussion I have spent in excess of 200 hours researching short side systems and found my weak link as to why I couldn’t get them to work favourably. I’d like to thank Marsten Parker for the small, somewhat illogical, yet key insight that I was missing. Marsten is interviewed in Jack Schwagers new book, Unknown Market Wizards.

And I know you’re thinking, “…so what was it?”

Simply put I was always looking for short side candidates in down trends. Makes sense right? We buy stocks in uptrends and sell stock in downtrends.

Nope.

By looking for shorting opportunities in uptrends the numbers turned dramatically to more favourable outcomes.

With this new insight I have been working back through all my past efforts and almost without fail all turned the corner to become more acceptable.

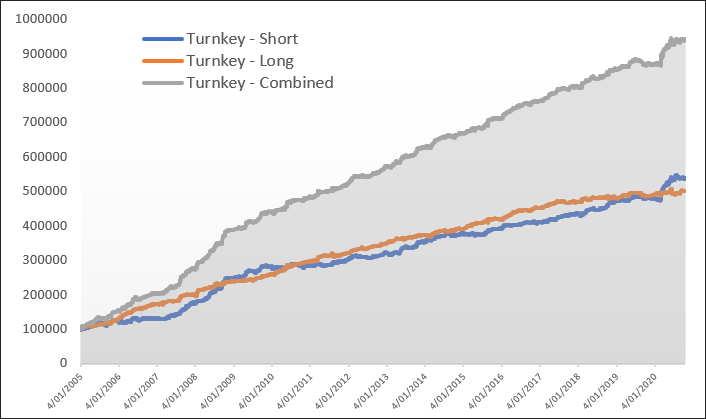

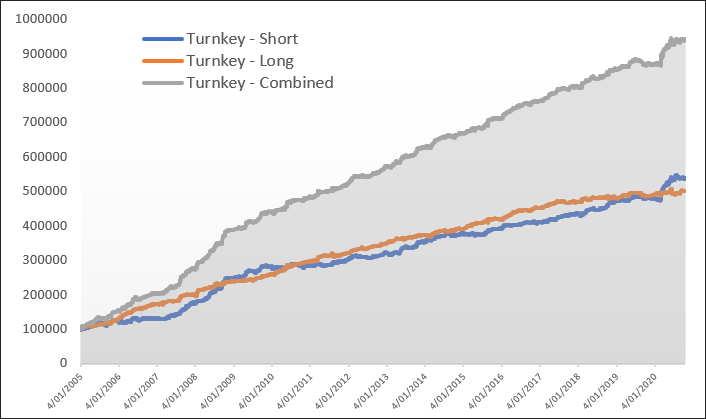

Last week I offered up a basic RSI long/short strategy. Today I want to show you what happens when I flipped the current ‘long only’ Day Trade strategy that we offer as a Turnkey solution.

The short side is slightly more conservative than the long side, mainly due to (a) the long term upward bias of the market, and (b) the possibility of getting caught in an aggressive takeover. That adjustment simply involves the stretch being slightly larger.

Results shows an non-compounded return of 11% with a maximum drawdown of 14%. Up until March this year the maximum drawdown had been 11.4%.

The correlation between the long and short is 0.018. Combined the two strategies profit on 59.5% of all trading days.

I’ve said it before and I’ll say it again; you don’t know what you don’t know so I’m always open to learning from others.