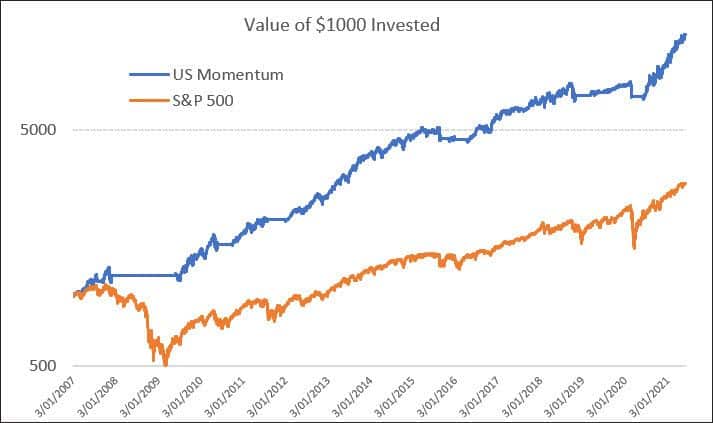

Long Only Strategies to Profit in Sustained Bear Markets

The Global Financial Crisis (GFC) was brutal for many investors. Not so for others.

It was brutal because it was a slow, sustained decline rather than a collapse. This gave investors a sense of calm. Suckered them in to buy what appeared to be relative value prices, yet only to see the weakness persist.

Another blow was the collapse of companies, many of which were deemed to be solid income earners.

So what about those that managed to get through without too much damage to their accounts or psychological fortitude? What did they do differently?

For this article we’ll take a look at the GFC singularly, specifically from 11th October 2007 through the absolute low on 6th March 2009.

One of the easiest ways to navigate bear markets is reverting to cash using a Regime Filter.

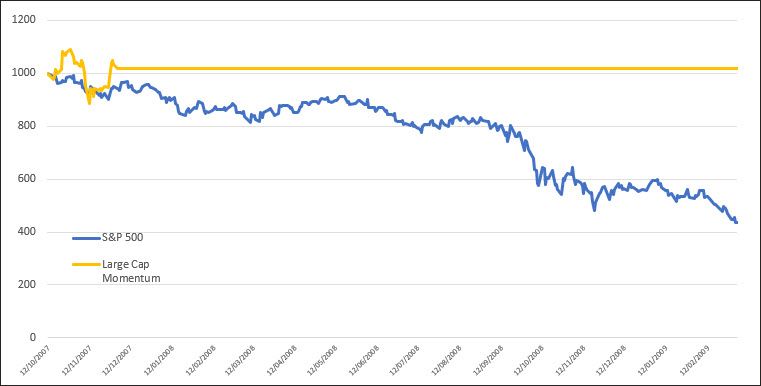

Chart 1

The following chart shows a typical momentum strategy, namely the Large Cap Momentum system. As can be seen it went to cash very early on and remained that way. For the specific window the strategy returned 0% but did suffer an -18.6% decline in equity.

For the majority of investors that’s a solid result. Minimal equity damage and, importantly, limited psychological damage. Reverting to cash allows you to pull the trigger again when the good times return.

However, for a lot of people, sitting on their hands for a lengthy period is actually difficult. The ‘want’ to trade, the ‘want’ to be active, is a strong emotion. Indeed when we advised clients in early 2008 to go to cash, there was push back. Only in hindsight could the benefits be seen.

Profiting in a Bear Market

So is there an accessible strategy that benefits from sustained bear markets? I say accessible because certain bearish strategies, like short selling or long put options, aren’t accessible for many people. Indeed inverse ETFs were few and far between back then, and even today they have their own risks.

A trait of bear markets is that investors are emotional. Even irrational.

And this creates opportunity.

You see, another trait of bear markets is elevated volatility and it’s this volatility that can be captured, even with a ‘long-only’ strategy.

In layman’s terms, think of it like this.

You’ve bought a stock because it appeared to be making a bottom or appeared to be priced too cheap. Yet now it’s 30% lower from that buy point. More bad news about the financial crisis comes out before the market opens. You can’t handle any more pain so you decide to fall on your sword and get out as soon as the market open.

You and a thousand others feel the same pain.

The market gaps down heavily on open yet seems to rebound during the day to close unchanged.

This type of pattern is extremely common, especially during highly emotional times. And it’s this same pattern that ‘long-only’ day trade strategies will profit from.

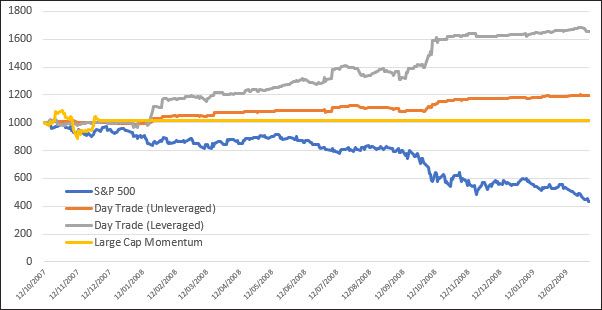

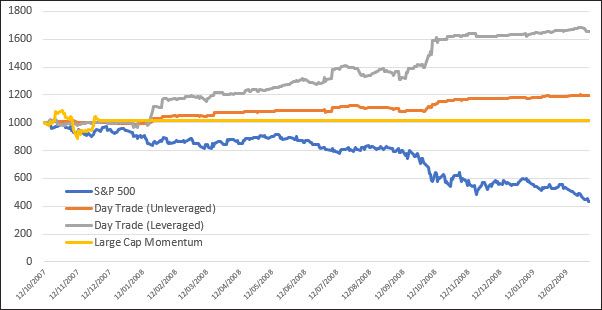

Chart 2

The following chart again shows that 2007 to 2009 window – for the exact top to the exact bottom. However, now we’ve added in our ‘long-only’ Day Trade strategy^.

The unleveraged version had a total return of +19.3% during the 18-month decline. The maximum drawdown was -4.16%^. That’s a great result compared to a -56% decline for a buy & hold portfolio.

As these day trade strategies tend to have lower drawdowns, namely because exposure is extremely low, they do open themselves up to being leveraged. Warning: leverage is not appropriate for everybody.

If we add leverage to the same strategy, the total return for the period goes to +66% with a maximum drawdown of just -7.0%^.

Certainly food for thought.

Not only can these styles of strategies produce positive returns during sustained bear markets, but they can also offer valuable diversification when used alongside trend or momentum strategies.