Forum Replies Created

-

AuthorPosts

-

ScottMcNab

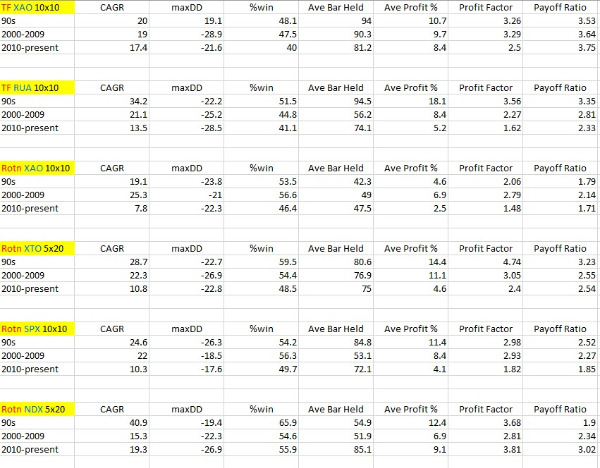

ParticipantCouple of the posts recently regarding performance of longer term systems so thought I would test again

only 2 systems here..first is a longer term TF system and other is rotational system…these 2 systems are then applied to different markets

ScottMcNab

ParticipantNice..thanks for the info Mike..best of luck with your new addiction

ScottMcNab

ParticipantTrent Rothall wrote:Has anyone traded using or studied Wyckoff principles either discretionary or systematically? If so does anyone have any code?Or VPA analysis?

Not sure if this of interest Trent?

https://www.elitetrader.com/et/threads/wyckoffian-intra-day-traders-asia-rth.344023/

ScottMcNab

ParticipantMeant to be working from home Mike but bored so … initial thoughts

1. I would trade this…nice !

2. exposure (10%) on low side…is it possible to get more bang for your buck?

a. is there a filter (index or indiv stock) that may be able to be relaxed ?

b. is the stretch too much such that the fill rate is only 11%

3. results in March 2020 gives confidence…was this due to system being off due to index/stock filter or did it continue to trade thru the month

4. nice low maxDD

5. what leverage are u using Mike?

6. see 1.ScottMcNab

ParticipantAlways found Julians’ to work well

100-ROC(C,3)

Could also divide by the C to favor cheaper stocks but nice if second system using totally different rank, even if slight hit on backtest performanceApril 28, 2020 at 2:20 am in reply to: Incorporating an Index Volatility Based Trailing Stop with the WTT #111336ScottMcNab

ParticipantYes…buy and hold on a few top stocks on SPX was hard to beat last year

another reason 👿April 27, 2020 at 11:43 pm in reply to: Incorporating an Index Volatility Based Trailing Stop with the WTT #111344ScottMcNab

ParticipantGlen Peake wrote:Haha….

Funny you should mention that…..I kid you not, I had a corruption in my Norgate Database not so long ago and had to create a new database…… Symptom was, it was taking 15 minutes to run an EXPLORE…..

Pad and Align was ticked :whistle: :whistle:

Going to be trouble when I find out which one of the kids is responsibleApril 27, 2020 at 8:13 am in reply to: Incorporating an Index Volatility Based Trailing Stop with the WTT #111341ScottMcNab

ParticipantThese are the Filters for the R3000. For the ASX WTT the only difference is the MIN Price, which I have set to 0.50 (fifty cents)…. no dividends included…

[/quote]

Damn [strike]you[/strike] it…must be something corrupt in my database..gotta be

April 27, 2020 at 7:31 am in reply to: Incorporating an Index Volatility Based Trailing Stop with the WTT #111338

April 27, 2020 at 7:31 am in reply to: Incorporating an Index Volatility Based Trailing Stop with the WTT #111338ScottMcNab

ParticipantGreat results

You know what I am going to say…give it a run on something else…SPX ? If filter has same sort of benefit it gives some comfort that not just curve fitted to ASX history (notwithstanding correlation between the two)PS tell me you’re not using turnover filters or using very loose ones ? Or do these results include dividends? Give me something to hold on to as I look for excuses as to why I am not getting these kinds of results…

April 23, 2020 at 7:30 am in reply to: Integration of $VIX into MOC system à la Index Filter #111328ScottMcNab

ParticipantNot tested it but another option may be something like

VixFail = PercentRank(C,250)>95;

VixFail could then be used as an index filter or as a means of reducing position size

PS = IIF(VixFail,5,10);

SetPositionSize(ref(PS,-1),spsPercentOfEquity);ScottMcNab

ParticipantMaybe try some of the drop down options here (tools/preferences) and see if it helps…may be a case of white label on a white background?

ScottMcNab

ParticipantThey have the data for Canada…paid for it all a while back..but were having trouble finding time to check it last I asked them…so Canada is my bet too…UK would be great though

ScottMcNab

ParticipantSmell that? You smell that? Norgate son. Nothing else in the world smells like that. I love the smell of Norgate in the morning.

Edit: anyone recognise this quote?…I’m not that strange…really!

ScottMcNab

ParticipantI remember hearing in a podcast (either with Faber or O’Shaughnessy I think) interview in 2018 or 2019…mentioned Australian property bubble in relation to Australian Banks….the gist of it was the person (I cant remember who sorry) felt that the Australian banks were exposed to an Australian housing bubble but were ultimately unlikely to face serious financial trouble…. except in the unlikely event of a significant increase in unemployment. They were part of a global macro fund I think and were looking at 3 main short positions around the world …and they had, or were, considering shorting Aussie banks as one of these three plays. Their analysis was naturally based on the assumption that a spike in unemployment would be followed by a rise in people unable to make their repayments. How could they factor in the changes the Australian Government and the banks were prepared to make in relation to deferring repayments? So I am also watching with interest…government and banks are moving rapidly to try and head off any related disaster and landscape changing almost weekly… will these changes last as long as the unemployment spike though? My guess is the strain on the housing market will become apparent as the peak of the crisis passes and these regulations are slowly wound back (ie when banks think they are out of danger).

ScottMcNab

ParticipantJust found it…merger…hmm

-

AuthorPosts