Is the Australian Dollar as Good as Gold?

Is the Australian Dollar as Good as Gold? Many factors can affect the price of Gold.

Based on historical relationships, a hawkish U.S Federal Reserve that leads to a stronger Greenback, tends to be bearish for Gold.

The reverse is true when U.S rates drop.

Yet, the U.S recently raised rates again, and is predicting further hikes throughout 2018 and well into 2019.

But the U.S Dollar remains in a bearish downtrend. This is keeping currencies such as the Australian Dollar robust and supported on the dips.

This and other factors may affect Gold prices, such as unexpected economic slowdown and political unrest.

If any of these factors pick up speed over the coming months, then safe haven Gold may take on a more bullish outlook throughout 2018 and into 2019.

If this proves to be the case, then the bearish Greenback may remain bearish, which could see the Aussie start to push higher with Gold as a consequence.

There are many factors affecting price action in the Australian Dollar. For example, commodity prices. Iron Ore is especially highly correlated to moves in our local currency.

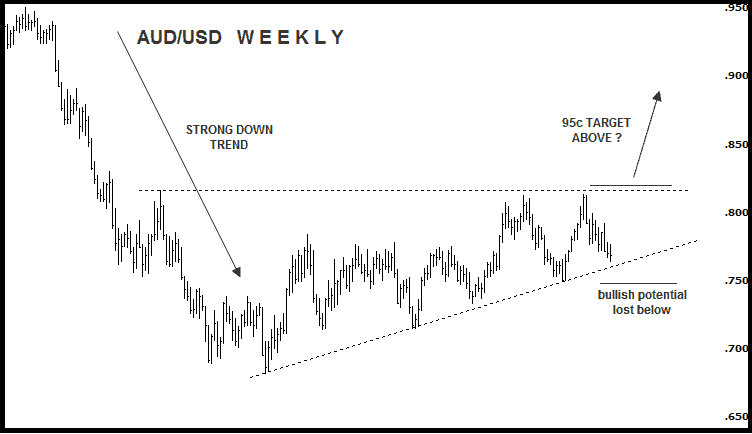

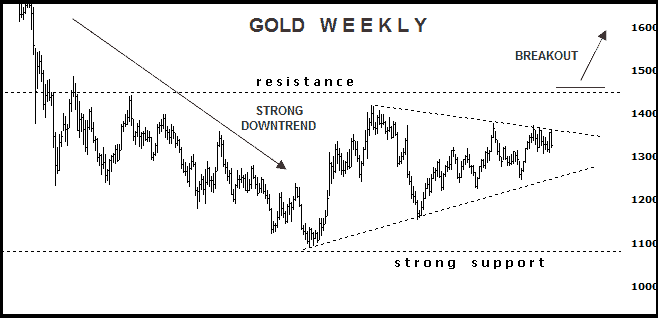

Interestingly, the weekly price charts for the Australian Dollar and for Gold are very similar. Both coming off longer term down trends, and also showing signs of possibly having locked in major low points.

However, we’re watching price action for confirmation.

For Gold confirmation will be a move above $1450 that sticks. For the Australian Dollar we’re looking for trading above 81.60. These are the momentum drivers we are looking for.

So keep an eye on these numbers over the coming months. The technical correlation between Gold and the Aussie has been there for quite some time. Both running together in unison, whether to the upside or the downside, continues to be a high probability.

So, is the Aussie as good as gold?

It looks that way.

Both Gold and the Australian Dollar are regularly reviewed in The Chartist’s Global Chart Research.