Investment Cycle

It’s been awhile since we’ve had an extended period of doom and gloom, but it should be expected at some stage over the investment cycle.

The trick is to survive as best as possible so we can get involved when the good times come around again…and they will.

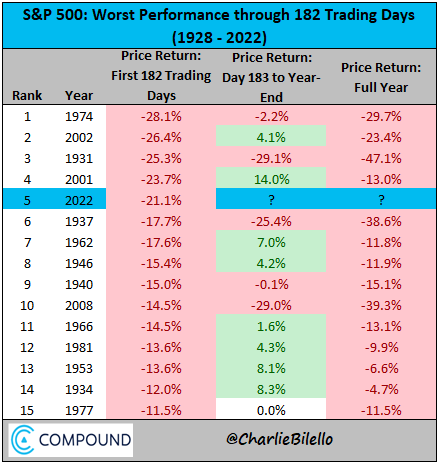

How bad has it been? According to Charlie Bilello (link no longer available), with the S&P 500 down 21% YTD, this is the 5th worst start to the year since 1928.

If you’re a glass half full kinda person, the good news is that there is a 61% chance the market will be up higher by year end.

On the other hand, there’s a 23% chance it could get a lot worse. Like it did in 1931, 1937 and more recently in 2008.

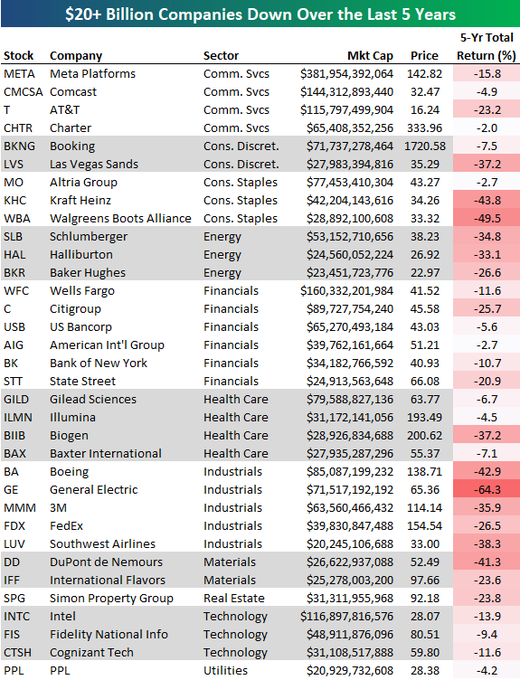

For many companies, 2022 isn’t the only bad year. The following table from Bespoke shows 34 companies with market caps above $20 billion that are now negative over the last 5 years on a total return basis.

Some more perspective. $META used to be a $1T+ market cap. The loss of $600B is possibly the biggest in history.

The following table shows the biggest losers in the ASX All Ordinaries (XAO) this year.

BWX Ltd leads the charge at -85.4% but has been under voluntary suspension since late August.

Zip Co comes in a close second, down -83% YTD, and -95% from is 2021 highs. Again, I’m sure it’ll come good 😉 (I’m Australian – that’s called sarcasm).

When it comes to market cap losses in Australia, AMP Ltd has been one of the biggest. It’s $16.3B decline since listing pales in comparison to Meta, but it equates to an 81% dilution in shareholder equity.

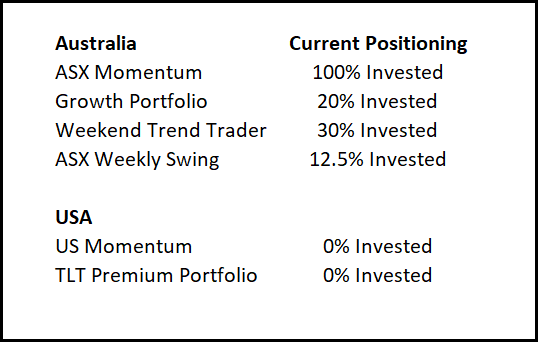

In terms of my personal positioning, much of the portfolio is in defensive mode.

An interesting comment was made at a conference I was speaking at this week.

When panic or uncertainty hit the markets, many assets become highly correlated. This year being a good example. Equities, bonds, gold, silver and even the great hedge called Bitcoin, have all declined substantially. However, the defensive nature of our portfolios means they actually become uncorrelated to major asset prices.

Food for thought.