Forum Replies Created

-

AuthorPosts

-

ScottMcNab

Participanttry again

Mar 2024

MRV1 0.2%

MRV2 -0.9%

MRV3 4.4%

MRV4 -1.4%

MRV5 9.7%

MRV6 0.7%ScottMcNab

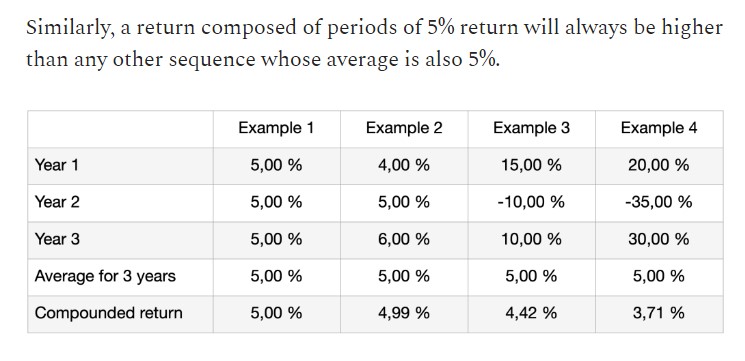

ParticipantNick Radge post=14620 userid=549 wrote:As a guess, it may be the same as I discussed hereI would say the rebalance and compounding effects make the sum greater than the parts.

Actually just reading an article made me realise than I did not appreciate the second point/factor in your answer properly

ScottMcNab

ParticipantThey are under a family/friends login but each of the accounts runs a different system. With RT it only takes 10 min or so which is great. I am happy to keep placing separate basket trade orders as long as I can continue to get them to work. Thanks for the help again Nick

ScottMcNab

ParticipantI hadn’t considered the rebalancing as a source of additional return but will now…cheers

ScottMcNab

ParticipantThanks again Nick….much appreciated. I manually renumbered them last night based on what I understood from your previous post and it all worked fine. I am stuck with the multiple different accounts for different entities/people etc but it doesn’t take long to manually renumber them

ScottMcNab

ParticipantThanks Nick. I will need to think more about this more…I am not sure how RT would know how to make the order ID different for each of the six different systems unless I combine them into one large file….but then I would need to separate the resulting order csv again before I load them into the different accts in TWS…hmmm

ScottMcNab

ParticipantIs this the order ID Nick ?

ScottMcNab

Participantanother appeal for help

i tried using basket trader for all 6 accts last night for the first time as had been successful trial for last week or so on single acct…this morning was a mess of warning errors about cancelled orders as cross with resting order

the stock in question was not placed as a buy order in any of the systems but it was trying to be sold (at market on open) in 3 different accounts

I (incorrectly ?) thought that as they were separate accounts I could avoid this issue…have I simply done something wrong when I set up csv file …or perhaps I launched basket trader incorrectly somehow (each of the 6 instances running had the correct account number)…or do I need to place the sell orders manually

Many thanks in advance for any helpScottMcNab

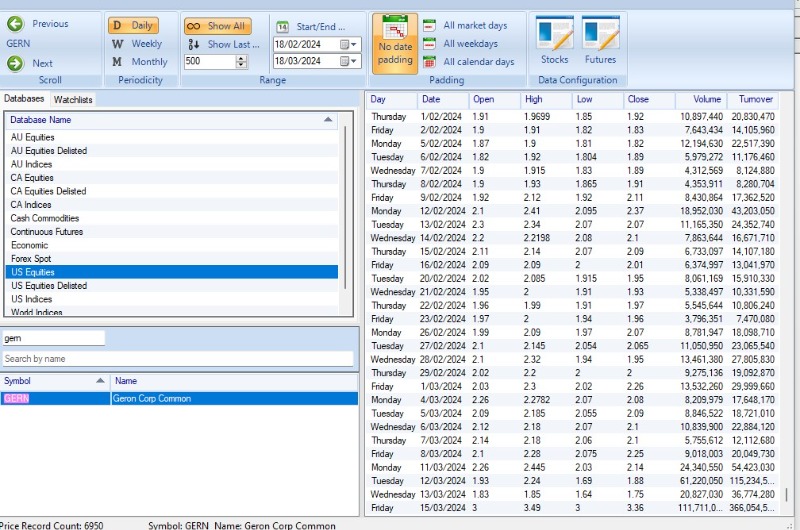

ParticipantCan I ask please if anyone else has data for Gern missing for Thurs 14/3. ..just spent 20 min thinking was an error in system code as stock appearing in backtest that was not present in list of orders from previous night…but error seems to be originating from missing data

update…seems was trading halt…i never looked at how there are dealt with in Norgate before

ScottMcNab

ParticipantDamn… I cant even get the names right….hopeless

BasketTrader

Thanks for info Nick …will use US Eastern in order sheetScottMcNab

ParticipantJust watched the batchtrader video and playing around with generating orders template in RT…

can I ask please…

the time for GAT…guessing is the time zone the particular version TWS running on ? Or is it being loaded and held on IB server and so I therefore need to use New York time ?

for stocks I need to sell at mkt on open….does batchtrader interpret “sell” as opening a short position like TWS does…or does batchtrader interpret “sell” as close long positions ?Many thanks in advance for any help

ScottMcNab

ParticipantI finally worked out how to compare live trade results from IB flex export with the back test “expected” results (apologies to Julian for emails asking for help…please delete before reading

). I have always just kept a diary each day (for last 6-7years) of trades from TWS to ensure was matching back test but have never had a systematic way of assessing slippage (just sporadic assessments). One month is not a huge sample size but I guess it’s no surprise that I saw more slippage (against me) in Feb in systems trading “all USA” stocks than in RUI and RUA….will be interesting to watch.

). I have always just kept a diary each day (for last 6-7years) of trades from TWS to ensure was matching back test but have never had a systematic way of assessing slippage (just sporadic assessments). One month is not a huge sample size but I guess it’s no surprise that I saw more slippage (against me) in Feb in systems trading “all USA” stocks than in RUI and RUA….will be interesting to watch.ScottMcNab

ParticipantI came across the following quote in a book was re-reading yesterday and thought it summed up nicely how I have found the last seven years or so :

“Every trade is haunted by the obsession of the possible failure of the system he (she) is trading. This is the psychological burden systematic traders need to withstand in order to achieve suceess.”

ScottMcNab

ParticipantAll the accounts are AUD based so I think the difference is between it being a regT v cash acct. I have not had any luck finding more specifics in the IB website yet. I will keep looking

ScottMcNab

ParticipantThanks Nick. I will do that. I am still a bit confused as to why the USD balance shows up as a positive value in the cash accts but with a minus sign in front of it in the RegT accts….what tomfoolery did I engage in those years ago to produce negative USD balance…i suspect being a regT acct I triggered a margin loan

-

AuthorPosts