Forum Replies Created

-

AuthorPosts

-

smurfki0808

ParticipantYikes, volatility creates opportunity! A big bounce back from July!

smurfki0808

ParticipantHi Rob,

Good to see you in the forum.

SMCI – a bit of signal luck there, ouch. Elsewhere in the forum, wiser folk than I have discussed the merits of excluding the same symbol from being present in multiple strategies. But its great to see you citing where these trades sit in the historical context of the systems.

Those little stocks in the ASX sure are jumpy. Happy days when they bounce our way.

smurfki0808

ParticipantA hold my breath sort start to the month. When the volatility began in early August from the unwinding of the so-called Yen-carry trade, for me it was my first big test to stay true to my systems. I had to trust that if a large correction was to unfold, the systems would exit in due time, and my portfolio would be spared the worst of it. If so, we would rebuild when the market was ready. So, it was a good learning experience for me to hang tight and ride the wave. I’m glad I did. All’s well, no harm no foul, carry on. With the volatility for the month, I was surprised at how few trades my ASX MR#1 system took, just 10. Of these, 7 were opened in the first 2 days, and 3 in the last 3 days of the month. The uptrend condition for individual stocks prevented entries. The open trades are all showing a profit, subject to closing them out today, Monday. Elsewhere, my ASX growth took a fair hit. Exits, triggered by earning reports in the early part of the month, did the most damage.Looking at the relative performance of the different strategies across the US and AUS markets, I am starting to see the material benefit of the strategy diversity. Net result for the month down <1%.

smurfki0808

ParticipantHi STT Users trading US equities with SelfWealth,

I am looking for suggestions on how best to reconcile US dividend payments coming from SelfWealth to the STT. I can see the cash balance in STT quickly getting out of whack with cash balance sitting in SelfWealth.

Specifically, how to best reconcile the difference between the gross dividend amount (units x div amount), versus the net dividend received (gross dividend minus 15% withholding tax minus Philip Capital charge of 1.5% – capped at max $1.50).

In STT, is the best approach to manually update each dividend amount to the net amount, after accounting for the withholding tax and fees?

Suggestions most welcome.

Thanks,

Sean

smurfki0808

ParticipantThe recent volatility in Japanese, US and AUS markets appears to be a litmus test for the status of my mind. So, I’ve decided to journal some observations that down the track I may reflect upon. Particularly, I wanted to capture that compared with periods like 2020 and through the grind of 2022-23, my mind set is different this time.

At this time, I find myself looking at the markets with a calm, semi-detached interest. None of what is going on is under my control. My focus and control is on executing my strategies and completing the trades, just following the exits as they come along. They are my responsibilities. There is no knee-jerk emotional response. If the markets continue to head south, so be it, exits will happen. The plans are in place, the strategies have their exits, and when the markets are ready, the strategies will have entries.

In prior periods of volatility, I spent a lot of energy attempting to second guess where the markets were heading. Now, I understand the markets will go where they do. I know full well, that my suite of strategies will be ready and waiting for the opportunities, on daily, weekly and monthly timeframes.

Training, Executing, Trusting.

smurfki0808

ParticipantSo ends the first month of the new FY. It marks the second month of operating a suite of strategies across the AUS and US markets. The focus of the month has really been about making sure my processes were in place and executing. The start of August looks a bit bumpy, did someone mention Murphy’s Law?

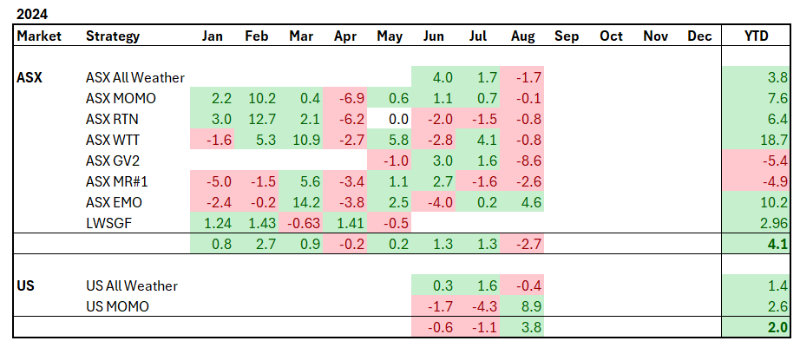

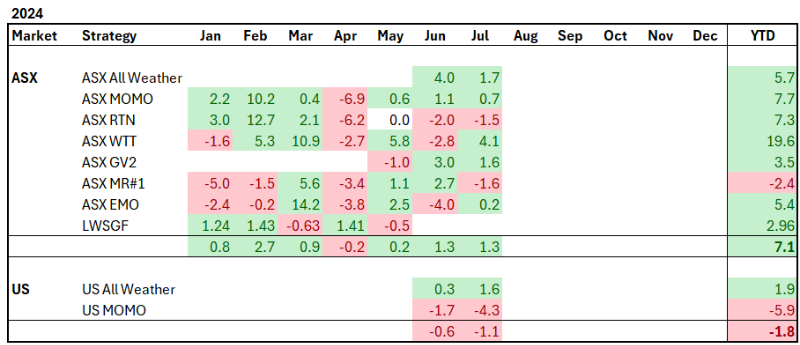

I’ll try reporting my strategy performance like this.

smurfki0808

ParticipantAt the start of the month, I implemented new strategies in the Australian and US markets. In the ASX, I implemented the All Weather and Growth strategies to complement the existing ASX MR#1, ASX WTT, ASX EMO, ASX MOMO and ASX XTO strategies. In the US markets, I implemented the All Weather and US MOMO. All in all, I am happy to finally deploy this range of strategies. Having these deployed, now gives me more head space to work on further strategies, and launch into RealTest.

And to stroke my confirmation bias, the managed fund we left, is down a further 2.7% since. ASX

All Weather 3.96%

MOMO 1.08%

XTO RTN -1.95%

WTT -2.79%

EMO -3.99%

MR#1 2.71%

Total 1.72%

USAll Weather 0.28%

MOMO -1.68%

Total -0.64%Total drawdown slowly shrinks -17.34%.smurfki0808

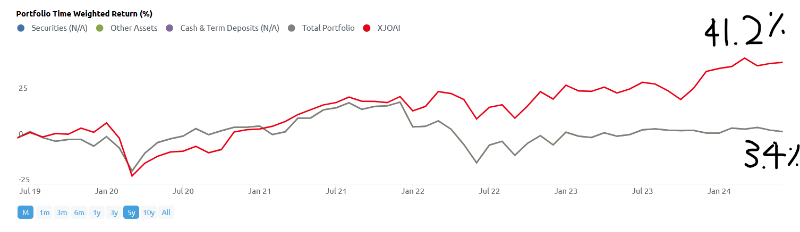

ParticipantFor the sake of completeness and as a reminder to myself, I’ll include a chart of the recent 5-year performance of our exited managed fund.

From July 2019 to June 2024, the managed fund had a total return of 3.4% compared with the All Ordinaries Accumulation Index return of 41.2%. For the fund, the bulk of the returns were derived from dividends, which were reinvested, despite it being a ‘growth’ fund.Five years from now, I will enjoy looking back at this point, and seeing my equity curve trending above the XAOAI.

smurfki0808

ParticipantThanks Nick, yes it will all pay pay off in due course. “A portfolio of robust strategies operated over the long term”.

smurfki0808

ParticipantGreat progress over the past 6-7 months Anthony, very encouraging, well done!

smurfki0808

ParticipantThanks Scott, and yes, I respect the challenge. But, seeing the fund manager change their style was the final straw. Onward and upward.

smurfki0808

ParticipantThis is a big outcome from me starting the mentor program Glen. I may not be a whiz at strategy building, but the bones are there!

smurfki0808

ParticipantMark May 2024 as a pivotal month in my trading journey. We liquidated our managed fund, and we are moving to self managed strategies. Is this daunting, of course, what could possible go wrong? However, following in the footsteps and standing on the shoulders of giants, gives me a calm sense of confidence. Certainly, the mentor program and training has revealed the types of approaches that suit my skill sets, tolerance, and time. Much of this month was spent organizing, to be in a position to implement new strategies at the start of June, both in AUS and US markets.

Another month, and another right tail in my WTT strategy with CU6.au showing a 247% return.

May 2024

ASX WTT: +5.75%

ASX MOMO: +0.57%

ASX XTO RTN: +0%

ASX EMO: +2.51%

ASX MR#1: +1.4%

ASX Growth: -1.04%

Managed Growth Fund: -0.5%Total for month +0.34%, Total drawdown slowly shrinks -18.85%.

smurfki0808

ParticipantHi Nick, thanks for the answering my question about the Australian ETF’s and the role of the market makers. It sounds like the key variable to keep an eye on is liquidity on offer pre-open. Cheers, Sean

smurfki0808

ParticipantNice month Terry. I like the way your systems are taking turns to lead!

-

AuthorPosts