Forum Replies Created

-

AuthorPosts

-

smurfki0808

ParticipantJulian Cohen post=15094 userid=5314 wrote:So given that he is changing to highly tactical hedge divestment strategies (WTF does that mean…do they look this crap up in a book…Confusing Jargon for Economists)You can be pretty sure that that will stop working almost immediately.

Absolutely Julian, it translates to “Baffle them with BS while quietly wiping egg from face.” Cheers

smurfki0808

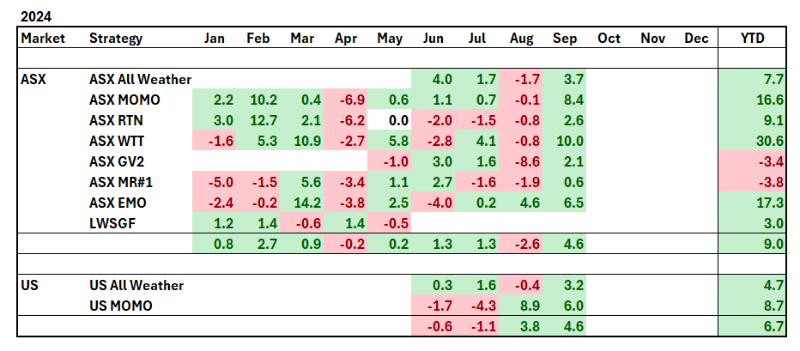

ParticipantAnother nice month Anthony. And then boom, your NDX100 comes to the party!

smurfki0808

ParticipantIt certainly is nice to see a month of momentum.

And yes, the fund manager is now back peddling about their approach, quote, “I originally intended to actively manage the hedged positions for 6 to 12 months. Now that time has lapsed, it is essential that I reassess the strategy and realign our portfolios back to traditional unhedged compositions. As we advance through the next six months, I will implement highly tactical hedge divestment strategies,…”

Nevertheless, for me, just one month of the next 300 or so.

smurfki0808

ParticipantThanks Kate. Yes, I agree, self-interest by the fund manager I believe led to style drift. So, so far so good with my shift. Good luck sorting your rollover.

smurfki0808

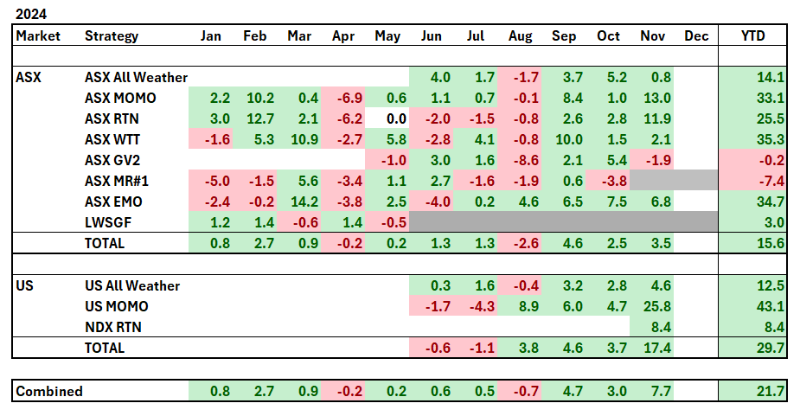

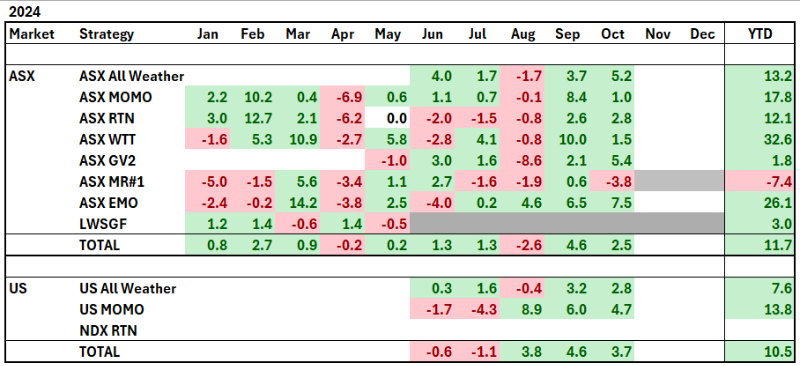

ParticipantWell, that was a good month, with total account up 7.7%. A raft of positions popped across multiple strategies, compounding returns.

For what it is worth, since converting my managed fund over to these strategies, my equity is up ~16%. By comparison, the data for the fund shows a rise of ~2%. The fund manager continues to execute, in their words, “a highly strategic sell down” of its 25-30% holdings in BBOZ and SPXU. This comparison vindicates my decision to learn the tools of the trade to self-manage, haha. Thanks Nick!

smurfki0808

ParticipantHi Kate,

This question was one of my very first questions to Nick some years ago, before doing the Mentor program!

I too place my WTT LIMIT orders before open, and have seen prices gap up through the order at open. I don’t chase it. These days, I leave my order as is for the week to see if it fills later at my price, but otherwise look for the next signal.

I think Glen P has mentioned that he does his best to get in on the open, what ever it is.

Its hard watching those rockets whiz by sometimes.

smurfki0808

ParticipantA good couple of months there Robert, building nicely.

smurfki0808

ParticipantCongrats on your best month so far Paul, a real cracker!

smurfki0808

ParticipantAnother month in the green, for all strategies bar one: the ASX MR#1.After 200+ trades in the MR#1 system, including a revision after 100 trades, I’ve come to the conclusion that its not possible to reliably trade the strategy. The differences between backtest and livetrade were insurmountable. The result on a handful of trades destroyed the profits that I had steadily amassed. Two positions gapped through my exit price forcing me to chase the exit, and so considerably underperforming the backtest. A third, failed to get a fill on what turned out to be a solid profit. A fourth, I elected not to take the trade because of media attention on the stock, but it too turned out to be a highly profitable trade in the backtest. And, a fifth, went south on media speculation about the CEO, resulting in a disproportionate loss. So, what did I learn? I learnt that just because a strategy appears profitable in backtest, it is not necessarily profitable in live trade. Liquidity and price volatility on the ASX can work against such a system. I developed a better understanding of MR systems, and how they operate. I patiently executed 200 trades, giving the system every chance to be profitable, got a good sample of trades to assess expectancy, from which I could conclude to park it. Perhaps an indicator that the system was not a good fit for me was the angst lurking in the background each time I sought to exit positions; would I get my exit at the open or not? I tried several different approaches to exit, including hidden orders, but there was always concern that I might not get my exit. Where to from here? I will reallocate the capital to another strategy in the US market. Doing so will bring my allocation a step closer to 50:50 ASX:US markets.Onwards.

smurfki0808

ParticipantKate, I’m sorry to hear of your further losses. You’ve a lot going on, so be kind to yourself, and let the trading take care of itself. Best regards.

smurfki0808

ParticipantA full house of green is nice to see. I’ll take that. Interesting coincidence that both AUS and US results for the month were the same.

I have another decision to make, but I’ll put that in another post.

smurfki0808

ParticipantThat’s a systematic way to track your progress!

The trickiest one is “Not Follow Rules +Profit $”.

Every rep of following my rules, is a good rep. I try to remember that. At least that way, I know I’ve done my best to execute the system.

Cheers

smurfki0808

ParticipantWishing you a smooth run with all you are juggling over the coming months Kate. One day at a time. Cheers

smurfki0808

ParticipantHi Kate,

Agreed that the combination of market volatility and outside volatility is a heady mix.

But, you showed a great list of positive outcomes for the month.

All the best!smurfki0808

ParticipantI hear you, most people react to big $ movements, but less so to a %. Many learned people here will say to focus on the process, and the dollars will look after themselves.

-

AuthorPosts