Forum Replies Created

-

AuthorPosts

-

ScottMcNab

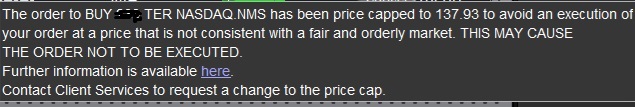

ParticipantI received the following warning when loading orders tonight and was hoping others might share their action when seeing such a message from IB.

For context, TER closed last night at approx 143 with an earnings release after 5pm…..my buylimit order was placed at about 140 but I can see some after hours trading has the last trade currently at about 133 so it seems some people are unhappy with the news.

Any recommendations on whether:

a. cancel trade

b. move buylimit to price cap of 137.93All responsibility on me, of course, for the choice but wondering if others more knowledge than I (ie everyone in forum) have a plan for these situations?

ScottMcNab

ParticipantI didn’t pay enough attention to tax at this stage of the course (not to say you’re not of course) when considering system design. Where I live taxes on short term systems can be very high…meaning I need a cagr of over 20% to beat what a long term / low turnover etf or stock system in a low tax retirement structure can achieve with relatively low volatility. May be relevant…or not

ScottMcNab

ParticipantJune 2024

MRV1 2.5%

MRV2 0.8%

MRV3 0.4%

MRV4 8.8%

MRV5 2.1%

MRV6 0.8%ScottMcNab

ParticipantMay 2024

ScottMcNab

ParticipantI now do this too JC… another trick (you may be also doing this) that is helpful and caught a mistake I made last month is the “precautionary settings” that can configured in TWS.. is under presets/stocks

ScottMcNab

ParticipantYeah… I got no idea what going to happen with these sorts of events….my systems lost money but because I’m not hedged at the moment and AUD dropped I made money…every day just open the door and see if its cash or a slap to the face

I watched a few minutes of an interview on you tube of an apparent guru….only thing I remember was the quote:

“If I call heads and the next coin flip comes up heads, I haven’t predicted the future”Has he or hasn’t he ? By making you think if you agree with this statement he cuts to your underlying belief about life, so called destiny, probability and its application to trading… all in a simple example…love it. In my case I can’t predict what’s going to happen and so just run the large numbers so the expectancy can eventually play out (not this month so far) ( or last month…hmmm )

ScottMcNab

ParticipantThat faint voice is whispering….”Nvidia earnings…..you gonna get smashed….smart play is to reduce position size”……

ScottMcNab

Participant

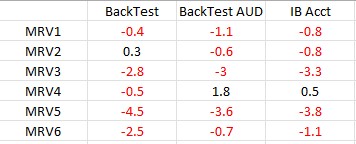

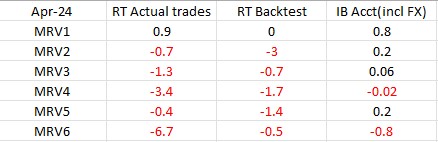

Main discrepancy in system 6 which is on USA ex RUI…on night when no orders went thru (most likely my fault) I missed out on a few big winners…one stock alone made 12% in back test but obviously wasn’t in my account

ScottMcNab

ParticipantI am starting to think that after running all the orders and generating csv files and placing them in the “import” folder that I simply didn’t load backet trader up…its a worry…..but by tomorrow it probably wont be bothering me any more if the trend continues

ScottMcNab

ParticipantNo other posts here about IB orders so must have been me. After several weeks where basket trader has been running perfectly, no orders (buy or sell) were executed for any account last night…when I checked this morning the basket trader templates were all completely empty…no clue what happened…wonder what I did

ScottMcNab

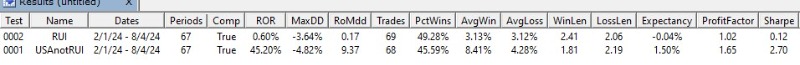

Participantfor sure…I didn’t explain it well…these are 2 of the 6 systems I run in the portfolio…RUI is the system1 in the EOM report and the other (USAexRUI) is system6…over the last 10 years RUI does a bit under 20%cagr and USAexRUI does mid to high 20’s (depending on limitextra etc settings in backtests) so not all that different on average….what piqued my interest was how vastly different they have been for 2024…be interesting to check again in Dec

ScottMcNab

ParticipantI like the boost in cagr too but I was thinking more along the lines of surprising how much diversification can sometimes achieve with same system that is restricted to different subsets of market…another possible benefit is psychological ..if it was still just running on RUI I would possibly be in some sort of FOMO crisis thinking about modifying the system because it must somehow be out of sync or broken

ScottMcNab

ParticipantJust happened to glance at results page of RT when placing orders and noticed quite a large difference between systems 1 and 6 for 2024….both same system (the first one I came up with in 2016/2017) but the first is on RUI and the other is on USA excluding RUI

ScottMcNab

ParticipantHi Heiko,

I use a similar process to Julian except I do not use OC. This means my initial step is using a flex query (log in to IB portal and it is found under the reporting tab…then u need to configure flex export which is a bit of trial and error)….

Next, u need a rtd file that looks at the csv file exported/created by the flex query…this rtd uses those trades contained in the csv only (ie actual trades)

Next, run your rtd file that you have been trading live (for the period looking at…eg the last moth) to get the trades the back test thinks you have executed

Next, right click on the results of the latest back test and select “compare trade lists from the drop down menu

Finally, select the results for the flex query rtd (tradelist1) and the live trades rtd (tradelist2)

I then filter by date of entry to get them to line up in a logical orderScottMcNab

ParticipantStrange how the few weeks I stopped trading when Russia/Ukraine war broke out suddenly became 2 years on the sidelines…

One last thing to finalise is futures hedging….still testing/pontificating/procrastinating/clarifying/systematising topic ….then will get back to trading total account size -

AuthorPosts