Forum Replies Created

-

AuthorPosts

-

ScottMcNab

ParticipantHi Terry,

I traded exactly as you are thinking about for a while…6 months perhaps…it was my first system in the mentor course….traded same MOC system on RUI and ASX so was working capital around the clock..the issue, as others have stated, came when I tried to increase my allocation.

I don’t think that you would impact/move the closing price in the closing auction too much as the liquidity in the closing auction is significant…the liquidity issue happened during the day at the level that I had the buy limit set to trigger for that stock….so while both the open and close will have plenty of liquidity, the volume traded at each of the price levels throughout the day were the rate limiting step (partial fills became increasingly common as size increased). I did experiment by modifying the system to trade on the open and close only as a way to get around this…think I tried LOO (limit on open order)…but cant remember now if this was available on asx, US or both. I then tried Hong Kong Stock Exchange…and then Japan…….so many rabbit holes

Hope something in there helpsScottMcNab

ParticipantI used to trade ASX MOC too (few years ago)… This is all a bit hazy but I’m pretty sure I got the API developer (Levente ?) we were using back at that time to code me up an API for me for the ASX ..I think its all included in the modern api but not used that function for a while…u need a live data feed with IB (can be expensive depending on how IB classified you)…at the closing auction (after 4pm) the API then places limit orders to sell at a predefined amount below the last traded price prior to the 4pm closing auction…so set time to place limit order (eg 16:02:30) and price modifier….at 4.10 pm the closing auction occurs and everyone gets the closing price (as long as determined price by exchange by matching the buy limit and sell limit orders in the closing auction is above the sell limit you set)

I don’t bother with ASX either any more…just wasn’t worth the effort for me.

…MOC orders are not supported on ASX.. Now TSX does support MOC… if we could just persuade Norgate to fire up on that front…anyone would think there was some significant world event happening that may impact the launch of a new product

ScottMcNab

ParticipantMichael Slater wrote:And not getting close to what Glen has shown with the ASX version of his rotation.I think few of us have been able to replicate Glen’s performance regarding rotational systems..all credit to him. This forum is an invaluable source of knowledge but if it has a hidden “hook” it stems from that human temptation to look over the fence and seeing what bbq the neighbour has …and then deciding need to upgrade

Twelve months ago, if anyone had offered you 20%CAGR on US and 15% cagr on AUS for the next decade would you take it? I would. I think your systems look good too. From here it is easy to venture into the minefield that is curve fitting as you try and improve the stats. The other thing to bear in mind is the low number of trades in monthly rotation systems (compared with MOC or MRV) and so periods of under performance may just represent a crappy few years for the ASX rather than any failure of the system.

If I had any concerns it is that the NDX is used as the basis of further comparisons…it obviously contains reasonably “special” companies that have had an amazing couple of decades …..the rock star of momentum trading. In a way, its not at all surprising that the same system is not quite as good when used on other markets…especially when comparing asx results to a system that only picks the top 5 from NDX…setting yourself an almost impossible benchmark perhaps ?

ScottMcNab

Participant31/-6 very impressive Len…interesting idea to combine in the one system

ScottMcNab

ParticipantJune 2020

XTO Rotn: still turned off

XAO Rotn Bailout: 3.7%MRV RUA: -0.3%

MRV RUI: -1.3%ScottMcNab

ParticipantNot sure why in the CBT code Seth..above my pay grade…would have not know was causing error with ADX calc if someone else with differnt version of Ami was not trading the same system…every few weeks was a single discrepancy between trades in exploration…sbrAll works fine with that (latest) version of Ami

ScottMcNab

ParticipantStatute of limitations ?

ScottMcNab

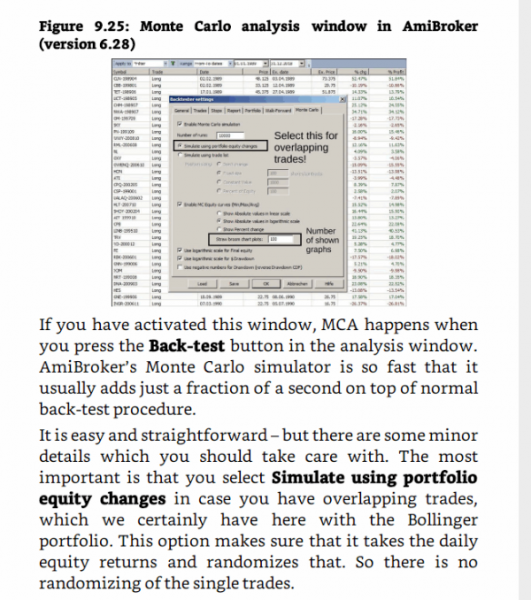

ParticipantWas reading “Trading Systems. A new approach to system development and portfolio optomisation”…. the quote below was instruction on how to use Ab MC for a standard breakout bollinger band breakout stock system on SPX (20 positions at 5%)..so MOC may still be different but at least clears it up for MRV and TF systems

ScottMcNab

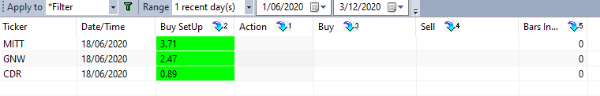

ParticipantADX calculated correctly and CDR now appears in exploration if I remove the line

//SetBarsRequired(sbrAll,0);

getting somewhere…just not sure whereedit:

SetBarsRequired(1000,0); also works fine

ScottMcNab

ParticipantMade a simple afl file to test

var1 = ADX(7);

“”;

“ADX7: “+NumToStr(ADX(7),1.3);

“”;

Plot(var1, “ADX7”, ParamColor( “Color”, colorRed ), ParamStyle(“Style”) );adx plots fine and interpretn windows work so it must be some conflict in my backtesting and exploration code

ScottMcNab

Participantadx graph for the stock CDR all good so don’t think database issue

ScottMcNab

ParticipantThanks Matthew. I cannot say it is clear to me at this time but I am very grateful for the time you have taken explaining it. I will give it some more thought.

ScottMcNab

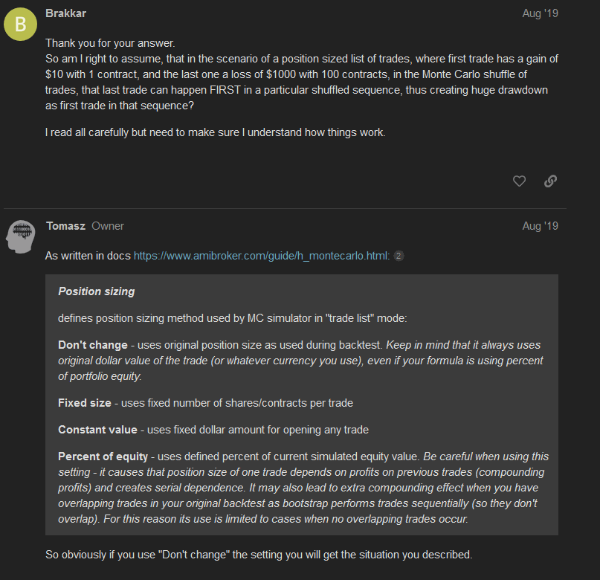

ParticipantThis is the post from AB forum that had me thinking that “Dont Change” meant that a massive trade at the end of a 5 year backtest could be reshuffled to the start of a MC run and distort the results

ScottMcNab

ParticipantHi Matthew…are you able to explain a bit more about “don’t change” positions sizing selection. I have read the Ab help tutorial but am still unsure. The original backtest would be decreasing position size with a string of losing trades (anti-martingale) and increasing it after a string of winning trades…if the position size is not changed in the MC when the order of the trades are randomly altered I don’t see how it can be an accurate estimation of system performance…but typically I am missing something obvious. Any help greatly appreciated

ScottMcNab

ParticipantThat is generous of you Omar. I really should look back into that. I have a funded Tradestation futures account sitting idle. I keep getting drawn back into my Amibroker stock systems. I was experimenting with TS with an intra-day breakout system on index to the downside but have not touched it for many months. I find coding so inherently difficult that the thought of learning a new language leads me to other more urgent tasks…like sanding and repainting the window frames.

To get the maximum value from your mentor course it may be best to focus solely on it for the next six months. I would be grateful for your recommendations regarding Easylanguage after that time but it would be wrong of me to distract you for now.

Cheers -

AuthorPosts