Learn How to Trade the Stock Market

Want to learn how to trade the stock market?

If we use an analogy; teaching my daughter how to drive. I had hair before I started teaching her to drive. Now I have none.

When you teach a teenager how to drive, the quantitative rules are pretty straight forward. Put your foot on the accelerator to move the car forward. Turn the wheel to the left to go left. Turn the wheel to the right to go right. Put your foot on the break to stop.

They’re rules that can be repeated.

In trading we have the same kind of things. You have an entry mechanism, a stop loss, fixed fractional position sizing, an exit mechanism etc. They are rules that can be taught and repeated into the future.

Then there are qualitative rules.

Again, if we use the analogy of teaching your teenager how to drive a car… How do you teach a teenager to recognise a dangerous situation on the road? How do you teach a teenager to understand that driving in the wet creates more complications and it takes longer to slow down? These are things you can’t teach. They have to be learned from experience.

It’s the same in trading. I can tell people that “at some stage we’ll have a drawdown of between 15% and 20%.” It’s going to happen. As soon as it happens they run for cover, they run for the hills. You have to experience that drawdown and come out of that drawdown. You have to experience it for yourself. But if you don’t allow yourself to experience losses, because you’re scared, then you’re never going to be a successful trader.

I can’t teach people that. I can tell people, “you’re going to have ten losing trades in a row” or “You’re going to suffer 15% drawdown.” And one thing I stress to people is that they can’t handle the level of pain (losses) they think they can. If someone says they can handle a 20% drawdown, chances are they can probably only handle a 10% drawdown. So, the rule is, if your pain threshold is a 10% drawdown then don’t trade a strategy where, at some stage, you can expect a 20% drawdown.

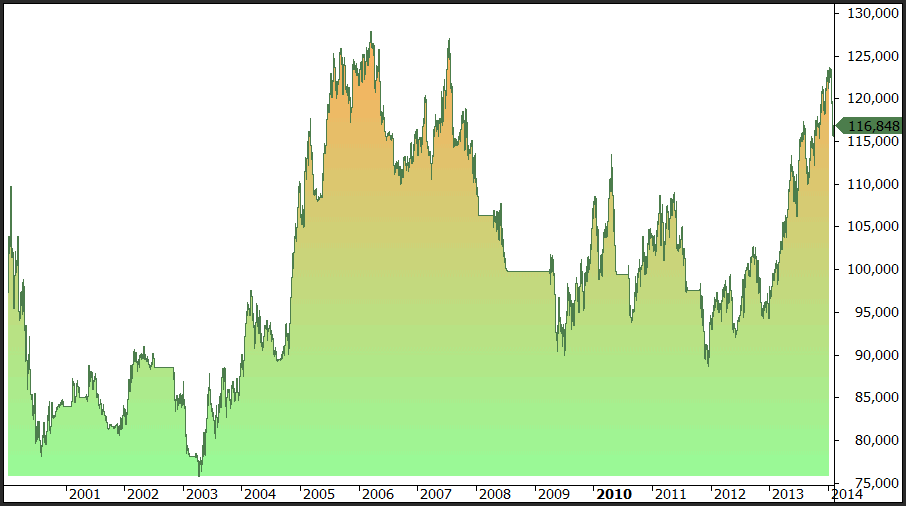

I do a lot of time window analysis where I go back and find out exactly how many months or how many years it would take to get to a 100% probability of profits.

My major trend following strategy in Australia, I can tell you that the probability of achieving a 100% probability of profit is twenty-two months. In other words, if you can’t give me twenty-two months, I can’t guarantee you a 100% probability of profit. We get people coming to us saying they’ll give it a go for two months – that’s no good.

100% probability of making a profit. That profit might be 1% or it might be 100%. That’s not the point. It’s the probability of making a profit. We want to find out at what point we hit the 100% mark. With my longer term trend following strategy, that comes in at twenty-two months.

So at six months I can tell you we’ve got a 60% probability of profit. At twelve months I think it goes up to about 83%, but at twenty-two months it hits 100% probability of profit. This means it doesn’t matter when you start. What matters is that you give it twenty-two months. If you can’t give it twenty-two months, then you have a risk, however large, of coming out behind.

When trading or investing we always look at the bigger picture and we work in long time frames, we’re not looking one or two months from now. We’re investing and compounding over time.

I was talking at a trading and investing conference in Perth and this guy came up after my talk and said, “I’m probably the youngest guy that’s been in the talk today.” He was, seventeen or eighteen, but he knew he was in a good spot. He knew he was learning something that he could apply for the rest of his life.

If I could be seventeen again and know what I know now…

Get a job and have a career. Trade a simple strategy like the Growth Portfolio on the side. Don’t focus on wanting to be a professional trader. Give it ten, fifteen years and you’ll be in a great position, way ahead of all your friends financially.