Forum Replies Created

-

AuthorPosts

-

ScottMcNab

ParticipantI upload each system separately so max no. trades typically 10-20 at a time…from time click upload trades to completion would be about a min…new version (in last week) seems more stable than previous one (no error msg to date)

ScottMcNab

ParticipantJulian Cohen wrote:I try not to pick my bottom eitherMore likely to pick selective tops ?

ScottMcNab

ParticipantI ended up adding a MRV with 2-3 day hold for that same reason Rob…frustrated when closed down on entry day and then climbed back in next few days….MRV can work well in sync with MOC…..MRV helps on those days when reversion comes after a day or two and MOC helps limit downside a bit in those times when it just keeps on falling…gives a bit of diversity for not much extra work on the coding/system design

ScottMcNab

ParticipantJan 18

LOO RUI 2.5%

MRV RUI -2.1%NDX Rotn 8.8%

RUI Rotn 0.1%

SPX Rotn 2.8%

XTO Rotn 1.1%ScottMcNab

ParticipantWe do have a choice but no longer with IB. I am saying that being with a US broker that offers SIPC protection to Australian clients has some obvious advantages.

ScottMcNab

ParticipantI’ve got some dodgy responses on the chat…when I raise a ticket it takes longer but the response is typically more considered

ScottMcNab

ParticipantBased on what I can see there Daniel it may be worth raising a ticket to ask about (did you do this or go through the chat channel) ?

ScottMcNab

ParticipantScottMcNab

Participant

ScottMcNab

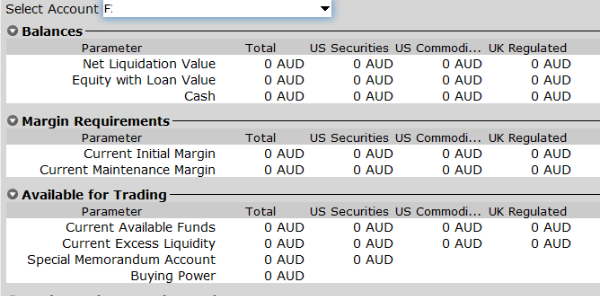

ParticipantSo can now trade futures but not quite the setup was expecting..I thought IB would enable it in my RegT account but instead the umbrella Family and Friends Account has been converted into a RegT account

Taken long enough to get this far that not sure if should question….hmmm

ScottMcNab

ParticipantFrom what I have found to date SIPC protection offered by US brokers (500k of which 250k can be cash in the case of broker going belly up) is extended to all customers of that US broker regardless of the customer’s nationality….try as I might I have not been able to find any similar type of protection for customers of Australian brokers (by ASIC or anyone else) but I will keep looking…if it doesn’t exist for Aus broker’s then it would seem that money would be safer with a US broker ?

ScottMcNab

ParticipantGetting closer Trent…it’s hurting…apparently some setting that has to be approved by IB admin

ScottMcNab

ParticipantScottMcNab

ParticipantRob Giles wrote:Hi Scott

Are you trying to hedge the USD exposure created in your US rotational systems?Hi Rob….you are correct…getting closer….

ScottMcNab

ParticipantIB has got back to me with advice in case anyone else in similar situation

As the RegT account is linked to family and friends, to enable futures in RegT I first have to update the advisor qualification in the master account (manage account/account info/advisor qualifn)

next…log into RegT account using login details for this sub-account and will then be able to alter permissions to allow futures (once change to advisor has been approved) -

AuthorPosts