Forum Replies Created

-

AuthorPosts

-

SaidBitar

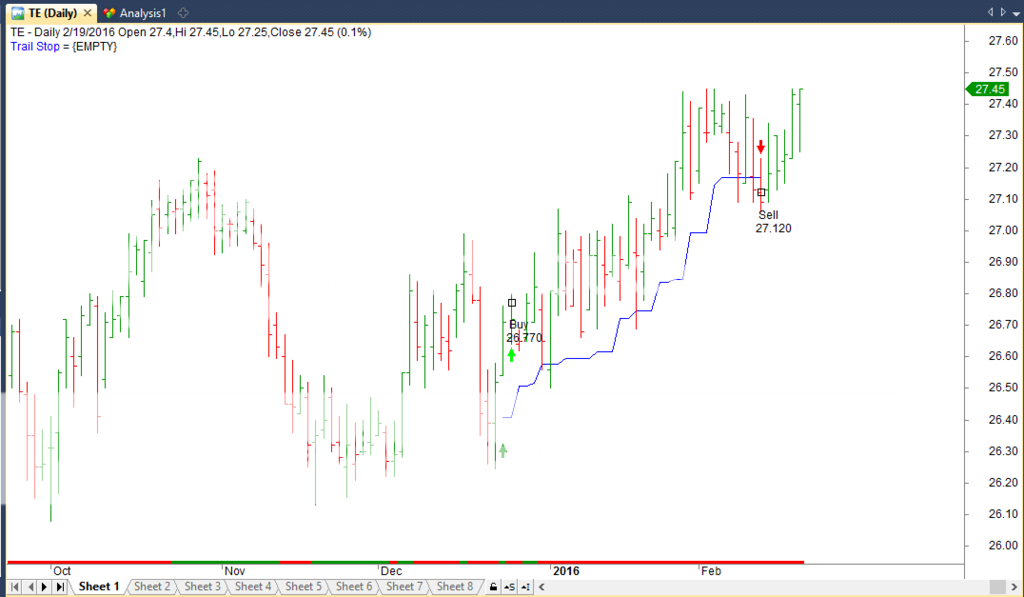

MemberHere how a trade looks like

SaidBitar

Member

SaidBitar

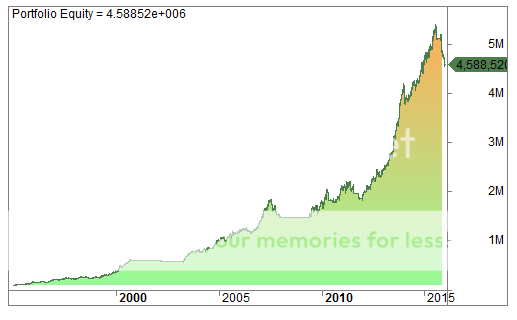

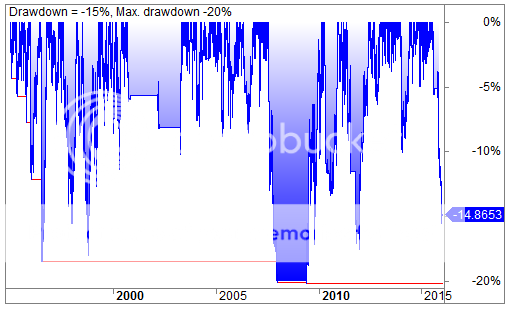

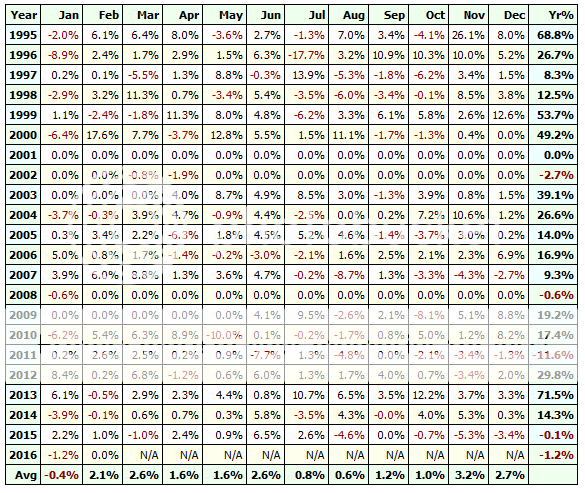

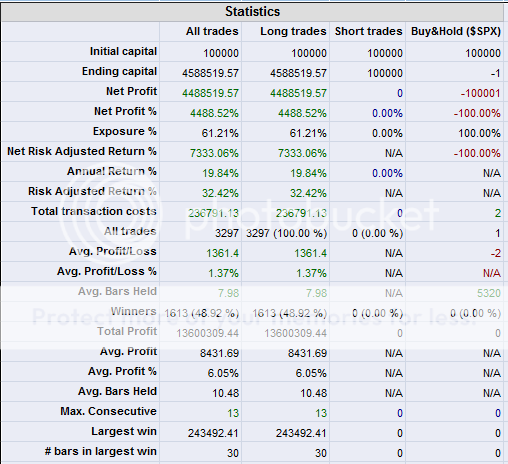

Memberhere are the results of single run

Universe Russell 3000

Price filter from 10 – 100$

1/1/1995 – 2/17/2016

SaidBitar

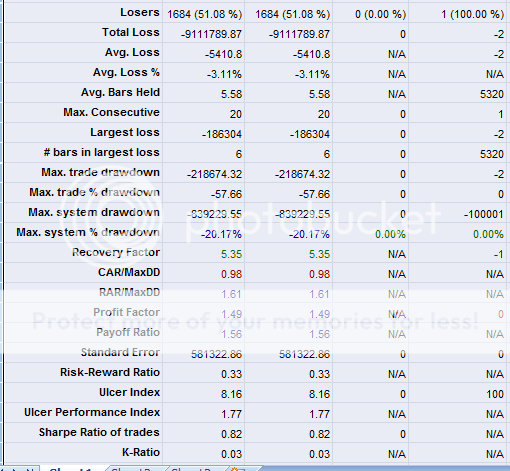

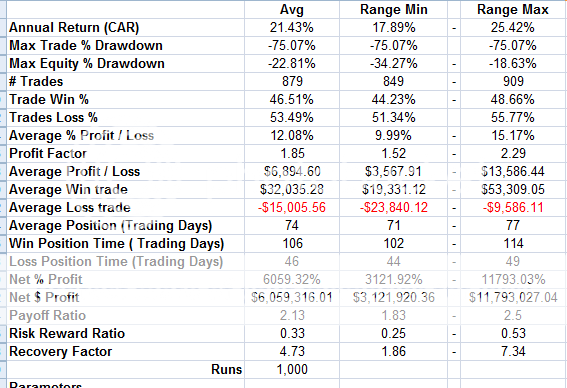

MemberSo i Ran 1000 MCs on the modified position sizing to compare it with the original and here are the results

5% position sizing

Modified Position sizing

SaidBitar

MemberSunday 21/2

Playing around with position sizing for WTT so i changed the position size from 5% to the same position sizing used in the momentum strategy

results are good from CAR point of view it is a bit better while the average MDD dropped down.Running 1000 MCs to compare the results with the results of the 5%

SaidBitar

MemberIndex Filter Modification II

Buy signal will be generated when the Index makes new 3 bars high trailing stop will be tighten if the Index is making new 7 Bars low

results are OK but is it better than the simple MA filter??

not much better so again i will be sticking to the MA filter

SaidBitar

Member,Saturday 20/2

Testing Index Filter based on ROC(30) and ROC(252)

So ROC(30) > ROC(252) Index Filter Green else Red

so the index filter became as in the snapshot long durations of OFF and ON

this means less trades which is not good since the edge depends on the number of trades, the more trades the more profit, less trades less profit , CAR,..

so my opinion i am not ready to sacrifice frequency of trades for better index filter

SaidBitar

MemberYes

SaidBitar

Memberthat is something to think about and test

SaidBitar

Member1- Try using 0.1 instead of 0.2 and 0.15

2- Try using OI instead of C in the position sizingCode:SetPositionSize( OI * PortfRisk /ATR(20), spsPercentOfEquity);The reason i am using OI not C is that if I was taking the trade at that date i will be using the C that is OI now. this will give exactly same percentage allocation to the trade the difference will be in the cost of the trade will be different since the entry is based on the open but still profits and losses will be exactly same as they would have been.

SaidBitar

MemberWED 17/2

Some philosophical moments regarding whipsaws how they can eat the equity curve and pull draw downs deep. Especially like the situation on last period of 2015 where the index filter was switching On and OFF all the time causing entries and then later exits with small losses. The thing with small losses is that they add up

End of the day nothing to do they are part of trading either accept them or forget about trading.

To avoid whipsaw losses, stop trading. -Ed Seykota

[video]https://www.youtube.com/watch?v=LiE1VgWdcQM[/video]Start thinking about Trend following system based on Volume. My opinion is that position sizing and trailstop are the ones that will help to lock profits and manage the trade, and in the worse case to insure that if a loss is taken it is small. Regardless on the reason we enter the trade (new X days high, new 52 weeks high, all time high, breakout of a channel) most of them are talking same language Strength. So i want to think how to find strength in volume and to use it as entry point.

Still the idea is not clear to me but may be in the coming period it will be.SaidBitar

MemberOGordon wrote:I am currently testing using Fixed % of equity position sizing with 10 max positions, and starting equity at $100K. No commissions.Just wanted to add one comment based on some tests that i made. In the beginning i was using similar position sizing 10/10% and 20/5% then i used the position size that is based on volatility and risk the same that is described in “Stocks on the Move”. I found out that it is much better at least for this type of systems to use such position sizing. Again this is my observation you can test and compare the results.

here are the comparison from my side:

[ul]

[li]lower draw downs[/li]

[li]higher CAR[/li]

[li]less number of trades[/li]

[li]smoother equity curve[/li]

[/ul]It would be interesting to test the same position sizing on other Trend following systems

SaidBitar

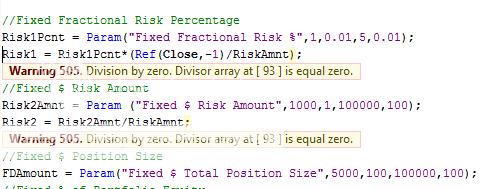

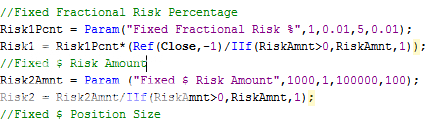

MemberHere is another workaround in case anyone will need it

when the warning is coming on [x] where is x is greater than 1

so what i am doing here is just saying incase RiskAmnt is zero then replace it by one

SaidBitar

MemberNice work around.

i have seen this warning recently mainly after the software upgrade. i was changing the initial value of j from 1 to 2 to clear it.

SaidBitar

MemberOGordon wrote:I changed AllowPositionShrinking to True, and following the first month, 3 sells occur, and now 3 new buys occur. It must fill the top criteria stocks first at full size and then the last as a partial fill as the size of the 3 new buys are $11,195, $11,192 and then $7,755.I guess in real time, I would be more likely to split the proceeds of the 3 sells into 3 equal portions for the new buys. Not sure if that can be coded?

the first two positions should be equal size more or less and this is totally controlled by the position sizing criteria, but the last one is smaller because the remaining cash is less.

this is why you have 11,192 and 11,195 and the remaining cash is around 7755 so you bought shares with this amount.

you can not split the money into three equal parts by code and even in reality I believe you need to follow your position sizing that you backtested with other wise you are deviating from your plan

-

AuthorPosts