How to Build a Portfolio of Trading Strategies

In this video, Nick Radge discusses how to build a portfolio of trading strategies. A portfolio of strategies allows you to diversify a range of trading strategies as well as markets, time frames and risk.

You can find the Portfolio Comparison Matrix here.

Watch Now:

We’ve put together a new tool, which may help you with regard to strategy diversification.

Now as you’re aware, I’m very much into strategy diversification. It’s something that I practice personally. I trade eight different strategies. There’s plenty of articles in our Knowledge Center discussing the pros of doing that. And I don’t just diversify across different markets. I diversify across strategies within the same market itself.

So why do this?

Well, most traders attempted to jump ship and look for something better when their strategy underperforms or they have a losing streak. The problem with that, when they jump ship to another strategy, invariably, that new strategy will run the same course, and it becomes a case of chasing one’s tail. In my view, every trader or investor needs to accept that every strategy will have times of underperformance and that it’s impossible to time or predict when the good performance is going to happen. Therefore, what you’re better off doing is using a suite of strategies to diversify, the same as what a financial planner would do, building a portfolio of shares and bonds.

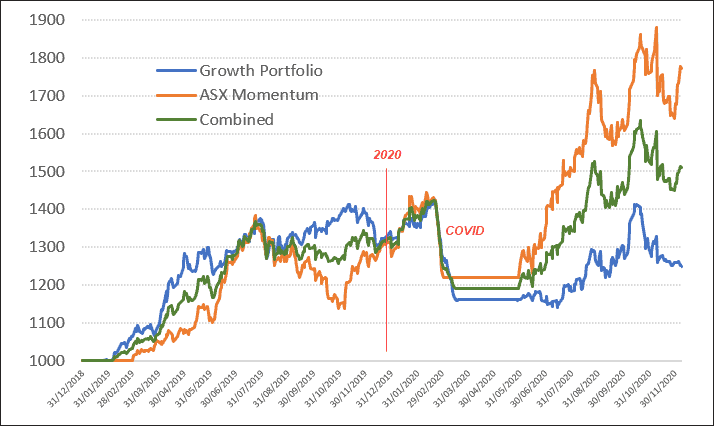

To give you an example, I trade the Growth Portfolio, which is an absolute trend following strategy and the ASX Momentum strategy. Both trade the ASX. And you can see there that up and through till about 2020, the strategies were more or less kind of neck and neck doing the same thing, with performance reasonably similar at that particular point of time.

Then the COVID crash came. Both strategies went to cash. And you can see from that point on, the ASX Momentum started to really pick up and gallop ahead, finishing the year well ahead of the Growth Portfolio.

Now the Growth Portfolio is something that I’ve used for over 20 years, and I continue to use it today and I will continue to use it in the future. Just because it had a bad year does not mean there’s anything invariably wrong with the strategy. It just had a bad year. I’ve written about why, specifically, it had a bad year, because, and I’ll just reiterate that, because it was so slow to actually get back invested into the market during that period of time there. Whereas the ASX Momentum went 100% long on the 1st of June. So that was the explainable difference with the performance.

My goal is to show you what happens when you diversify. So if someone was relying solely on the Growth Portfolio, then potentially, at the end of last year, they may have been a little disappointed and they may have been tempted to jump ship. That was the wrong thing to do. Alternately, if you would put money, 50% of your money in the ASX Momentum and 50% in the Growth Portfolio, you would have got a nice balance between the two.

Now it was impossible to know that last year was gonna be a scorching run for the ASX Momentum. It finished up, from memory, something like about 56, 57%. It has an annualized return of 22%, so it obviously had an outstanding year. Now there’s no way we knew that was gonna happen. I’ll take it, absolutely, I’ll take it whenever it’s offered, but you need to be there for it when it is offered.

And the opposite is true. You need to take it on the chin when the performance isn’t really up to scratch in any particular short period of time. And as I said, every strategy, without fail, will have swings and roundabouts of great performance and underperformance, and you can’t predict when it’s gonna happen.

So we want to use a suite of different strategies to diversify. That way, if one has a poor year and another has a good year, it balances it out very nicely.

So let me introduce you to this little tool that we’ve created, the Portfolio Comparison Matrix. It’s a quick view matrix of all the different portfolios that we offer in both the Subscription services and the Turnkey Code if you want to do it yourself.

Build a Portfolio of Trading Strategies

Diversify With Monthly Strategies

So let’s say, for example, you only trade the ASX and that you want to diversify into the US market, but you don’t have a great deal of time. So what you could do is select the ASX Momentum, and to diversify, select the US Momentum. And the beauty with that is they’re both monthly strategies. So in terms of time taken each month to participate in these portfolios, probably 20 minutes tops, and that’s it. Both have good outstanding long-term performance, and that way, you get some nice diversification.

An Active Trading Approach

If you’re a little more active or you wanna be a little bit more active, you could, for example, choose the ASX Momentum in Australia. And then you could also choose the US High Frequency in the US. So one’s short-term, three days, and one holds positions for weeks to months. So a little bit more active, different equity curve, a different part of the market. US High Frequency trades the Russell 1000. And that’s obviously for more advanced traders there, but it gives you options.

Diversify with Turnkey Code

If you want to do it yourself, if you don’t want to subscribe and you want to look at the code and learn a little bit and tinker and optimize and do all those kinds of things, then you can do the same kind of thing with the Turnkey strategy. So for example, you might decide that you want to trade longer-term only. Maybe you run a busy household and you’ve got a busy career and you don’t want to be doing stuff on a day-to-day basis. So you could diversify using Large Cap Momentum, which trades monthly, and also the Weekend Trend Trader, which trades once a week.

So again, I trade the Weekend Trend Trader myself. Last year, I think my portfolio returned about 58%. This year, I think I’m up 15 or 16% from memory. But the thing is it only takes about five minutes a week to operate that portfolio, so not a great deal of time. And same with the Large Cap Momentum. Probably 5 to 10 minutes a month to run that one.

So the portfolios you choose will be determined by your experience, how much time you have to allocate to it, how much capital you have. Obviously, if you have a smaller amount of capital, then you can’t stretch yourself too far. You need to be careful of commission drag.

The matrix shows you, for example, that for the Subscription services, no software or data is required. Obviously, you’re gonna need software and data for the Turnkey Code.

To clarify precisely what I trade with my family money, we trade the High Frequency, we trade the Growth Portfolio, the ASX Momentum, the US Momentum. We trade the Trade Long Term. That’s our sister website, the Premium Portfolio. And I trade the Weekend Trend Trader. Now I also trade my own Day Trade strategy, not the Turnkey one.

If you have any questions, please get in touch.

Nick