Keeping It Simple

For some reason, when people think of building a trading strategy they do not consider keeping it simple.

I commonly see very complex trading plans and strategies. This one came across my desk recently:

- Share prices are predominantly above 30 week EMA

- A golden cross with two moving averages of different time durations; for example, a 30 week EMA and a 15 week EMA

- A rising momentum indicator at a historically low level (using MACD as the indicator)

- An upward sloping trend line

- A breakout through a significant resistance line on heavy relative volume, preferably initiated by a white bullish candle or a gap

- A recovery from a period of retracement

- A resistance line that becomes a line of support

- Heavy relative volume when a share moves upward in price

- A low relative volume when a share moves down in price, compared with when it moves upward

- A predominance of white candles compared with black candles

- Longer white candles compared with black candles

- A series of candle tails pointing downward, indicating buyers moving into the market

- Ease in the share’s ability to break through round dollar value figures for example 5, 5.5, 6

- A series of higher lows and higher highs (close price)

- A momentum histogram showing higher highs while the share price is also displaying higher highs (using MACD)

- A gap that hurdles a previously established level of resistance, particularly on heavy relative volume levels

A comment from one of the best traders in the world, Bill Dunn, resonated with me many years ago. It was about keeping trading rules simple. So simple he said, you could write them on the back of an envelope. The theory goes that the more complex the rules, the more could go wrong.

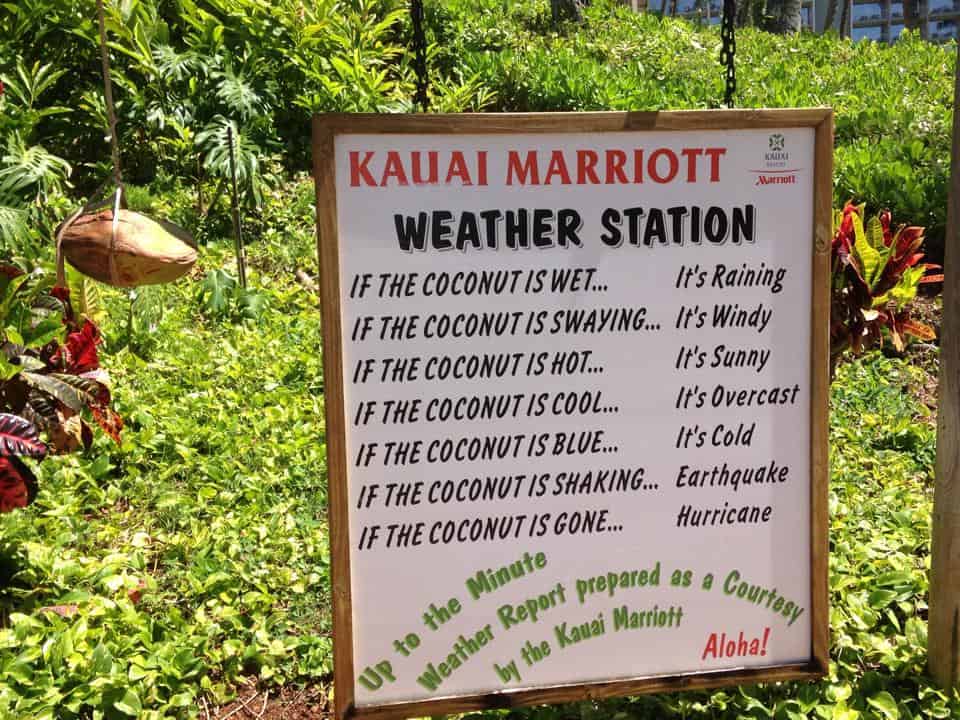

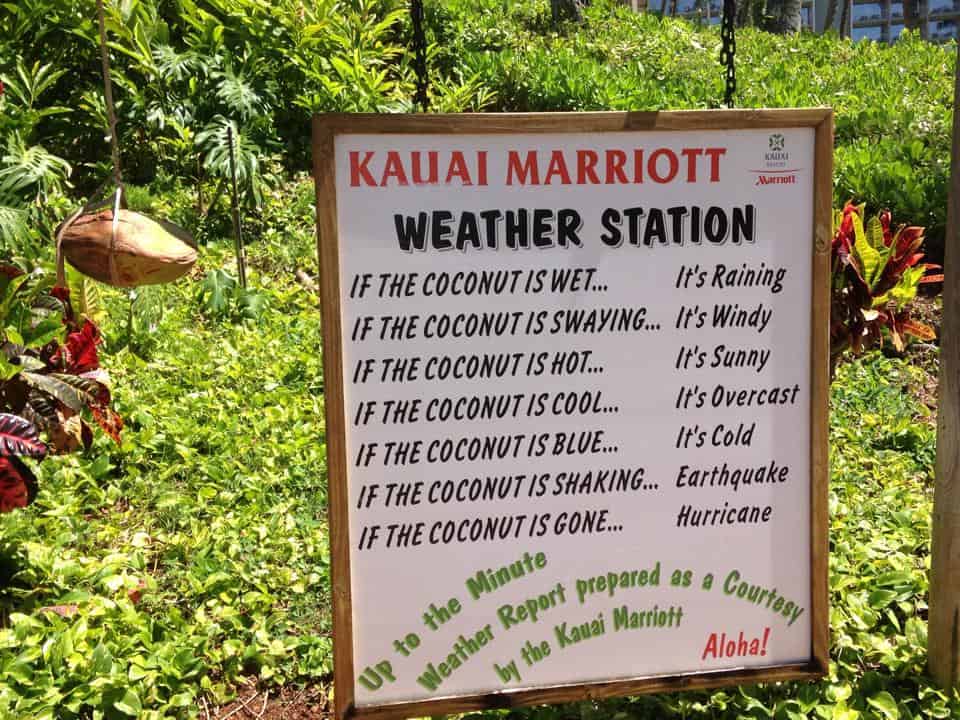

Which leads me to this amusing sign that I feel should be applicable to trading and investing rules:

If you are after a simple strategy to follow then consider The Chartist’s Growth Portfolio. It’s easy to understand and simple to follow.