Forum Replies Created

-

AuthorPosts

-

StephaneFima

ParticipantMy email is

[email protected]

(Same for Skype)And I live in Paris, France

StephaneFima

ParticipantAll,

Playing around with the model, I see a potential problem with it:

– If we start with a 100K portfolio and a position size of 5% of the equity, we end up with positions in excess of 500K, which I think would be difficult to fill

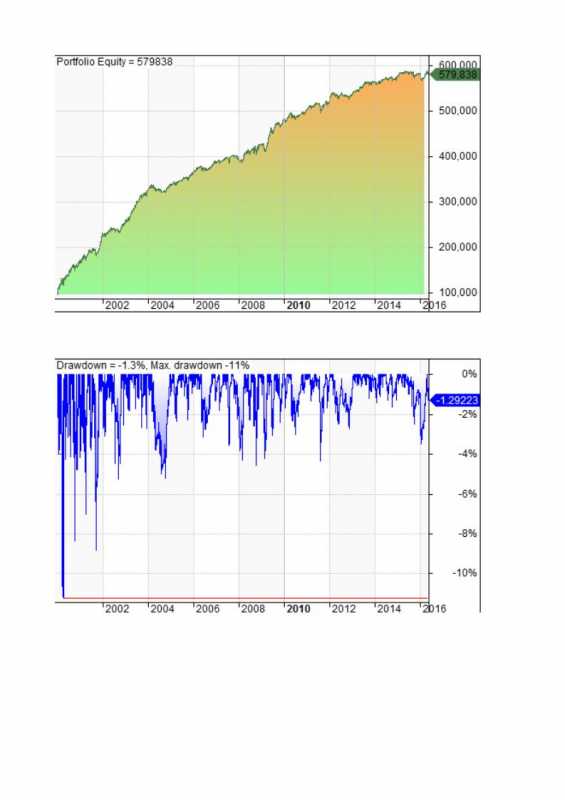

– However, if we start with a 100K portfolio but a fixed $5000 position size, obviously CAGR significantly decrease to around 11% (which is acceptable) and the DD is also signficantly reduced. Below are the graphs with these parameters.

What do you think?

StephaneFima

Participant😆 😆

StephaneFima

ParticipantThanks Said.

Did you already trade this system?StephaneFima

ParticipantSaid,

In this system there is one rule which is BB width is greater than 5%. What is the interpretation of this?

As far as I understand BBands, if b% (i.e. the width) widens, it means that volatility increase and vice versa.

So, does the rule above implies that we want a minimum level of volatility to trade?StephaneFima

ParticipantThe answer Craig gave me was the following: “Use OpenInt when backtesting if you have a price filter in play as that will give you the close price at the time of the buy signal, which may have been different to the current chart due to splits or other corporate actions“

StephaneFima

ParticipantI think I’ve found it.

In my code, I do not have your second condition (Cond2 = C < ShortMA;) as an entry condition.

This probably explains why you have less tradesStephaneFima

ParticipantSaid,

I guess that this portion of code

NTPeriod = 30;

DN = DateNum();

LastDate = Status(“rangetodate”);

NT = LastDate – LastValue(DN) >= NTPeriod AND DN == LastValue(DN);

LastBarExit = BarIndex() == LastValue(BarIndex());

NTEx = IIf(NT,LastBarExit,0);is related to adressing the historical constituents, right?

Just one idea if this is the case, have you tried Craig’s code, i.e.OnSecondLastBarOfDelistedSecurity = BarIndex() == (LastValue(BarIndex())-1) AND !IsNull(GetFnData(“DelistingDate”));

OnLastTwoBarsOfDelistedSecurity = BarIndex() >= (LastValue(BarIndex())-1) AND !IsNull(GetFnData(“DelistingDate”));and LE = Ref (LESetUp,-1) AND L<=Ref (BuyLim,-1) AND NOT OnLastTwoBarsOfDelistedSecurity; Normally it should give yout the same results but mlaybe worth testing

StephaneFima

Participant

StephaneFima

ParticipantGuys, you are too quick for me!

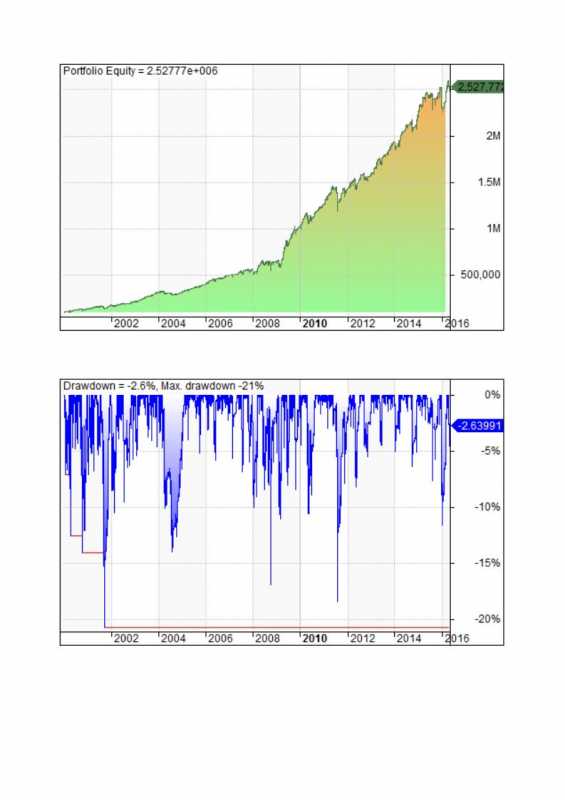

Here are my results based on :

– Russell 1000 from 01/01/00 to yesterday

– 100K portfolio

– Position size = 5% fixed

– Slippage and commission = $5 per trade

StephaneFima

ParticipantSounds good for me too.

StephaneFima

ParticipantI’ve been using BitDefender Total Security for many years now. It’s a great one, never had to complain.

StephaneFima

ParticipantOk for me too

StephaneFima

ParticipantThanks Said. I will try. Seems to be a smart way to achieve it.

Here are the MCS results of my MR strategy. Not too bad, but Max DD is annoying me a bit.PS: I think I saw somewhere on the forum how to insert directly a picture in the message. Do you remember where it was? Thanks! 😳

StephaneFima

Participant04/05/16

1) Sorting existing strategies: some mean reversion, only one trend following and one momentum. Need to work on the last two categories

2) Re-working on one of my favorite MR strategy. Never traded it: will probably paper trade soon. Will post the MCS results once the hour and half of calculations needed will be over…

3) On the momentum strategies, I really need to understand how to code a monthly rebalancing. Will dig further next week on this topic (I found something in Amibroker’s knowledge base but it is a CBT code… I would like to find something in plain AFL.

-

AuthorPosts