Forum Replies Created

-

AuthorPosts

-

smurfki0808

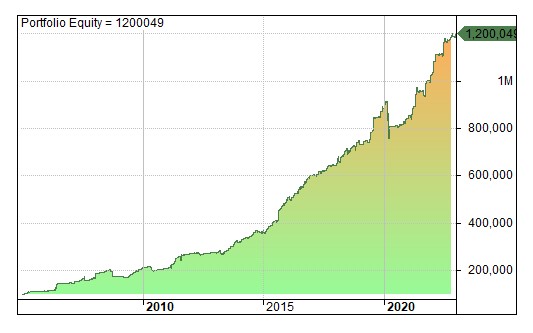

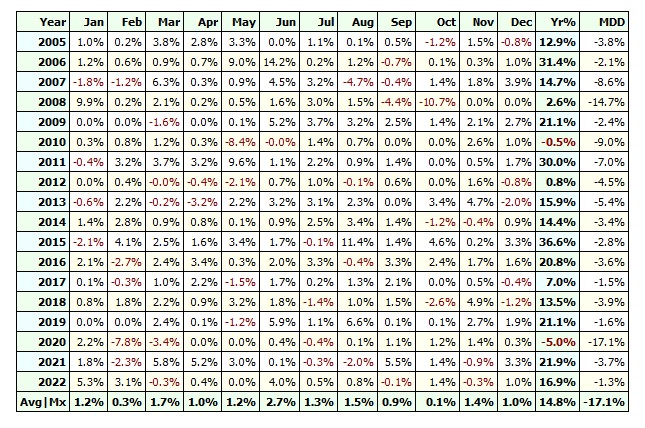

ParticipantToday looking at using the same setup, as previous post, but instead of using a same week exit, I tried running on a daily time frame and exit signalled by a simple cross of short term MA. Simple 10 positions by 10% equity, no leverage.

Again, not so much the end result is important, as my understanding of the options that might exist.

For reference, CAR 17.7%, MAR 1.0, Avg P/L 1.49%

smurfki0808

ParticipantA day of progress for me in gaining some understanding of the MR code and getting something that has an upward equity curve! I’ll take that as a win. Thanks Craig and Julian for your pointers. At least I now understand a little bit of the mechanics.

The equity curve below may not be that pretty, but to me its a beautiful thing, haha. My first go at a weekly system, signaled by an end of week close below an ATR channel, a stretch entry, and close on Friday. I think I am beginning to see the light.

Onward.

smurfki0808

ParticipantOoops, I’ll do that again and insert the images.

smurfki0808

ParticipantThanks Julian for the lead.

Today I downloaded RealTest, so I can hopefully check out the mechanics in those strategies for the principles and add them to my thinking. I feel I am at the very beginning of a steep learning curve!

Cheers

smurfki0808

ParticipantAfter bedding down the momentum side of my strategy toolbox, I am now looking to develop a MR strategy to complement them. This is a real challenge for me, as my understanding of the essential components of MR systems is less clear. As I have had zero experience trading these types of systems, I have little experiential or theoretical knowledge. From reading the posts, I can clearly see the success and enthusiasm for these approaches that people are having, vis, Julian, Glen, Terry etc. I have searched/read/analysed many posts and threads trying to wrap my head around the essentials.

My objective over the coming days is to have a go at coding even the simplest MR system (e.g. RSI(2)) or ATR band) and progress from there. I am hoping that this gives me a better understanding of the essential components, and what levers to push and pull.

smurfki0808

ParticipantHalf way through the month, my ASX WTT looked like it was heading to all cash, before receiving signals late in the month to take it fully invested.

ASX WTT -2.0%

ASX MOMO 0.7%

Managed Growth Fund 3.6%Total 2.2% taking total drawdown to -21.8%.

smurfki0808

ParticipantA brief update to jot down some progress over the past 3 weeks.

My first system build is complete. ‘Emerging Momentum – EMO’ is a thing. Reaching this point is somewhat of a surreal experience. For a couple of years I have had an idea festering in my mind, and now it has emerged into an “operational” system. Was the path straight; no. Did the path go in the direction as I might have pre-empted; no. Did I learn a lot; yes.

My original idea was an attempt to capture early movement in prices as momentum accelerated through a ROC threshold of 30% over a period of say 100 days, operating on a daily basis, and ride the momentum until tipped out. However, we quickly found that while the concept was logical, there was a lot of noise among those signals. By varying regime index and restricting the universe to the small end of ASX town, we were able get something to work. But, optimisation showed there was a lot of variability induced by the period over which ROC was taken. It was just a little too jumpy operating at a daily time step. So, Nick suggested a raft of ideas to consider, including, weekly time steps, additional entry criteria like a breakout of some sort, changing regime index, and maybe different universe in an attempt to distill the signal from the noise.

Taking these on board, I went to weekly time steps, applied a more standard regime filter of the XAO, applied a Bollinger Band breakout together with ROC breakout, and presto, something that has usable metrics. Optimisation showed increased stability/robustness in the parameters, compared with the daily system, which led me to align values of some variables and simplify further. MCS, with 5% skip trades, showed reasonably tight performance over the period 2005-2023; average CAR 22.16%, MaxDD -23.32%, MAR 0.95, and Profit Factor 2.09, win rate ~48%.

While I developed this strategy on the $0.25-$10.00 universe of the ASX, I took it to the $0.25-$500 universe of the XTO. I accept there is some overlap in symbols between those two universes, but the backtests still performed. In some ways, it was a smoother ride; a higher win rate, but a little less CAR. So, this gives me some comfort that in a partially unseen universe, the strategy was robust and gives food for thought of a variant of the strategy to apply to a different universe with higher turnover.

When comparing trades with the WTT over the same periods, EMO picks up different symbols, and perhaps earlier than the WTT. So, a little bit of diversity there for me.

Onward.

smurfki0808

ParticipantMarch update – I’ve continued to work on developing my first system, Emerging Momentum. We have a functioning system, using the WTT code as a template. Nearly at the point of starting some stress testing analysis, to see if it easily breaks.

Working towards all cash in my WTT (just 4 positions open) and ASX MOMO, all cash as of today. My WTT has one position, AVZ that is in extended suspension, as many others know.

WTT -5.1%

ASX MOMO -2.0%

Managed Growth Fund -1.6%Total -2.4% taking total drawdown to -23.5%, and not a new low, thankfully.

smurfki0808

ParticipantTough trading conditions – on the Wednesday group call, many noted that recent trading conditions were tough. Today I note that the XJO finished the week down for the 7th week in a row. The last time that I can see that happened was July 2008. Certainly tough on the momentum strategies and explains why my WTT portfolio is nearly all back in cash.

smurfki0808

ParticipantHi Terry,

No, I am working with BellDirect, but I see that at some point that might have to change. I have to learn to crawl first before running!

Thanks for the heads up on what I should research.

smurfki0808

ParticipantThanks Ben for the encouragement.

I hear the message about getting my setup a little smoother. I just loaded 8 trades in my weekly system, and yes, it took about 10 minutes after I had done the prep over the weekend.

And, yes, discussions with accountant are scheduled.

Have a great week.

smurfki0808

ParticipantHi Terry,

Thank you for your encouragement, it is most welcome.

You make two important points that resonate with me, 1) “Once you have a MR system you’re happy with” – that is a work in progress, and 2) “it does not take much time”, when you are properly set up – my present trade execution is all manual, which is probably not ideal.

I have an appointment with our accountant to discuss that other 3).

Have a great week.

smurfki0808

Participant19 March 2023 – I have made my way through to the end of module 26, completing the coding/theory components. Certainly, I have gained a deeper insight into what is required in a robust trading system. Moving into the practical, I want to develop and test two strategies. 1) a simple momentum based strategy, operating on daily time steps, looking for holds in the weeks to months. Nothing special about the entry, a simple ROC entry, but with tight money management edge, quick to enter, and in a down turn, quick to exit. 2) a swing system, looking for a return to trend after a retracement. Looking for a simple bar pattern to trigger the entry, with tight money management edge, hopefully to result in a high risk:reward outcome.

The biggest challenge to my beliefs, however, hinge around the role of shorter term reversion and swing trading strategies, and how they might work for me. I never envisaged myself to run systems that trade this way. Why? 1) Clearly, I did not understand how these system work, and how they can work with momentum systems to help smooth the equity curve. 2) Presently, I do not have the processes in place to run such a system, and so thought they would be too high a workload to run while working full-time. 3) Presently, I am not classed as a trader by the ATO and I assume, a step towards the shorter term strategies will trigger that event. So, a little more thinking and consideration required here.

I look forward to keep progressing in my journey, and learning how to ‘think it, code it, test it’ and make robust strategies my own.

smurfki0808

ParticipantThat is eye watering…not enough time to grab a cuppa!

smurfki0808

ParticipantA little note to self 13 March 2023. “Don’t press the bright red flashing ‘panic’ button”. Trade the signals as they come. No expectations, equals no disappointment.

-

AuthorPosts