Forum Replies Created

-

AuthorPosts

-

ScottMcNab

ParticipantJune 2018

RUI LOO 0.7%

RUI MRV 0.0%ROTN

NDX -2.6%

RUI 1.6%

SPX -1.7%

XTO 3.4%ScottMcNab

Participantconcerning use of eodhistoricaldata for other exchanges:

there are 2 types of api data queries at the moment:

1. historical data for a particular ticker

2. data (eod) for the day for entire exchangeso the initial set up for each new exchange would be a bit of work…download 2000-3000 csv files and then upload them …then repeat for each new exchange need data for

ScottMcNab

ParticipantAndrew Bennett wrote:The postdictive error is correct. I am only concerned in determining that every order becomes a trade,

That way you take the data into excel ( There trade results are irrelevant)

I just do this to know how many orders existed on any given day.

This performance enhancement is in excel. Scaling up on the days where your orders are less than the max orders.

Its working for me…..so far.Nick trialed a system where position size varied depending on number of buysetups that were generated for the following day…are you doing this on buysetup signals Andrew or on buy signals ?

//

AddToComposite(buy == 1,”~BuySignals”,”X”,atcFlagDeleteValues|atcFlagEnableInBacktest);

Graph0 = Foreign(“~BuySignals”,”C”);AddToComposite(buysetup == 1,”~SetUpSignals”,”X”,atcFlagDeleteValues|atcFlagEnableInBacktest);

Graph0 = Foreign(“~SetUpSignals”,”C”);ScottMcNab

ParticipantHi Rob..it was the EOD data feed I was thinking about that STT folks have arranged as an option….I was interested in the information they provided about potentially also using the EOD data for uses other than simply updating STT…on the list to do this week…hopefully

ScottMcNab

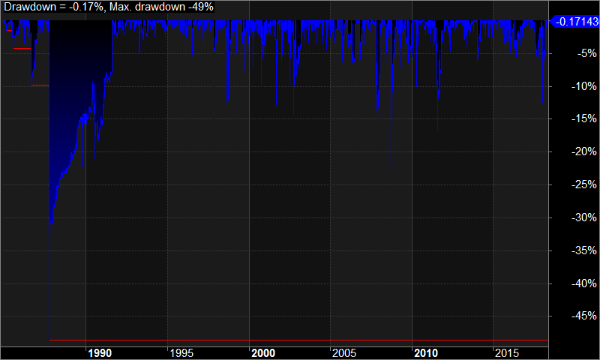

ParticipantMRV system I have been trading backtested to 1985 on SPX..

1987 would have had more impact than I would have hoped but good to know

ScottMcNab

ParticipantHmm..tempting to go diamond for US in first year while have 50% discount although how relevant data is from 1950 to current systems (esp moc) I am unsure ? For momentum rotational systems may more applicable ?

ScottMcNab

ParticipantMay 2018

RUI LOO 1.5%

RUI MRV -2.4%Rotn systems

NDX 2.7%

RUI 5.6%

SPX 1.3%

XTO -3.3%ScottMcNab

ParticipantAnyone using EOD data feed with STT ?

Good/bad/indifferent ?…..was looking at the sentence beginning with “Key note:”…..

Using data source from 40+ exchanges sounds appealingScottMcNab

ParticipantOne way to approach it is to consider whether the maxDD was a concern for you prior to this study? It not then you may have added a layer of complexity to the system when it may not really have be necessary (Occam’s razor etc).

On another note, I think the difference in returns for 2018 is very interesting and your research may form the basis of another system that has low correlation to your current one.

ScottMcNab

ParticipantJulian Cohen wrote:When I first started to test this I found ranking by ROC worked well for me, but in keeping with the spirit of collaboration, I would greatly appreciate anyone finding a better ranking method to pass it on

Better might just be better for your system, but at least we all get a chance to try it.

100 + atr(x)/close

ScottMcNab

ParticipantCheers Julian..might stick with 20 10 for swing for now..was tempted to also have a variation with 10×20 similar to the aggressive rotational system approach

those are amazing results…what time frame is that over ? Now I have to go back and try and obtain that

ScottMcNab

ParticipantYup. I found setting the stretch to effectively Open didn’t help but a system that was running before on 0.7 ATR stretch is now at 0.4. You don’t need to worry if it creates 500 buy signals, as your ranking method will let the cream rise to the top and you’ll only place 20 or 40 of them.

Basically I took my existing system and bolted this code on the bottom. Then I started to play with the parameters to see what worked.

If your existing system has a tight selection bias anyway then this really helps to improve it.[/quote]

Cheers Julian. The size of the atr stretch was a (the) key factor in eliminating the “weaker” trades in my systems. The ave profit/loss % /payoff ratio drop when I reduce the atr but I appreciate the need to do this for the fill rate…just means I need to work a bit harder with regards to the other conditions in the buysetup.

On another note it perhaps suggests a another thought regarding the number of positions and leverage….playing around with 20×10 at moment but keen to hear what others are doing…not surprisingly systems with a low maxDD look great when ramped up to 10×20…without selection bias becomes more an issue of portfolio volatility and whether can mitigate this volatility with diversity of other systems on multiple exchanges ?

Thanks again for all this Julian and to both you and Nick for sharing with us all.

ScottMcNab

ParticipantJulian Cohen wrote:Scott McNab wrote:So the system would have a lower trade frequency for the elimination of selection bias ? Intuitively (ie probably incorrectly) I would think that a different system design would excel in this environment than the ones we have been designing to date ? Did you find this Julian ?ps..I will enjoy spending hours testing different variations but keen to hear your thoughts Julian

try lowering the stretch…you’ll see the fill rate climb dramatically. That’s where I was managing to achieve the trade frequency

Confirming that lowering meant as in a smaller stretch (so a higher buylimit price)

ScottMcNab

ParticipantNick Radge wrote:Quote:So the system would have a lower trade frequency for the elimination of selection bias ? Intuitively (ie probably incorrectly) I would think that a different system design would excel in this environment than the ones we have been designing to date ? Did you find this Julian ?Yes. But now you can make it more targeted which in fact will increase trade frequency.

I need to give that some more thought…thanks for the tip Nick

ScottMcNab

ParticipantDaniel Baeumler wrote:Great effort! Thanks, Julian.Just to make I understand the approach. On part 2, Nick says: ‘If your system takes 20 positions, then you only ever place the top 20, etc.’

Today, I may get 30 or 50 signals but end up with just 10 fills (for max 20 positions). With the new ranking I would only place 20 orders and may end up with just 5 fills. If so, there would be no need for the API to control the number of fills anymore. Is this correct?So the system would have a lower trade frequency for the elimination of selection bias ? Intuitively (ie probably incorrectly) I would think that a different system design would excel in this environment than the ones we have been designing to date ? Did you find this Julian ?

ps..I will enjoy spending hours testing different variations but keen to hear your thoughts Julian

-

AuthorPosts