Forum Replies Created

-

AuthorPosts

-

ScottMcNab

ParticipantThis is the post from AB forum that had me thinking that “Dont Change” meant that a massive trade at the end of a 5 year backtest could be reshuffled to the start of a MC run and distort the results

ScottMcNab

ParticipantHi Matthew…are you able to explain a bit more about “don’t change” positions sizing selection. I have read the Ab help tutorial but am still unsure. The original backtest would be decreasing position size with a string of losing trades (anti-martingale) and increasing it after a string of winning trades…if the position size is not changed in the MC when the order of the trades are randomly altered I don’t see how it can be an accurate estimation of system performance…but typically I am missing something obvious. Any help greatly appreciated

ScottMcNab

ParticipantThat is generous of you Omar. I really should look back into that. I have a funded Tradestation futures account sitting idle. I keep getting drawn back into my Amibroker stock systems. I was experimenting with TS with an intra-day breakout system on index to the downside but have not touched it for many months. I find coding so inherently difficult that the thought of learning a new language leads me to other more urgent tasks…like sanding and repainting the window frames.

To get the maximum value from your mentor course it may be best to focus solely on it for the next six months. I would be grateful for your recommendations regarding Easylanguage after that time but it would be wrong of me to distract you for now.

CheersScottMcNab

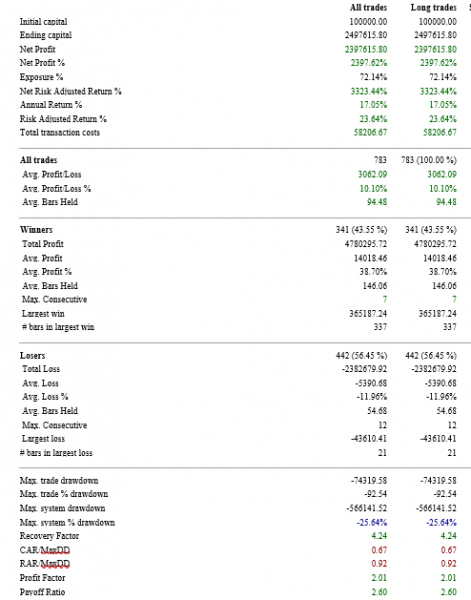

ParticipantRUA 20×5

ScottMcNab

ParticipantRUA 10×10

ScottMcNab

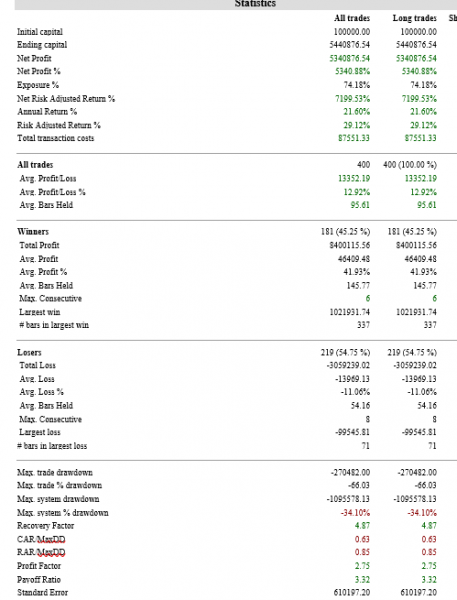

ParticipantXAO 20×5

ScottMcNab

Participantusing those filters…

XAO 10×10

ScottMcNab

ParticipantI will try it Glen…did you remove all price/turnover filters or keep a minimum? If there is a minimum, can you please post and I will use those settings to then test on XAO. I added an exit and found a coding error ( had LTS = IIf(ref(IndexPass,-1),high*0.75,High*0.9); )… together the addition of the exit and reduced lag from LTS change has reduced DD…. I also tested your approached of just buying on open and the system is now using that entry

Cheers

edit: not had 2nd coffee…sells on open and buys on closeScottMcNab

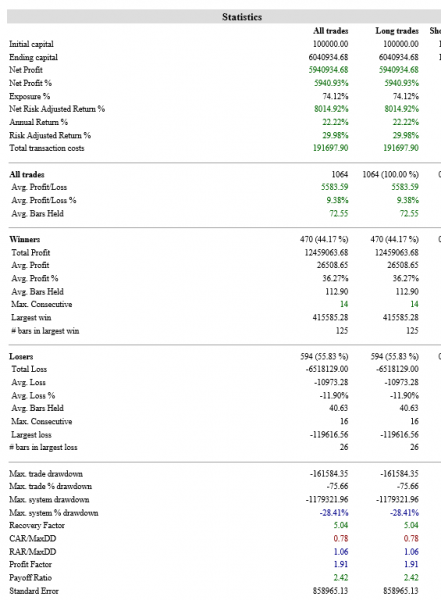

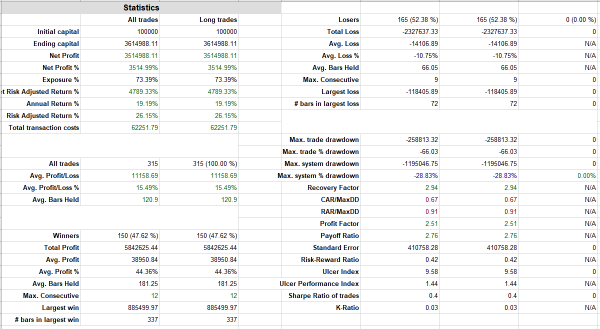

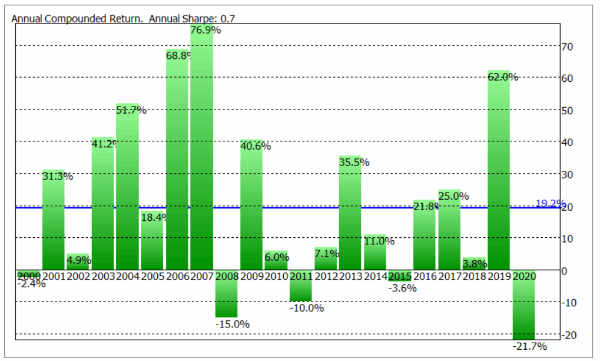

Participantsystem uses 10 positions at 10%

results pretty lumpy…at moment just using trailing stops so need to give some thought to seeing if DD can be reduced with an additional exitScottMcNab

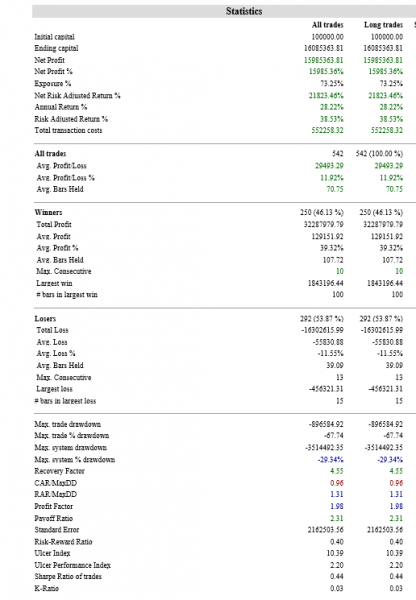

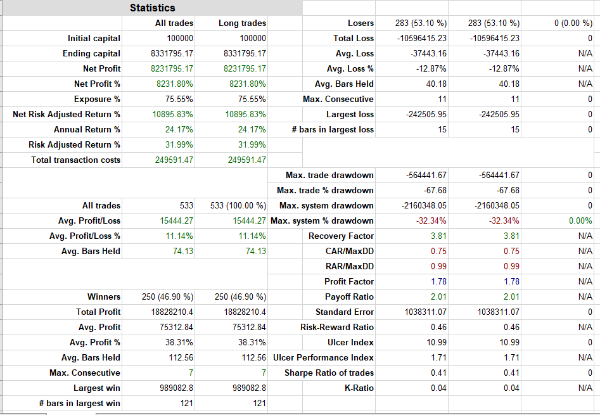

Participantsame system on RUA…apologies re images

ScottMcNab

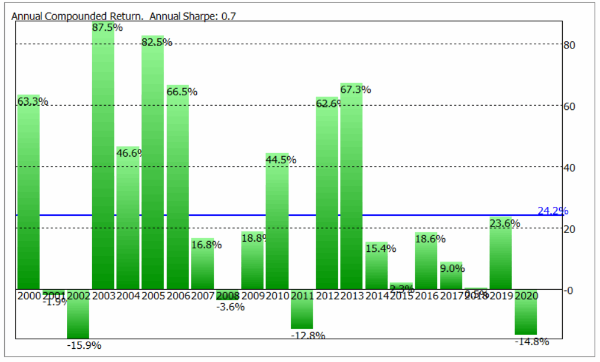

Participantworking on WTT after seeing impressive results posted recently

ScottMcNab

ParticipantYep..I’m using older version tho..seems a definite change in last few weeks..my brother just bought latest version of Amibroker last week…seemed even slower than my backtest when I was watching it over Teamviewer last night (not sure what impact Teamviewer would have on processor speed?)

ScottMcNab

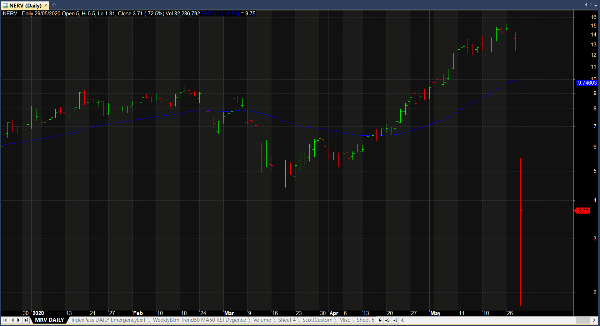

ParticipantTesting a new system….was running DDE afl and produced a negative buy limit price which had not seen before..assumed coding error at first….yikes

ScottMcNab

ParticipantKilling it….fantastic..:cheer:

ScottMcNab

ParticipantMay not be possible but fingers crossed can remain as an “independent” entity..in an industry where many of us have had adverse experiences I suspect most of us are here because of the trust in the Radge name/brand developed over years of walking the walk. All the best

-

AuthorPosts