Forum Replies Created

-

AuthorPosts

-

smurfki0808

ParticipantJuly saw me return to my day job, which frankly, seems a little less stimulating after sinking my teeth into the Mentor Program. So, July was a month of learning to balance a new bunch of competing demands, while bedding down my trading processes, reconciliations, and so on.

The good news is that I have completed one month of trading my ASX MR#1 strategy, following all signals and executing as per the rules. This was a real win for me, as before the Mentor Program, I thought running such a strategy would be beyond my capacity. The month revealed that with my code, my order sheet, and routine, I can process trades in about 10-15 minutes. I still check each signal on charts just to make sure nothing odd is happening, but it is well worth it. The month began really well, with 10 profitable trades in a row before a bit of pullback late in the month. In total, 14 completed trades, 11 wins, 3 losses, total return +3.3%. Two of the losing trades coming late in the month were tied up in earnings revisions, and trading halts, which didn’t end too well on resumption of trade. Why don’t those ones go in our favour?

In my ASX WTT, revisions also whacked a few positions, just after it went fully invested. Earnings expectations not being met apparently.

In looking for some further diversification in my trading strategies, I reexamined my ASX EMO, emerging momentum strategy. I built it to trade pretty much the same universe as my ASX WTT strategy, which at the time seemed a logical path for me to follow. However, I found that by expanding the price range of the universe, and reducing the # of positions, the metrics improved substantially.

So for me, a good month to have completed.

ASX WTT: -2.1%

ASX MOMO: 0.1%

ASX EMO: 0.5%

ASX MR#1: 3.3%

Managed Growth Fund: 2.5%Total for month 1.3% taking total drawdown to -21.7%

smurfki0808

ParticipantGlen Peake post=14140 userid=314 wrote:I ignore the outside ‘noise’ and place the trade and get the OPEN price.Murphy’s Law (no pun intended) suggests that if you wait post open auction for price discovery to ‘settle’ down, the stock will run higher without you onboard and you’ll sit there saying to yourself “why didn’t I just get in on the OPEN”.

So follow your system and buy the open would be my approach.

FWIW:

If I get a ‘double up’ of buy orders for the same stock between e.g. my WTT and XSO monthly systems flag the same stock, I treat each signal separately and take the trade in both systems. No 2nd guessing, no sitting on the fence, just pull the trigger and be a robot and follow the system.Cheers

Hi Glen,

Yes, I accept your counsel. The rule is buy the open, so get on board. If I did not know the outside noise of the Growth Strategy signal existed, I would just get on board regardless.

Thanks for your thoughts, much appreciated.

By the by, my newly deployed ASX MR#1 system is up to 10 wins from 10 trades, averaging 3.5% profit per trade. Tomorrow, an exit (which will be the first loss) and a few more buy signals to enter. It will be interesting to see how it goes in this next week.

Cheers

S

smurfki0808

ParticipantCompeting trades from different strategies? Any words of wisdom?

For Monday, I have a BUY signal for SSM in my ASX WTT strategy, while The Chartist ASX Growth strategy has the same signal. I am not trading the latter. I suspect the equity tracking the Growth Strategy is somewhat larger than mine tracking my WTT, so interest at the open will be high.

So, I guess it might be prudent for me to be patient with my entry into SSM on the weekly strategy? How do others handle this type of scenario?

Cheers and thanks,

Sean

smurfki0808

ParticipantA quick update for the month of June.

ASX WTT: -0.7%

ASX MOMO: 1.6%

ASX EMO: 0.3%

ASX MR#1:, First 2 test trades, 2 wins, for 5.6% profit.

Managed Growth Fund: -0.3%Total for month -0.1% taking total drawdown to -22.9%

For 2022-23, sideways all year, drawdown deepened from -21.1 to -22.9%

smurfki0808

ParticipantNice to have a positive start. Now for the next 1000….Cheers

smurfki0808

ParticipantGlen Peake post=14088 userid=314 wrote:Well Done Sean.Nice Trade!!!!

Keep us updated on the progress!

Thanks Glen, my strategy has a bit of your wisdom buried inside it. Certainly a nice trade to kick off with. The backtest for June has so far returned 6.8% with 9 wins and 7 losses. Maybe I should have started earlier in the month?

smurfki0808

ParticipantA little update in late June 2023. I am at the end of my formal Mentor period with Nick and Craig. What I have learnt is a story for another post, but suffice to say at this stage, “you can teach anybody to design, code, test, and trade” a robust strategy. So for what you guys have taught me and exposed me to, I think my family and I will be forever grateful!

For me, the past 4 months has been non-stop learning, researching, analyzing, building, coding and thinking. All good things must come to an end as I return to my full-time job next week. So, over the last couple of weeks, I have worked on transitioning my mind from full-on systems development, to a place of implementation and execution. Slowly slowly, and softly softly. Setting up new brokerage accounts, planning movement of equity to allow implementation of my strategies etc. Dipping my toe in.

To that end, I can happily say that this morning I executed my first full circle mean reversion trade by closing out my first position! Does that feel good to someone who was rather reticent to go down the higher frequency trade route? You bet. For my position to close with a 8.8% win in just 3 days is just amazing. Was it just signal luck? Probably. Beginners luck? Sure. But, it certainly feels good. Especially the part that the signal came from a strategy that I developed (with help of course).

What did I learn by executing this first signal? There was a slight teething problem around the ranking, which I believe I sorted out, but it taught me another lesson about why in backtesting my strategy works. Did I get a complete fill? Yes, just $0.01 above the low of the entry day. Did my exit influence the opening today? Yes, slightly. My exit suppressed the opening auction price by ~1%, but it was a successful exit in the open. Could I have held the position to exit later in the day? Yes, but that would break my rules and I had no certainty that the price was going to keep rallying.

So with the completion of that trade, and the prospect of another 1000 like it, I feel like I have turned a corner. Will all my mean reversion trades be so profitable? Definitely not. But, my backtesting suggests a win rate of ~68%, so I should be confident to keep taking the signals. Today I have three entry signals in play, and another trade in play, and in the black for now. So, a positive start all round.

I will do another post of where I got to with my strategy development during the mentorship. Suffice to say, I wildly exceeded my objectives in what I achieved.

smurfki0808

ParticipantHi Steve,

thanks for sharing your journey in system development. Quite the journey. It sounds like you have arrived at two systems representing Yin and Yang. May the force be with you! Cheers, S

smurfki0808

ParticipantWell done Stewart. Here’s to good trading!

smurfki0808

ParticipantMay 2023 – I continued developing a Mean Reversion system on the ASX, which has come together quite nicely. In back testing, it appears that there is an opportunity for an account size in my comfort zone. I have a few more checks to do with Craig next week regarding operational procedures, but the strategy looks like a worthy addition to my little stable of systems.

In the mean time, I have had a go at developing a Monthly rotation strategy using momentum ranking for the ASX100. Early days just yet, but at least I have the mechanics heading in the right direction. Now, I need to do some more development regarding regime filters, volatility filters and # positions to see if I can get close to Nick’s ASX MOMO performance.

Now in June, I am in my last month of the mentor program and I am working towards getting my processes in order, vis. IBKR, mechanics of multiple order placements, and so on.

Results for May

ASX WTT: -3.8%

ASX MOMO: 0.0%

ASX EMO: -2.9%

Managed Growth Fund: -0.9%Total -1.5% taking total drawdown to -22.8%

smurfki0808

ParticipantYes, for sure Julian. Nick and I have talked about these issues. I don’t for a second think that it would be feasible to trade the compounding account to $200m.

Nick suggested to look at results over 5 year blocks, to see if similar performance measures come out and position sizes stay feasible.

Thanks for the feedback.

smurfki0808

ParticipantAnother week, another week of learning. The week seemed like an adventure into a deep, dark, rabbit hole of CBT code. But, I popped out an exit to see the light once more.

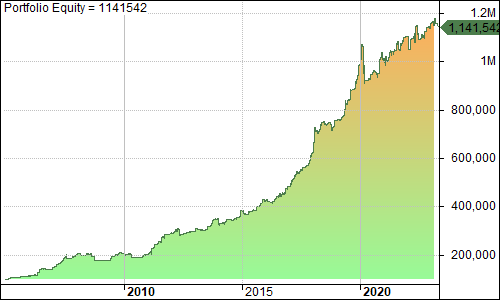

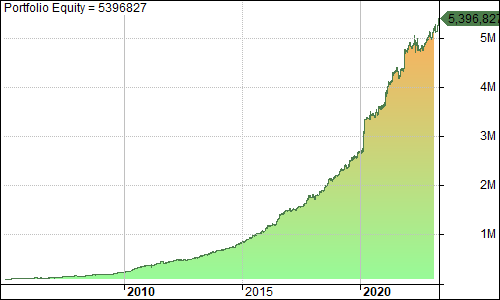

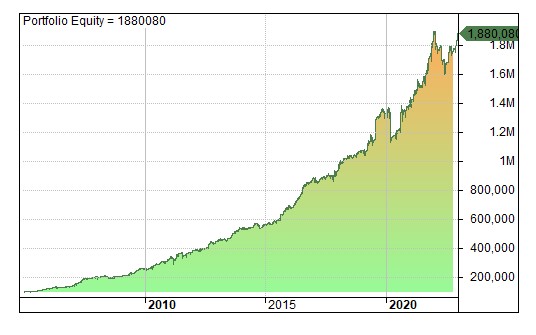

This post is a about my learning of the impact of time frames. My original thought for the strategy was to look for a system that operated at a weekly time frame, aiming to enter during the week on a stretch, and exit on Friday at close. After working with Nick and Craig, this idea morphed into a multiday swing system. The charts below show the same parameters operating on the same ASX Universe, but in three different time frames. Weekly same bar exit, Daily same bar exit and Daily multibar exit on higher C. Each approach offers differing benefits, vis, CAR, MAR, MaxDD, MaxWait, LBIT, etc.

Weekly same bar exit = lowest trade # but highest W. Avg. % Profit and Avg % Profit per trade.

Daily same bar exit = smallest MaxDD, smallest Avg % Profit per trade, but highest trade #

Daily multibar exit = highest Win %, highest CAR, but highest MaxDD, with highest MAR, and obviously, longest LBIT.Which horse, on which course?

smurfki0808

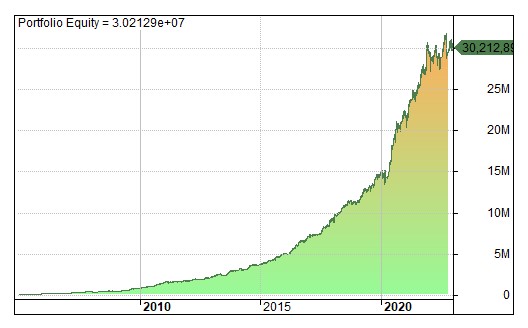

ParticipantSorry Julian, its hard to tell from that chart. MDD increased from -17.67 to -24.37, but MAR went up from 1.00 to 1.53.

I’m very much feeling my way around with this type of system. Thanks for your interest.

smurfki0808

ParticipantWell, I do have a lot to learn, don’t I.

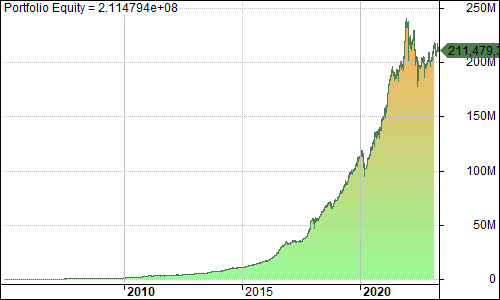

Two equity curves. The first, from my post earlier this afternoon, and the second, following Julian’s suggestion of changing the exit to a higher C and changing the ranking method to ATR(5)/C.

# trades increased from ~2000 to ~5000, and number of winners increased from 1300 to 3400. There was a modest drop in W. Avg. % Profit from 4.95 to 3.92. and modest improvement in L. Avg. %Loss from -4.75 to -3.66. The power of large numbers.

Daylight and dust.

smurfki0808

ParticipantThanks Julian. Yes, I will have a go at the higher close exit too. My knowledge of how to apply the different ranking approaches for these short term systems is a work in progress. I have noted down a few from threads and posts. So, its a matter of me trying them to see what happens and get a feel for what they are doing. Cheers.

-

AuthorPosts