Forum Replies Created

-

AuthorPosts

-

TrentRothall

ParticipantGood stuff Christian, Good luck!

TrentRothall

Participant“Trading in the zone’ by Mark douglas, haven’t read it myself but it’s on my list

TrentRothall

Participant‘Complete turtle trader” is a good one, covers the story of the turtles and some discussion on their system

TrentRothall

ParticipantTesla been breaking my heart since July (well basically since the 1st Noosapalooza) i had some support lines drawn on the chart that it had respected previously and was going to buy if it bounced off it. for some reason i missed it, rocket ship since!

TrentRothall

Participantyeh i use LIT orders, but to be honest I can’t really tell if they are helping. One thing they do allow me to do is place more orders in the market than cash available because I only have a cash account with Ib now so that is a handy side-effect of using LIT orders. One downside is that they are only sent to the market after the opening auction, so if price opens below your limit and races higher you can miss a fill, these tend to be good trades too.

TrentRothall

ParticipantJan 2020

ASX MR = -.60%

TrentRothall

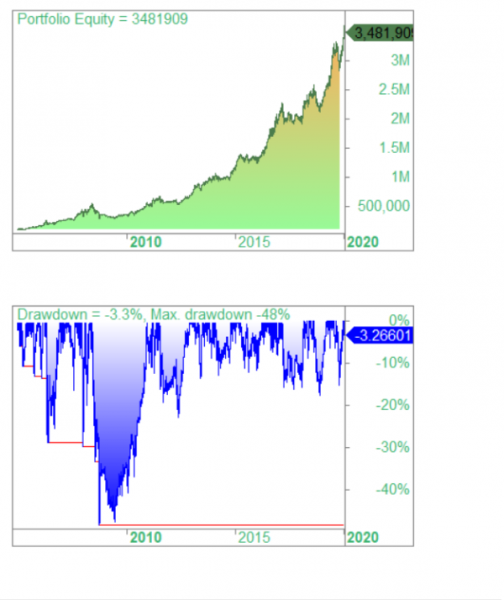

ParticipantThanks guys, I have been playing around with a index filter change which seemed to help returns a fair bit without changing the drawdown. It is still pretty high though, this is from 2005 to now.

TrentRothall

Participantfrom 95-now

CAR 18.2%

MDD 50% (smoked over tech bubble) 30% beside thathow about you?

TrentRothall

ParticipantSounds pretty similar to myself im ranking using ROC i’m just not ranking price though. I’m wanting to diversify my MR a bit and i figure exposure to the top 100 should help this.

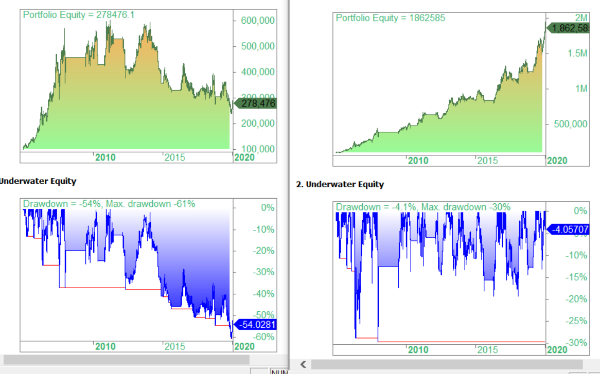

Surprisingly removing the index filter it isn’t too bad minus 08

TrentRothall

ParticipantDo you know what % dividends added last year?

TrentRothall

Participantmine is a 5 position system mike, what are you running?

TrentRothall

ParticipantCurrently developing a ASX100 rotation system, the metrics so far are looking pretty good i think

05-now

CAR 21%

MDD 29%I then tested it on the ASX200 and it doesn’t look so good!

Is anyone else trading anything similar that can run a quick test?

TrentRothall

ParticipantAlso Daniel for that system you posted I see that your average win is held for approximately 6.7 bars where your average loss is nearly double this. I think I read somewhere that you have a N-bar exit, have you tried to reduce this down to 8 or nine bars? This might help reduce some of your drawdown also might help with trade frequency.

When I was building my system I did a back test with the N bar exit of something like 20 days I then dump the results into excel and sort then from bars held and calculate what are the chances of having a winning trade after x-days. It also helps psychologically instead of seeing the position going down down down down.

TrentRothall

ParticipantGood discussion guys.

Daniel one thing i do too especially in the US is try to test after the year 2000, this is mainly because MR system seemed to go crazy over the Dot Com Boom. I have found if you have a year with super high returns it can skew the final figures a fair bit, but then in saying that it probably isn’t the worst to test over that period because of the different market conditions.

For interest sake i ran my ASX MR on the rus1000, it isn’t pretty. Hopefully not a sign of things to come

TrentRothall

Participantgreat work Said!

-

AuthorPosts