Forum Replies Created

-

AuthorPosts

-

ScottMcNab

ParticipantI have a set of instructions on how to close out existing positions with my wife and my father (in case my wife and I are in the same accident) (or my wife decides to collect on life insurance) with copy of log in codes (in separate location) , account details etc.

ScottMcNab

ParticipantJournals are good places for rambling….cathartic….been testing a lot of rotational systems in last few months…all of mine have a 2 year (or more) stretch of being underwater somewhere in the backtest…..and momo crashes are often pretty brutal ways to enter the drawdown….rotation systems seems to be least “labor intensive” day to day but also appears to be most psychologically demanding…impressive resilience Mike

ScottMcNab

ParticipantSep 2021

MRV RUA -0.7%

MRV RUI 1.4%

MRV USA AK 0.4%

MRV USA RB 6.3%

MRV USA SM -2%

MOC USA -2.1%ScottMcNab

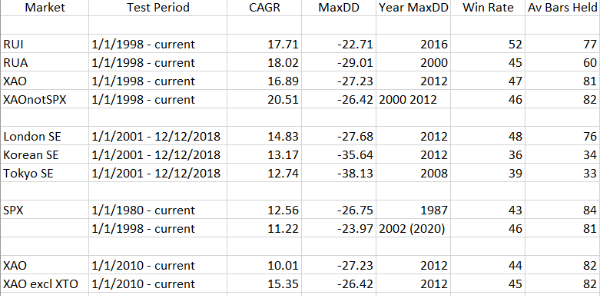

ParticipantHave been inspired by Glen’s post to do some research….so I thought I would also update my journal. First half of 2021 was meant to be the straightforward launch of new MRV and MOC systems…was a bit of a cluster but now into second half of Sep these are finally tracking. Second half of this year was meant to be launch of longer-term systems but only now getting to the paper trading stage so hopefully live Jan 2022. Three types are in development: daily trend following (breakout/trailing stop loss), weekly rotation and end of month rotation (with ability to exit immediately if index fails on any day). My goal has always been 15% cagr/-25% maxDD of long term portfolio with under 30% maxDD for any individual system. I am not confident that I will be able to achieve this last aim (actually I am fairly sure I won’t)….something always seems to sneak over the 30% DD mark somewhere in the back testing on some market…time for me to accept this and move on.

Of these three system types, the daily TF system is the only one I am happy with at this stage and I will start paper trading this weekend (actually my daughters will… they prob wont muck things up as often as I do). I find myself surprising comfortable with this daily trend following system. It is remarkably robust across time frames and I can alter ranking criteria or break out / look back time frames with relatively little impact on the results. The only thing I would like is a larger sample size but the systems only do 20 or so trades a year. For this reason, I have tested it on all data I have, just to try and exclude any complete disasters (not to add/remove or tweak any conditions or filters etc). The simplicity of this system is something I have not yet been able to achieve with my other long term (rotational) systems and gives me confidence (hope) that it is not over fitted.

I did some testing of the XAO excluding XTO based on Glen’s post and got a major improvement, particularly in the 2010-2021 period. While Glen was able to base his findings on a large number of trades, I have quite a small sample size. The improvements are enough that I will pursue this idea further.

edit: typo…should be XAOnotXTO

ScottMcNab

ParticipantThanks Julian and Terry for your replies..two different opinions..both appreciated… I’m also of the thought if it can hit 30 in testing in could hit 40 in the future.. also agree occasional 30 maxDD does not seem unrealistic with these long term trend following systems

ScottMcNab

ParticipantThanks Tim

ScottMcNab

ParticipantWould be keen to hear your goal metrics Terry if you feel comfortable sharing. I too am finding it difficult to dip my toe back into the long term pool. My models are pretty basic (which hopefully means not curve fitted) and seem decent (15-20 cagr depending on time frame with approx 20-25% dd) but when I force the variables to flex a bit during stress testing on mulltiple markets then it is not unusual to hit a 30% DD (either 2000-2002, 2008, 2018 or 2020). The only way I can think to try and avoid this is the diversification route (currently weekly rotation and a daily trend following/trailing stop loss on XAO, NDX and RUI) but am I really that diversified when just trading stocks on US and AUS markets ? That leaves me circling back to accepting a 30% (or more) loss as a reasonable expectation going forward with long term systems (hopefully mitigated by short term systems)….a bit out of my comfort zone. Other option is to scale it back a bit and just accept lower cagr I guess. Anyone else feel like throwing in their thoughts or experiences ? Have you focused on system design such that confident a 30% DD unlikely or are you using portfolio diversification the key…or are you comfortable with 30% ?

ScottMcNab

ParticipantThanks for sharing Tim. Are the incredible returns you have achieved due, in part, to accepting an increased maxDD for each individual system ? Are the maxDD for the rotational systems higher than for MRV ? I imagine the maxDD for the combined portfolio is sig lower though..

ScottMcNab

ParticipantAug 2021

MRV RUA 1.5%

MRV RUI 4.0%

MRV USA RB -0.7%

MRV USA AK 6.0%

MRV USA SM 5.4%

MOC USA 0.7%ScottMcNab

ParticipantCould the diff between account balance and STT be fx related Taranveer ?

ScottMcNab

ParticipantWhich stock markets did you settle on Len?

ScottMcNab

ParticipantJuly 2021

MRV RUA 1.8%

MRV RUI 3.9%

MRV USA RB 1.4%

MRV USA AK 2.4%

MRV PB -12.6%

MRV SM -6.1%Continue to experiment with the MRV systems added in 2021. 70% of portfolio equity remains with the stalwarts from previous years (RUA and RUI systems). I have increased filters with USA systems so that there was no longer any slippage (when sell mkt on open) in July but in doing so the returns are now no better than other systems. As such, I will ditch the worst (PB has been fired) and will restart the MOC long system I was trading earlier in the year as it gives a bit better diversity in returns than if only trading MRV systems. Considering also stopping MRV USA RB and using a second MOC I have waiting in the wings.

All in all…would have been better if had just kept the MOC going from earlier in the year but the MRV USA looked so much better in testing :whistle: …but assumptions on how much liquidity was present were wrong…nothing ventured nothing gained

ScottMcNab

ParticipantScottMcNab

ParticipantScottMcNab

ParticipantSo many ways to make errors with the code….once I’ve made them all I forget some and start working through the list again

-

AuthorPosts