Forum Replies Created

-

AuthorPosts

-

ScottMcNab

ParticipantIn the output of trades taken in the backtest, select the stock (VEEV in this case), right click and select “Show arrows for raw signals”

Gotta be honest mate…the system seems a bit of a dog

ScottMcNab

ParticipantCongrats on the milestone Seth

ScottMcNab

ParticipantAbsolutely..it was both which was intriguing and confusing..I couldn’t binge watch it as would get a bit overwhelming at times

The Detectorists is hit or miss…I liked it…twin brother did not…ScottMcNab

Participantthe MRV RUA was rejected for Jobkeeper on grounds it was just a lazy sod

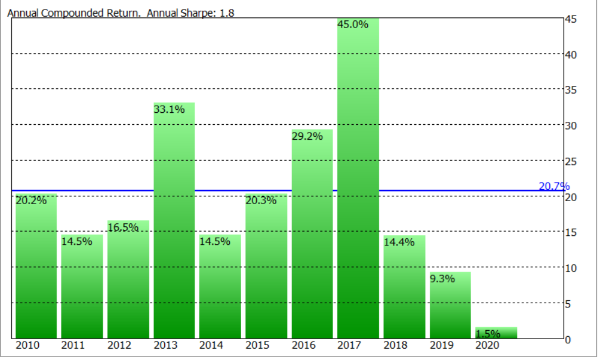

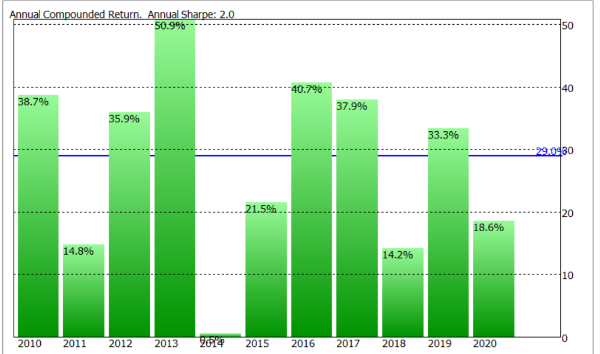

Here are the current stats from 2020 (10 positions at 10%)

This system has a filter so only trades when price above a MA…so I combined it with another system in development but only used it when below the MA…so original system only above MA..new system only when below MA (10 positions at 10%)

ScottMcNab

ParticipantMichael Slater wrote:unfortunately, too much on Netflix. I binged on things like Narcos and Lillyhammer late at night. Some stuff we have in the UK may not be in Aus, but 20 minutes of (what I find funny) Friday Night Dinners, Still Game and After Life (Reicky Gervais with pathos)If like quirky British humour then check out The Detectorists…written and directed (and starring) by Mackenzie Crook….not as dark as After Life

ABC iview I think?ScottMcNab

ParticipantNick Radge wrote:Not quite what you’re after Scott, but I recently bought this…https://alvarezquanttrading.com/multiple-strategies-backtest-and-optimization-tool/

I have always thought it would be a tool that the company that makes STT could produce with a little modification. At the end of the backtest would (ideally) just copy/paste the list of trades from Amibroker into an excel spreadsheet…repeat for all systems want to test..click upload button….then have a function to select which systems want to combine, how much equity to give to each, if want to rebalance/frequency of rebalance…STT already has the metrics and graphs etc.

ScottMcNab

ParticipantWill do Ben…no idea what it is but will do some digging

CheersScottMcNab

ParticipantThanks Nick..I have been looking at that tool too. Are you happy with it ?

In the end, the results from combining multiple systems into one the way I was trying has not produced the synergy I was hoping for..instead of 1+1+1 the combo is giving something closer to 1.5. Most likely majority of entry signals common to the three systems

the combo is giving something closer to 1.5. Most likely majority of entry signals common to the three systemsScottMcNab

ParticipantWill give it a go..thanks Said

ScottMcNab

ParticipantGlen Peake wrote:For me, when I’ve looked at combining/testing multiple systems into one, my BUYSETUP/Cond code has looked something along these lines:System1 = cond1 and cond2 and cond3;….etc etc

System2 = cond4 and cond5 and cond6;….etc etc

System3 = cond7 and cond8 and cond9;….etc etcBuysetup = System1 or System2 or System3; …..etc etc

Then everything gets passed through on the same RANK calculation…

Were you also thinking/wanting to RANK each system with a different rank

I was trying to work out what happens when have multiple stocks satisfying different systems and one system (eg A) is superior…so would prefer to trade stocks in system A even if rank would otherwise be lower than some stocks in system B…I prob have it all arse about again

ScottMcNab

ParticipantNick Radge wrote:Quote:I don’t think I have ever seen a single 40,000 unit order executed all in one lumpThe reason is because there isn’t a single exchange as such – unlike Australia. In Australia there is a single exchange where there is only one place that all volume sits.

That’s not the case in the US. The US has ‘one exchange’ but uses ‘venues’ operated by market makers. This is what the IB Smart Routing does – sends your orders to the best venue at any given point in time. These venues need to follow the SEC NBBO rules, but it means larger orders get broken up to get filled at the most efficient venue at that time. As market makers may not be providing the wanted size, it means the orders have to move around several venues.

Have you guys used Scale Orders yet?

Have you tried these Scale Orders Nick ? Or anyone else ? They look very interesting…

perhaps in conjunction with a modified excel spreadsheet that export dde into (before it goes into api) that would chop any order over (eg) 2000 shares into thirds…and add a tick to one entry price and subtract a tick from another ?

I am thinking for use with ASX and Canada more than US

ScottMcNab

ParticipantOldie but a goodie…Breaking Bad..early seasons may be on Netfilx..or Stan (prob watch during free trial if commit to it)

ScottMcNab

ParticipantApril 2020

XTO Rotn: switched off by Index filter

MRV RUA: -0.3% (only 3 trades only for the month…applied for Jobkeeper allowance)

MRV RUI: 6.4%ScottMcNab

ParticipantHa…Those were the mind blowing stats that sent me of on a 2 week rotation binge..I couldn’t get anywhere close to them

This in turn made me refocus on original goal ..if I get to 70 and have achieved 15% CAGR and not greater than 25% DD for portfolio I will be thrilled (firstly to still be alive but also with) the results. I sometimes take for granted what we have been able to create in this course!

The 2 week dive resulted in a new rotation system which has a lot fewer moving parts…it also exits any day the index filter turns nasty but will not restart until next month (if index filter allows)…this hurts back-test metrics but is just what I need to do psychologically to be able to trade it going forward

I am a bit confused re the universe question…XAO is All Ords and XTO is ASX 100..was that the universe question sorry or was it more to do with filters used?ScottMcNab

Participantso…the air conditioned lawn mowers purchased for the grounds keepers in the 90’s were sold off and now Jim’s mowing comes twice a year

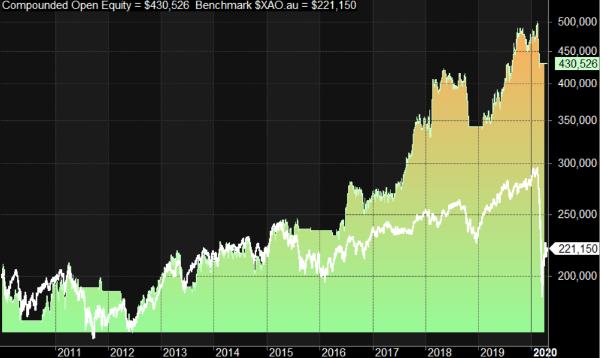

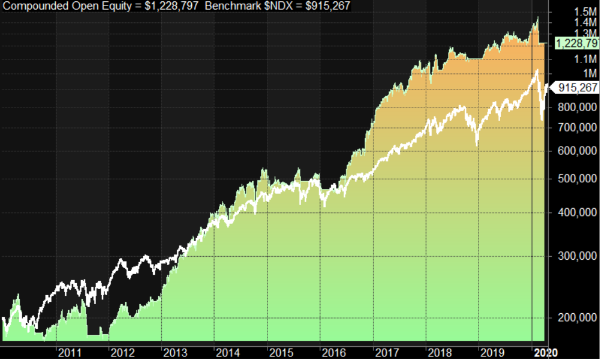

It never is a simple as it seems though…rotn system on XAO looks like (was) a dog for last decade and NDX smashed it (even though exactly the same system)…but when compare to underlying index the XAO rotn system outpaced the returns compared to index while NDX kept pace. (edit…XAO done bit over 10% while Rotn on XAO returned over 100% when I look more closely)

I find these longer term systems harder to trade than shorter term systems…not unusual to be in drawdown for 2years. They can underperform a market for years too…but taken over any decade they have always kept pace or outperformed (so far)

In the end, I think we just have to accept what the market gives us and to diversify across systems and markets…unless we can predict which market will outperform in the next decade what other logical choice do we have?…the next decade may resemble any of the previous ones or be completely different again…may look like Tokyo in 90s or NDX in 90s or SPX in 70s :S

-

AuthorPosts