How Does Currency Affect Our Trading Strategies?

Currency movements can significantly impact investment returns, especially when trading across international markets. For investors considering cross-border strategies, understanding currency effects is essential. Amidst turbulence in the US markets and our US All Weather Portfolio moving into defensive asset classes, a handful of clients have asked what effect exchange rates have on our All-Weather strategies and if a US trader should invest in the ASX All Weather. Let’s take a look.

But first, some background. The Chartist’s two All-Weather strategies aim to provide straightforward, low-volatility growth for both the ASX and the US markets. They exclusively use ETFs to gain easy access to a broad range of asset classes, including bonds, commodities, bitcoin, and stock indexes.

The ASX All Weather invests in the ASX using Australian dollars, while the US All Weather invests in US markets using US dollars. So how does currency affect the performance of these two strategies? One of the easiest ways to demonstrate is through gold.

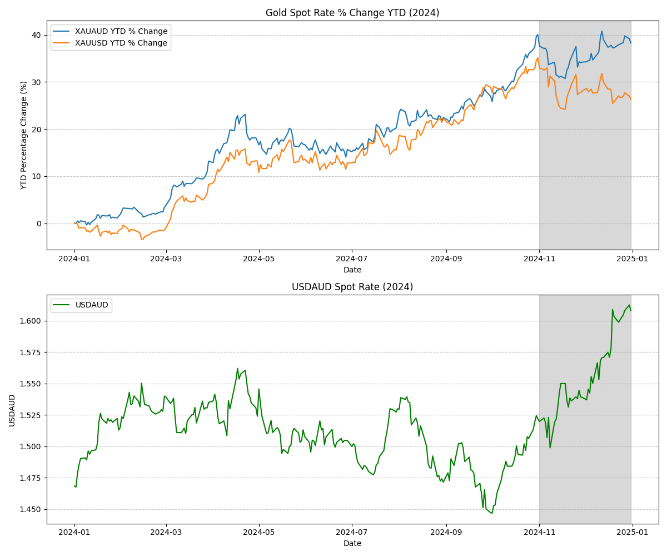

Across 2024, both the ASX and US All Weather strategies had significant allocations in gold, but these allocations did not bring the same returns. In fact, the gold to USD conversion (XAUUSD) returned 10% less than the gold to AUD (XAUAUD) conversion. The difference here has nothing to do with the price of gold but rather a strengthening US dollar (comparative to a weakening Australian dollar).

As the Australian dollar declines, the relative value of gold increases. This can be seen in the charts below, particularly in the shaded section from November onward. Notice how as the AUDUSD price rises, the exchange XAUUSD and XAUAUD spot rates diverge. This concept is true not just for gold, but for all commodities, bonds, and bitcoin.

But of course, the same is true in the opposite direction. Below are the same charts for 2020. Again, we can see as the USD strengthens in March, the AUD gold conversion gains significantly. But as the USD slides towards the end of the year, the relationship flips, and the AUD to gold spot rate finishes lower than the US counterpart.

So, what do we do about this currency fluctuation? Well, if you’re investing in your domestic market with your domestic currency, currency fluctuation isn’t a concern. However, if you’re exposed to foreign currencies, hedging could help mitigate sharp swings. That said, hedging adds complexity and costs, and it can also mean missing out on potential gains when currencies move favourably. Given our All-Weather strategies are designed for simplicity and long-term growth, they don’t actively hedge currency exposure. Historically, major currencies like the USD and AUD tend to balance out over time, making currency hedging less critical for long-term investors. To view their long-term metrics, why not take a 14 day Free Trial, this allows access to our members area and whole range of portfolios.