Forum Replies Created

-

AuthorPosts

-

TrentRothall

ParticipantHi Glen

Nice work, been a while since i popped in.

Just thought I would say re tradingView. Interactive brokers are starting to incorporate trading view into their charts. You will need the beta version of IB TWS I believe and then you can open up an advanced chart which has a fair few of the features. There are still a few bugs but it is a big improvement. I’m not sure if you know this yet.TrentRothall

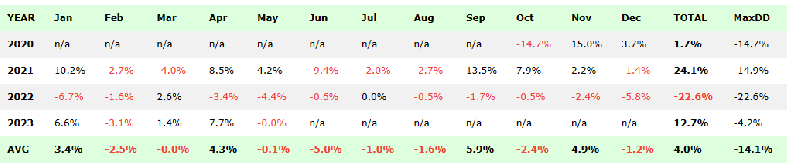

ParticipantWow, I just realised how long it’s been since I updated this… This is my WTT since inception. Last use should have been a better year but due to some mistakes it cost me a bit. We live and learn

My XSO rotation went from cash to fully invested today. That is at its maximum drawdown over its testing. But I only have a small amount of capital allocated to it. I am not too worried, especially when you look at the chart of the XSO it does not help for trend following/momentum.

TrentRothall

ParticipantI am also holding the DNK.

I got caught in a takeover of another company and my funds were sitting idle for a few months until settlement I think. Which was all off market and then I was reinstated into my IB account.

I’m not sure what will happen in this situation, hopefully they come out of a trading halt and can do it nice and easy

TrentRothall

Participantwhere did you see that Kate?

https://www.interactivebrokers.com/en/software/systemStatus.php

looks ok here i think?

Like you said, should be ok tomorrow hopefully

TrentRothall

ParticipantThanks =]

TrentRothall

ParticipantIs anyone having trouble with their IB two factor authentication?

I have deleted the app, reinstalled it etc but still getting a message saying incorrect security code…

TrentRothall

ParticipantNick do you run your 2 extra screens off your laptop? No issues if so?

TrentRothall

ParticipantI have a DELL Vostro. It works well but the fan is bloody loud and goes almost all the time. I would get a XPS next time. I went the cheaper option

TrentRothall

ParticipantI think using entryskip only skips trades that have passed the ranking. Not that this is a bad thing but it won’t simulate taking any trades that are outside of your ranking criteria.

For example if you are filtering setups to find the top 20, if you use entryskip: it doesn’t replace the 20th set up with one outside of the ranking.

Not so much of an issue for short-term systems probably but I have found this isn’t really an effective way for rotation systems because you are missing a trade every month. Similar for trend systems

TrentRothall

ParticipantHi All

I adapted the course info on data variance to the code below. I then used the value of RC to adjust things like MA, ROC, ranking etc. this just changes the closing price by a maximum of 2.5% in the case below. That might be a bit extreme but you can adjust as you see fit.

I just put this at the top of my data section in any stress testing scripts

edit: I just saw you’re doing similar anthony.Code:

RandomPercent: 2.5 // Adjust Close by this much %

perc: RandomPercent/100

RandomClose: C * (1+(perc-Random()*(perc*2)))

RC: RandomClose // replace C in calcuations to RC

TrentRothall

ParticipantAug 22

WTT -0.6%

XSO Rotation -8.2%TrentRothall

ParticipantHave you read Atomic Habits Kate?

It’s similar to the Demartini books. You might like it if you haven’t read it yet.

TrentRothall

ParticipantThis is just the SPX also, I am assuming that with the MOC systems you are trying to target the more volatile symbols each day, or something along those lines.

So it would be interesting to see a similar test done on the symbols that are being targeted, the distortion to the historical “normal” might be even more pronounced.

TrentRothall

ParticipantJune 22

ASX WTT -0.6%

XSO Rotation 0% cashTrentRothall

ParticipantKate M post=13094 userid=5397 wrote:Got surgery tomorrow and it could be a major one depending on surgeons plan. My health takes priority.Good luck with the Op!

-

AuthorPosts