Long/Short Day Trade Strategy

A Long/Short strategy is typically designed to provide greater capital protection when markets turn down and ideally offer uncorrelated returns to equity markets and other asset classes.

The usual process is buying companies with outstanding fundamentals and selling short companies with deteriorating businesses. The theory is those that have done well will continue to do well, and those doing poorly will continue to flounder.

Today we’ll put a different spin on it. Firstly we’ll drop the fundamentals…I mean who has time right? 100% technicals for us…

Next we’ll reduce overnight exposure by exiting positions at the end of the day.

Sounds like the Holy Grail; greater capital protection, uncorrelated returns, no overnight exposure and we don’t even have to know what the company does!

I’m not going to go into depth of the specific system rules, suffice to say:

- Mean reversion (buy weakness, sell strength) using RSI

- Stock must be in an uptrend

- Go long if RSI falls below 20 and falls further the following day

- Go short if RSI goes above 80 and rises further the following day

- Tested on the Russell-1000 from January 1st 2020

- Maximum of 20 positions with 10% allocated to each.

I chose 2020 because it’s been such a crazy year; a major selloff comparable to 1987, followed by an enormous and unexpected run higher. In theory everything that a long/short strategy promises should be delivered in a year like we’re witnessing.

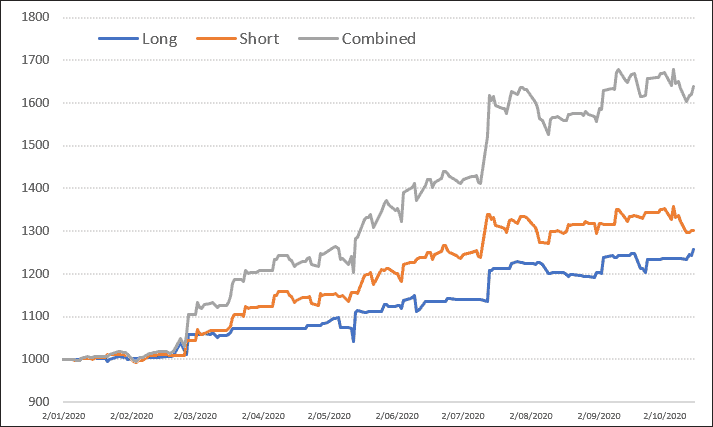

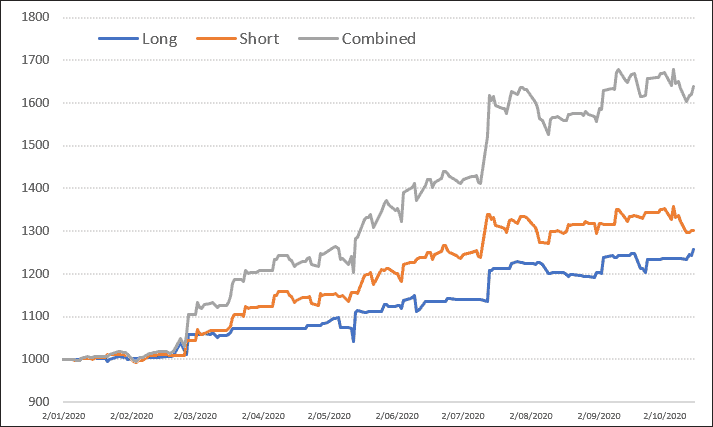

The correlation between the long and shorts is -0.0321 and you can see that both have made steady growth over the course of the year.

Interestingly the long side did not trade at all between March 24th and April 21st – the trend higher was so strong that pullbacks weren’t deep enough to generate fills. However, during the period the short system made a +5% return.

Another interesting observation is the jump in equity during July. On July 13th the S&P gapped higher and then reversed down closing -0.9%. The short system made 8% on the day and the long system lost -0.5%.

The following session, the 14th July, the exact opposite occurred. The S&P 500 gapped down on open then closed +1.3% on the day. This time the long system gained +6.3% whilst the short system didn’t trade.

The broader market was almost net unchanged yet the long/short strategy made a combined +14.6% return.

Some more statistics. Of the 200 off trading days in 2020, the long side made a profit on just 65 (32.5%) and the short side on 87 days (43.5%). Combined the strategy made money on 130 days (65%) and 11% of the time both sides made money.

And yes, I did test the strategy back to 2000 and it stands up extremely well.

This strategy is now part of our Turnkey Code.